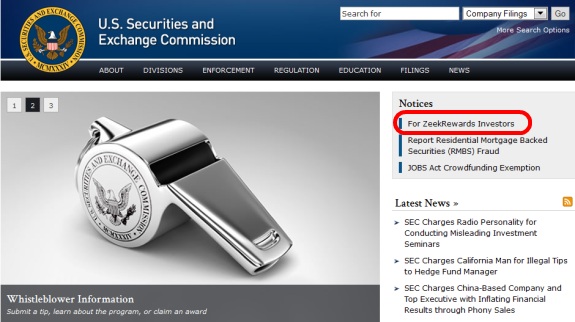

URGENT >> BULLETIN >> MOVING: (UPDATED 6:25 P.M. EDT (U.S.A.) The SEC has filed an emergency action in federal court in Charlotte, N.C., that alleges Zeek Rewards is a $600 million Ponzi and pyramid scheme.

URGENT >> BULLETIN >> MOVING: (UPDATED 6:25 P.M. EDT (U.S.A.) The SEC has filed an emergency action in federal court in Charlotte, N.C., that alleges Zeek Rewards is a $600 million Ponzi and pyramid scheme.

“The obligations to investors drastically exceed the company’s cash on hand, which is why we need to step in quickly, salvage whatever funds remain and ensure an orderly and fair payout to investors,” said Stephen Cohen, an associate director in the SEC’s Division of Enforcement. “ZeekRewards misused the power of the Internet and lured investors by making them believe they were getting an opportunity to cash in on the next big thing. In reality, their cash was just going to the earlier investor.”

In its emergency filing, the SEC described Zeek as a classic Ponzi scheme. The agency charged that “approximately 98% of ZeekRewards’ total revenues, and correspondingly the purported share of ‘net profits’ paid to current investors, are comprised of funds received from new investors.”

Records show that the AdSurfDaily Ponzi scheme which, like Zeek, suggested that investors would receive a return on the order of 1 percent a day, also received only about 2 percent of its revenue from sources other than members. Zeek had members in common with ASD.

Zeek, the SEC alleged, “is teetering on collapse.”

Zeek CEO Paul R. Burks has been charged with selling unregistered securities as investment contracts, the SEC said. Burks presided over Rex Venture Group LLC, Zeek’s purported parent company. Rex Venture also has been charged. The SEC said it was aided in the probe by the Quebec Autorite des Marches Financiers and the Ontario Securities Commission.

Burks’ program holds “approximately $225 million in investor funds in approximately 15 foreign and domestic financial institutions, and those funds are at risk of imminent dissipation and depletion,” the SEC charged, noting that the Ponzi potentially could affect more than 1 million people globally.

A federal judge has ordered an emergency asset freeze and a receiver will the appointed, the SEC said.

“Through the ZeekRewards program, Defendants offer affiliates several ways to earn money, two of which involve the offer and sale of securities in the form of investment contracts: the ““Retail Profit Pool” and the “Matrix,” the SEC charged.

And, the agency said, the “compounding” effect has created a condition under which 3 billion Zeek “Profit Points” are outstanding.

“Based on the ZeekRewards current outstanding Profit Point balance, the company would be obligated to pay out approximately $45 million per day if all Qualified Affiliates elected to receive their daily award in cash,” the agency charged.

Amid Zeek claims that it paid out 50 percent of its daily net and that its business model was “proprietary,” investigators discovered that Zeek delivered an unusually consistent return of about 1.5 percent a day.

“In fact, the dividend bears no relation to the company’s net profits,” the SEC charged. “Instead, Burks unilaterally and arbitrarily determines the daily dividend rate so that it averages approximately 1.5% per day, giving investors the false impression that the business is profitable.

Similar allegations were made in 2008 against ASD operator Andy Bowdoin.

Zeek’s fabled Zeekler “bids” were described by the SEC as smoke-and-mirrors. From the complaint (italics added):

Despite encouraging affiliates to purchase and give away VIP Bids to promote and drive traffic to the Zeekler penny auction website, Defendants fail to disclose that almost none of the VIP Bids given away by Qualified investors are actually used on the Zeekler penny auction website. Of approximately 10 billion VIP Bids purchased by or awarded to investors, less than one-quarter of one percent have been actually used in auctions on the Zeekler penny auction website. Thus, the VIP Bids do little or nothing to actually promote the retail business.

Zeek operator Burks, meanwhile, “has withdrawn approximately $11 million while operating Rex Venture and ZeekRewards, of which approximately $4 million remains in his possession, custody or control.

Burks “distributed approximately $1 million of the funds garnered from ZeekRewards to family members,” the SEC said.

Amid high drama and confusing website reports from Zeek yesterday, including the virtual abandonment of its office in Lexington, N.C., and petition drives by Zeek affiliates to demand the return of Zeek, it turns out that “Burks has agreed to settle the SEC’s charges against him without admitting or denying the allegations, and agreed to cooperate with a court-appointed receiver,” the SEC said.

The U.S. Secret Service also is investigating Zeek, as is the office of North Carolina Attorney General Roy Cooper.

Read the SEC complaint.

URGENT >> BULLETIN >> MOVING: (UPDATED 12:16 P.M. EDT (U.S.A.) The office of the corporate counsel for Charles Schwab in San Francisco has informed a federal judge that it is holding almost $18.6 million in two accounts linked to the alleged Zeek Rewards’ Ponzi scheme.

URGENT >> BULLETIN >> MOVING: (UPDATED 12:16 P.M. EDT (U.S.A.) The office of the corporate counsel for Charles Schwab in San Francisco has informed a federal judge that it is holding almost $18.6 million in two accounts linked to the alleged Zeek Rewards’ Ponzi scheme.

UPDATED 4:06 P.M. EDT (U.S.A.) It happened after the collapse of AdSurfDaily in 2008 — and it’s happening now in the aftermath of the collapse of Zeek Rewards amid spectacular allegations by the SEC Friday of Ponzi and pyramid fraud.

UPDATED 4:06 P.M. EDT (U.S.A.) It happened after the collapse of AdSurfDaily in 2008 — and it’s happening now in the aftermath of the collapse of Zeek Rewards amid spectacular allegations by the SEC Friday of Ponzi and pyramid fraud. URGENT >> BULLETIN >> MOVING: (UPDATED 6:25 P.M. EDT (U.S.A.) The SEC has filed an emergency action in federal court in Charlotte, N.C., that alleges Zeek Rewards is a $600 million Ponzi and pyramid scheme.

URGENT >> BULLETIN >> MOVING: (UPDATED 6:25 P.M. EDT (U.S.A.) The SEC has filed an emergency action in federal court in Charlotte, N.C., that alleges Zeek Rewards is a $600 million Ponzi and pyramid scheme.