The World Bank confirmed to the PP Blog this morning that a person named Andrea Lucas left its employment in December 1986, nearly 25 years ago. But Lucas was never a member of the World Bank’s board of directors, as many members of business “opportunity” known as Club Asteria have implied in online, MLM-style promotions for the firm.

The World Bank confirmed to the PP Blog this morning that a person named Andrea Lucas left its employment in December 1986, nearly 25 years ago. But Lucas was never a member of the World Bank’s board of directors, as many members of business “opportunity” known as Club Asteria have implied in online, MLM-style promotions for the firm.

Rather, the World Bank described Lucas as a former department head among “many” department heads who held the internal title of director of an individual department. Lucas, the World Bank said, was director of the management systems and account department. She worked in Washington, D.C., according to the World Bank’s records.

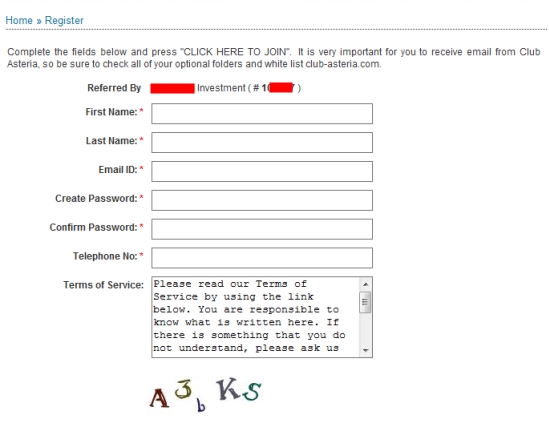

The PP Blog initially sought comment from the World Bank on March 3 about Lucas and various claims about Club Asteria made by members of the purported opportunity. Some of the claims have been made on the TalkGold Ponzi scheme and criminals’ forum. The World Bank’s name is being used in Club Asteria promos on TalkGold and other websites.

A blurb for Andrea Lucas on the slow-loading Club Asteria website describes her in the first sentence as “former Director of the World Bank,” using an uppercase “D” in “Director” with no other qualifiers. The reference to the World Bank begins seven words into the profile. The profile also lists Andrea Lucas as “founder and Managing Director of Club Asteria.” No other entities are referenced in the Andrea Lucas blurb.

The blurb makes no mention that Andrea Lucas left her staff job at the World Bank more than two decades ago, when Ronald Reagan was President of the United States and Mikhail Gorbachev was General Secretary of the Communist Party of the now-dissolved Soviet Union.

When Andrea Lucas last worked at the World Bank, George Herbert Walker Bush was Vice President of the United States and still more than two years away from his term as President. The “Black Monday” market crash of October 1987 had not yet occurred, and Iraq’s August 1990 invasion of Kuwait that led to the Gulf War was still nearly four years away. Modern-day accused shoplifter and actress Lindsay Lohan was five months old, and few people outside of Arkansas recognized the names of Bill Clinton and Hillary Clinton. Barack Obama, a community organizer in Chicago, had yet to enter Harvard Law School or meet Michelle Robinson, who’d become his wife and, later, First Lady of the United States.

Regardless, Lucas and the World Bank are referenced repeatedly in online promos by Club Asteria members. Why the company and promoters had seized on the World Bank’s name when Andrea Lucas last was employed there nearly a quarter of a century ago as a young woman was not immediately clear.

“Real Profit Sharing Program ! No Ponzi !” one affiliate promo preemptively screams. “Club Asteria from the Former Director of World Bank – Andrea Lucas.” The affiliate site includes a photo of a letter dated Dec. 14, 2010, and the letter appears to feature the World Bank’s letterhead and verify the former employment of Andrea Lucas at the World Bank. It is positioned by the affiliate as a reason to trust Club Asteria.

Why the affiliate would preemptively argue that Club Asteria was “No Ponzi” was unclear.

Another promo describes Club Asteria as “a perfect home based business that specializes in the remittance business of sending funds back home.

“We provide training, opportunities, consultation and one of the most sensational pay plans of our time,” the promo continues. Club asteria (sic) is run by a former Director of the World Bank and it (sic) set to take the net by storm.”

“Ken Russo,” who posts at TalkGold as “DRdave” and promotes one highly questionable scheme after another, announced yesterday that Club Asteria’s membership ranks had soared to 187,481.

The announcement occurred against the backdrop of a December warning by the Financial Fraud Enforcement Task Force led by U.S. Attorney General Eric Holder that visitors to websites and forums should be skeptical of claims.

“Be wary of people you meet on social networking sites and in chat rooms, where investment fraud criminals have been known to troll for victims,” the Task Force warned.

Except for its confirmation this morning that a person named Andrea Lucas once worked for the World Bank and its release of certain details about her employment nearly a quarter of a century ago, the World Bank declined to comment immediately about the linkage of its name to Club Asteria and the promos at TalkGold and other websites.

The bank, however, confirmed it is aware of the claims. Meanwhile, some Club Asteria members are grumbling in forums about the firm’s slow-loading website and spotty customer support. Among the concerns is that the company recruited members under one set of rules, but may be trying to implement a new set that may force higher costs on participants who expect to get paid.

Some Club Asteria members appear to be confused about whether Club Asteria conducts business from the United States or Hong Kong.

How the company makes money beyond membership fees is unclear. Also unclear is whether the firm has significant revenue streams beyond membership fees. Club Asteria appears to publish no verifiable financial data.

The World Bank is the most recent prominent international entity to have its name appear on TalkGold and other Ponzi forums that push highly questionable business pursuits. Last year, members of the purported MPB Today “grocery” program, which operates as an MLM, flooded websites and social-media sites such as YouTube with references to Walmart.

It is common in the MLM sphere for affiliates to trade on the names of prominent business entities even if no ties exist. Walmart’s name also appeared in promos on the Ponzi boards.

TalkGold, MoneyMakerGroup and ASAMonitor are referenced in federal court filings as places from which international Ponzi schemes are promoted. Even if Club Asteria is a legitimate enterprise, the mere fact it is being promoted on the Ponzi boards raises troubling questions about whether its revenue stream is polluted by proceeds from any number of fraud schemes operating globally.

In recent weeks, federal agencies such as the SEC and CFTC have taken actions against schemes promoted on the Ponzi boards. Meanwhile, the FTC announced an action this week against an online enterprise that allegedly was not policing its affiliate sales force properly.

The FTC charged Lester Gabriel Smith and Legacy Learning of Nashville, Tenn., with disseminating “deceptive advertisements by representing that online endorsements written by affiliates reflected the views of ordinary consumers or ‘independent’ reviewers, without clearly disclosing that the affiliates were paid for every sale they generated.”

In bringing the case, the agency held Smith and Legacy accountable for claims made by affiliates.

“Whether they advertise directly or through affiliates, companies have an obligation to ensure that the advertising for their products is not deceptive,” said David Vladeck, director of the FTC’s Bureau of Consumer Protection. “Advertisers using affiliate marketers to promote their products would be wise to put in place a reasonable monitoring program to verify that those affiliates follow the principles of truth in advertising.”

See the FTC news release on Legacy Learning, which was assessed a $250,000 penalty.

BULLETIN: Even as the SEC and CFTC were charging alleged Ponzi schemers and “precious-metal” fraudsters in Florida yesterday, the FTC was preparing to announce charges against an alleged “timeshare” telemarketing scheme operating in the Sunshine State.

BULLETIN: Even as the SEC and CFTC were charging alleged Ponzi schemers and “precious-metal” fraudsters in Florida yesterday, the FTC was preparing to announce charges against an alleged “timeshare” telemarketing scheme operating in the Sunshine State.