EDITOR’S NOTE: Utah has been abuzz since the Salt Lake Tribune reported on Jan. 11 that a plea deal between Jeremy Johnson and the government had unraveled when prosecutors balked “at placing a list of people into the record that Johnson said prosecutors had promised not to indict if he entered a guilty plea.”

“Included on that list were Johnson family members, business associates, friends — and Utah Attorney General John Swallow,” the newspaper reported. Johnson planted the seed that Swallow had been involved in a bribery scheme to make FTC civil allegations of fraud against Johnson go away in 2010. Swallow denied the allegations.

Johnson has been engaged in a long-running media campaign to discredit the government. Among other things, he has claimed he had no money to mount a defense to the FTC charges brought in December 2010. But in an update to the court a year ago this month, the receiver in the FTC case raised allegations that some of Johnson’s family members and friends were helping him hide money through scores of business entities.

Now, receiver Robb Evans has filed a new document (Feb. 6, 2013) that alleges a company owned by Johnson’s parents wired $500,000 to a new bank account opened by a Johnson business associate referenced in last year’s receivership report 10 months after the report was filed. The suspicious transactions involving Kerry and Barbara Johnson and Jason Vowell allegedly occurred in December 2012.

Although the receiver’s Feb. 6 filing does not reference Johnson’s collapsed plea deal last month, it may lead to questions about the credibility of Johnson, his parents and certain of his business associates. Vowell, for example, is alleged to have withdrawn in cash nearly all of the money supplied by the firm owned by Johnson’s parents just a little more than a month before Johnson’s plea deal collapsed, reportedly in part because prosecutors refused to commit to not charging his parents and others.

** _______________________________ **

The court-appointed receiver in the Jeremy Johnson/IWorks fraud case has advised a federal judge that KV Electric Inc., a company owned by Johnson’s parents, wired $500,000 on Dec. 6 into an account opened Nov. 28 through Johnson business associate Jason Vowell.

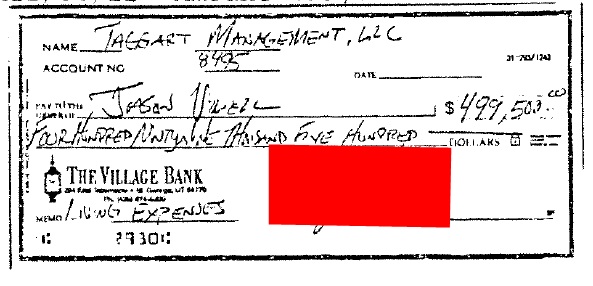

In court filings, receiver Robb Evans said that bank records suggest Vowell removed $499,500 from the account on the same day the wire deposit was made. The withdrawal appears to have been made in cash. An evidence exhibit shows what appears to be a counter check drawn on The Village Bank. The check was filled out in longhand, with Vowell’s name in the “Pay to the order of” line. The words “Living Expenses” are written on the memo line of the check, and the name of Taggart Management LLC is written in longhand at the top of the check.

Taggart Management, through Vowell, opened the account only days earlier with a deposit of $100, according to the receiver. On Dec. 6, $500,000 flowed into the account via wire from KV Electric, which is owned Johnson’s parents, Kerry and Barbara Johnson, according to the receiver.

“The transfer of $500,000 to Taggart for the immediate withdrawal of $499,500 in cash by Jason Vowell has no discernible business purpose and is highly suspect under the circumstances,” the receiver said, noting that Taggart is part of the receivership’s investigation into Jeremy Johnson’s business affairs and that Kerry and Barbara Johnson are defendants in a receivership lawsuit to recover ill-gotten gains from their son’s alleged scam.

Various suspicious transactions involving large sums of money and the Johnson family and other entities have occurred since the FTC sued Jeremy Johnson for fraud in December 2010, alleging a massive Internet-based scam that gathered hundreds of millions of dollars, the receiver alleged.

On Jan. 3, 2013, the receivership issued a subpoena to The Village Bank, which provided records of the alleged Vowell/Taggart and KV Electric transactions during the previous month, according to court filings. In November, the receivership issued a subpoena to Chartway Federal Credit Union as part of a forensic investigation into the banking activities of Johnson’s parents and others individuals and entities involved with Johnson. Chartway provided sought-after information on Johnson’s parents on Dec. 4.

On Feb. 8, U.S. District Judge Miranda M. Du authorized Evans in an order to continue the asset investigation of Johnson’s parents.

Read Feb. 6, 2013, filing, including exhibits, by the receiver.

A federal judge has ordered the sale of helicopters, airplanes, houseboats, vintage cars and real estate allegedly linked to a massive fraud scheme engineered on the Internet by Utah resident Jeremy Johnson and dozens of corporations, including at least 51 shell companies.

A federal judge has ordered the sale of helicopters, airplanes, houseboats, vintage cars and real estate allegedly linked to a massive fraud scheme engineered on the Internet by Utah resident Jeremy Johnson and dozens of corporations, including at least 51 shell companies.