EDITOR’S NOTE: If you’re pushing Ponzi schemes on MoneyMakerGroup, TalkGold and other criminal forums, allegations brought by the Ontario Securities Commission (OSC) against geographically localized promoters of Gold Quest International (GQI) may interrupt your delusions of invincibility over the next several weeks.

EDITOR’S NOTE: If you’re pushing Ponzi schemes on MoneyMakerGroup, TalkGold and other criminal forums, allegations brought by the Ontario Securities Commission (OSC) against geographically localized promoters of Gold Quest International (GQI) may interrupt your delusions of invincibility over the next several weeks.

Upline and downline networks within Gold Quest International (GQI), a bizarre company taken down by the SEC just three months before the U.S. Secret Service raid on AdSurfDaily in 2008, are in the news in the Canadian province of Ontario.

The Ontario Securities Commission (OSC) will conduct a hearing March 24 to consider taking provincial action against local promoters of GQI, which already has been ruled a Ponzi scheme, pyramid scheme and “sham” investment by the Alberta Securities Commission.

OSC pointed out that GQI “has never been registered in any capacity with the Commission” and alleged that its promoters within the province also were not registered.

The case is important because it signals that Ontario regulators have backtracked millions of dollars of GQI transactions that originated in the province, segregated the source of the money to specific groups of promoters within the province and now intend to hold them accountable for spreading financial misery to their fellow citizens.

The odds of the respondents avoiding sanctions after the hearing may be low. One Ontario man implicated in the GQI scheme already has filed bankruptcy and has been ordered to pay $652,000 in disgorgement and penalties for his role in GQI. The man, Donald Iain Buchanan, allegedly was introduced to GQI by some of the promoters who are the subject of the hearing next month.

And the odds may be weighted even more heavily against the promoters prevailing at the hearing because of the bizarre claims of GQI itself, which purported to have a “Lord” among its key managers and said it was immune to regulatory oversight because it was an extension of a North Dakota sovereign “Indian” tribe and was permitted to operate untouched from Las Vegas.

GQI, which gathered about $29 million in a long-running scheme by promising returns of 87.5 percent a year and huge commissions, sought unsuccessfully to sue the SEC for the astronomical sum of $1.7 trillion. A U.S. federal judge dispatched U.S. marshals to haul key players into court for ignoring court orders, and vast sums of money appear to have gone missing down ratholes in Europe and New Zealand.

Some of the money also is tied up as a result of criminal allegations — including murder — against James Fayed, the operator of the now-shuttered E-bullion payment processor.

In its statement of allegations, OSC accused Simply Wealth Financial Group Inc., Naida Allarde, Bernardo Giangrosso, K&S Global Wealth Creative Strategies Inc., Kevin Persaud, Maxine Lobban and Wayne Lobban of promoting unregistered securities. All of the accused companies and individuals have Ontario addresses, according to OSC.

“During the Material Time, Simply Wealth, Allarde, Giangrosso, K&S, Persaud, Maxine Lobban and Wayne Lobban . . . promoted securities in Gold-Quest to Ontario residents,” OSC charged.

About 94 Ontario residents plowed $1.6 million into GQI “as a result of promotional activities conducted by Allarde, Giangrosso and Simply Wealth,” OSC charged. “These activities included recommending investment in Gold-Quest, providing information regarding the nature of the investment in Gold-Quest, facilitating the process of investing in Gold-Quest, and, in certain cases, facilitating the transfer of funds to Gold-Quest on behalf of investors.”

K&S and Persaud, meanwhile, caused about nine Ontario investors to plow about $69,000 into the GQI scheme. Among their alleged customers was Buchanan, who also became a promoter and caused his customers to bring $1.8 million more into the scheme, according to OSC.

Maxine Lobban and Wayne Lobban also became promoters and caused investors to bring “at least $675,000” into the GQI scheme, the OSC alleged.

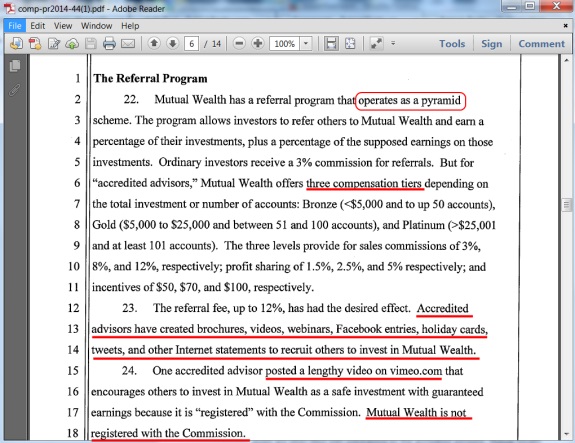

The math of the scheme was doomed to fail, but purveyors were lured by titles and promised both spectacular investment earnings and commissions. Promoters were categorized in upline/downline tiers, the OSC alleged.

“Individuals who introduced an investor to Gold-Quest would receive the title ‘Administrative Manager’ for the new investor,” OSC alleged. “Administrative Managers would receive an up-front commission of ten percent of that investor’s original investment and then a further four percent per month for a year (for a total commission of 58 percent of the principal invested).

“The individual who had introduced the Administrative Manager to Gold-Quest would receive the title ‘Managing Director’ for the new investor and would receive a commission of 1.5 percent per month for a year (for a total of 18 percent of the principal invested),” the OSC continued.

“Lastly, the individual who introduced the Managing Director to Gold-Quest would receive the title ‘Supervisory Managing Director’ for the new investor and would receive a commission of one percent per month for a year (for a total of 12 percent of the principal invested).

“In sum, when a new investor sent funds to Gold-Quest, 88 percent of the investor’s funds were earmarked for commissions to be paid to the investor’s Administrative Manager, Managing Director and Supervisory Managing Director over the course of a year,” OSC alleged.

In November 2010, OSC ordered penalties and disgorgement of $652,000 against Buchanan for his role in the GQI scheme.

“Buchanan’s conduct warrants a substantial administrative penalty,” OSC said. “He was involved in two investment schemes in which Ontario investors invested approximately US $4.3 million.”

Although commission staff had recommended an administrative penalty of $150,000 against Buchanan, who is bankrupt, OSC doubled the amount to $300,000, saying Buchanan had shown no remorse and that the smaller penalty would not serve as a deterrent.

Rockwell Partners SA, an HYIP “program” that has a 218-page thread at the MoneyMakerGroup Ponzi forum, now is the subject of a warning from the Ontario Securities Commission.

Rockwell Partners SA, an HYIP “program” that has a 218-page thread at the MoneyMakerGroup Ponzi forum, now is the subject of a warning from the Ontario Securities Commission.

URGENT >> BULLETIN >> MOVING: (UPDATED 6:25 P.M. EDT (U.S.A.) The SEC has filed an emergency action in federal court in Charlotte, N.C., that alleges Zeek Rewards is a $600 million Ponzi and pyramid scheme.

URGENT >> BULLETIN >> MOVING: (UPDATED 6:25 P.M. EDT (U.S.A.) The SEC has filed an emergency action in federal court in Charlotte, N.C., that alleges Zeek Rewards is a $600 million Ponzi and pyramid scheme.