Ponzi schemer Robert Miracle, who scammed investors in a $65.3 million oil-and-gas fraud operating in the Seattle area, knows he’ll bed down tonight in custody at the SeaTac Federal Detention Center in Washington state.

His co-defendants, though, are less certain of their sleeping spots — and still have to worry about knocks at doors in the middle of the night.

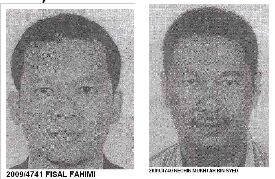

Fahimi Fisal and Mukhtar Kechik — both Malaysian nationals of middle age — are international fugitives wanted by INTERPOL. Fisal is 40; Kechik is 54. There are “Wanted” posters in each of their names.

Miracle, 50, Bellevue, Wash., was sentenced this week to 13 years in federal prison, but he already was in custody. While awaiting trial in May 2009, his bail was revoked for not complying with the conditions of his release.

In February 2009 — just two months after the $65 billion Bernard Madoff caper came to the fore and the word Ponzi became a daily part of the national and international dialogue — Miracle, Fisal and Kechik were charged in in a 23- count indictment alleging conspiracy, mail fraud, wire fraud, money-laundering and tax evasion. The criminal case against Miracle and his co-defendants was one of the first major prosecutions of the post-Madoff era.

Many towns across the United States now have their own individual “mini-Madoffs,” and the alleged schemers are accused of consuming individual and family wealth on a local, regional, national or international scale, taking wrecking balls to churches, charities and endowments — and leaving Ponzi pain on the doorsteps of hundreds of thousands of people.

The Miracle scheme “ruined people’s lives,” prosecutors said, quoting U.S. District Judge James L. Robart, who sentenced Miracle. Miracle pleaded guilty to mail fraud and tax evasion.

Prosecutors said he operated companies purportedly involved in oil development in Indonesia, and sold “shares” in ventures known as Laramie Petroleum Inc., MCube Petroleum Inc., Diski Limited Liability Co., Basilam Limited Liability Co. and Halmahera-Rembang Limited Liability Co.

“Miracle and his co-defendants represented to investors that various companies were making money from oil field development and services on oil and gas fields in Indonesia,” prosecutors said. “In fact, the proceeds of later investors were used to pay off the investments of earlier investors in the form of a ‘ponzi’ scheme.”