URGENT >> BULLETIN >> MOVING: (Updated 9:05 a.m. EDT April 15 U.S.A.) An investment scam known as LB Stocks and Trades Advice LLC was targeted at military personnel at Fort Hood in Texas and perhaps other installations, the SEC has alleged.

URGENT >> BULLETIN >> MOVING: (Updated 9:05 a.m. EDT April 15 U.S.A.) An investment scam known as LB Stocks and Trades Advice LLC was targeted at military personnel at Fort Hood in Texas and perhaps other installations, the SEC has alleged.

Charged in the scheme were the company and alleged operator Leroy Brown Jr., 32, of Killeen, Texas. The SEC described Brown as a member of the U.S. Army between 2001 and 2013.

“Trust is a bedrock principle to our military, and we allege that Brown exploited his own military experience and abused that trust for his own personal gain,” said David Woodcock, director of the SEC’s Fort Worth Regional Office. “Investment fraud is always wrong, but it’s especially pernicious when perpetrated against those who have sacrificed so much for our freedom.”

A federal judge imposed an asset freeze and temporary restraining order, the SEC said.

Brown, the SEC said, claimed a longstanding presence in the investment trade, offices in New York and San Francisco, “guaranteed” returns, an ability to double or triple money in 120 days and business associations with “Walmart, Apple, Sony, Microsoft, Best Buy, HP, USA Today, and McAfee.”

From the SEC’s complaint (italics added):

Based on these intentional misrepresentations, Brown solicits investors to purchase $1,000 membership certificates in LB Stocks to participate in the Company’s purported investments in undeveloped real estate that Brown guarantees will double or triple the investors’ investments. Brown also represents that he and LB Stocks trade stocks, mutual funds, exchange traded funds (“ETFs”), commodities, and foreign exchange currencies for their clients.

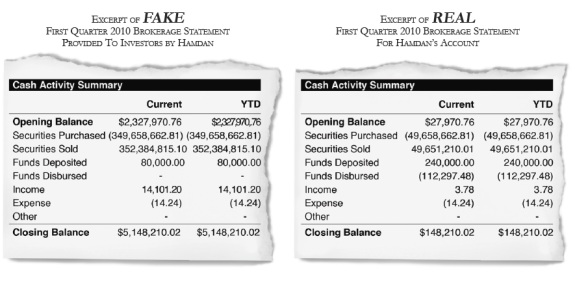

In a statement, the SEC said Brown “specifically claimed to have all the necessary licenses and registrations to conduct securities business. In reality, Brown is not a licensed securities professional and his firm is not registered with the SEC, Financial Industry Regulatory Authority, or any state regulator. Brown and his firm have no evident experience with investments.”

Some of Brown’s claims were bizarre. Among them, according to the SEC, was that Brown would offer an “IPO” under a ticker symbol already in use by another company.

“Thank you God. BOOM POW BAM[,]” Brown allegedly wrote on Facebook.

As part of his scheme, Brown copied information from the website of E*Trade to his own website — and then swapped in “LB” names, the SEC alleged.

The precise dollar sum gathered by the scheme was not immediately clear.

“Beginning in the first quarter of 2014, Brown began receiving substantial deposits of funds into his personal brokerage account,” the SEC charged. “These deposits show that Brown received funds from investors who intended to invest in, or with, LB Stocks. In fact, wire transfer details for several of these deposits specifically reference LB Stocks as the ‘Acct Party’ in the receiving account field — even though the funds were deposited or transferred directly into Brown’s personal brokerage account.”

“Nearly all” of the funds went from the personal brokerage account into Brown’s personal bank accounts, the SEC alleged.

Although Brown didn’t leave the Army until July 2013, he claimed to have 65,000 investment clients, the SEC charged.

Americans are very sensitive to events involving Fort Hood. In 2009, the base was the site of a mass shooting carried out by Nidal Malik Hasan, a former Army major now on Death Row. Thirteen individuals were killed, including officers, enlisted personnel and one civilian employee.

Thirty-two more individuals were wounded, many of them struck by bullets.