Roger Alberto Santamaria Del Cid, an apparent nominee director for offshore companies who is listed as a corporate “subscriber” for VX Gateway in Panamanian business records, is referenced at least three times in the “Panama Papers.”

Roger Alberto Santamaria Del Cid, an apparent nominee director for offshore companies who is listed as a corporate “subscriber” for VX Gateway in Panamanian business records, is referenced at least three times in the “Panama Papers.”

The PP Blog discovered the Del Cid listings today. On Monday, the International Consortium of Investigative Journalists made its database of Panama Papers listings searchable. (For additional background and reporting on the Panama Papers, visit ICIJ’s website.)

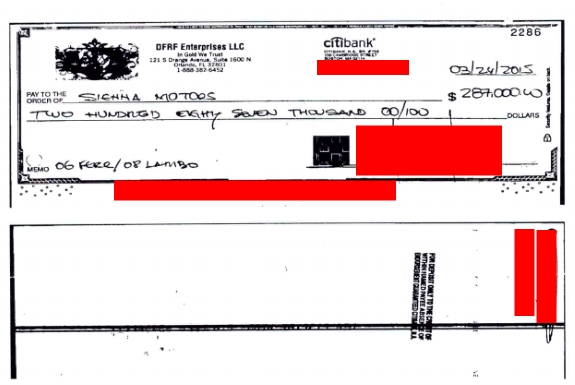

VX is a payment processor for the MyAdvertisingPays (MAPS) cross-border scheme that touts Anguilla registration after earlier operating from the U.S. state of Mississippi. MAPS purportedly pulled out of the United States last year, potentially leaving thousands of American affiliates expecting payouts holding the bag.

In April 2015, the PP Blog reported that MAPs, a purported “advertising” program similar to the AdSurfDaily Ponzi scheme, was trading on the name of President Obama after ASD previously had traded on the name of President George W. Bush. MAPS is known to have members in common with the judicially declared TelexFree Ponzi- and pyramid scheme, which also traded on the names of government officials.

It is somewhat common in the HYIP sphere for “programs” and their affiliates to drive traffic to schemes by suggesting the endorsement of government agencies or prominent government officials.

TelexFree, which may have generated $3 billion in illicit cross-border business, collapsed in 2014.

The Facebook site for the TaraTalksBlog, a MAPS critic, reported on May 7 that it had received “numerous reports that MAP has closed members accounts, with no redress, after members have requested payment withdrawals.”

In short, non-U.S. affiliates of MAPs also may be having trouble getting paid.

MAPS recently attempted unsuccessfully to sue TaraTalks. In 2012, a top official from the U.S. Department of Justice who was speaking at an event in Mexico warned about bogus libel lawsuits in the context of cross-border crime.

Then-Deputy U.S. Attorney General James Cole also said (bolding added):

“Because of the sophistication of the world economy, organized crime groups have developed an ability to exploit legitimate actors and their skills in order to further the criminal enterprises. For example, transnational organized criminal groups often rely on lawyers to facilitate illicit transactions. These lawyers create shell companies, open offshore bank accounts in the names of those shell companies, and launder criminal proceeds through trust accounts. Other lawyers working for organized crime figures bring frivolous libel cases against individuals who expose their criminal activities.”

As noted above, the Panama Papers database shows Del Cid’s name at least three times. On April 14, the PP Blog reported (italics added):

Del Cid’s name has appeared on the PP Blog a couple of times. On Feb. 8, 2011, the Blog reported that his name had appeared in court filings in a federal forfeiture case involving assets linked to the notorious EMG/Finanzas Forex scheme in the Middle District of Florida. (See Paragraph 10 of this affidavit by a Task Force investigator.)

Money from EMG/Finanzas was linked to the international narcotics trade. OpenCorporates lists del Cid here as a Finanzas “subscriber.” The site lists Tatiana Itzel Saldaöa Escobar as another Finanzas subscriber, and the same name appears alongside Del Cid as a VX subscriber.

As the PP Blog reported on Feb. 10, 2011, del Cid’s name also had appeared as the contact person for Perfect Money, another financial vendor purportedly operating from Panama. The SEC has linked Perfect Money to the incredibly toxic Imperia Invest IBC offshore scheme that targeted thousands of people with hearing impairments.

UPDATED 3:32 P.M. EDT U.S.A. Faith Sloan received $710,319 from the TelexFree Ponzi- and pyramid scheme, according to filings by TelexFree bankruptcy Trustee Stephen B. Darr.

UPDATED 3:32 P.M. EDT U.S.A. Faith Sloan received $710,319 from the TelexFree Ponzi- and pyramid scheme, according to filings by TelexFree bankruptcy Trustee Stephen B. Darr.

Big Four accounting firm Pricewaterhouse Coopers posted more than $115,000 in fees from the TelexFree Ponzi/pyramid scheme and will pay it all back under the terms of a stipulated settlement with TelexFree Trustee Stephen B. Darr, according to court filings.

Big Four accounting firm Pricewaterhouse Coopers posted more than $115,000 in fees from the TelexFree Ponzi/pyramid scheme and will pay it all back under the terms of a stipulated settlement with TelexFree Trustee Stephen B. Darr, according to court filings. Let’s begin by encouraging you to read Andrew Ceresney’s opening remarks at a joint symposium today sponsored by the SEC and the University of Illinois at Chicago. (Link at bottom of story. Also see Twitter links.)

Let’s begin by encouraging you to read Andrew Ceresney’s opening remarks at a joint symposium today sponsored by the SEC and the University of Illinois at Chicago. (Link at bottom of story. Also see Twitter links.) DEVELOPING STORY: (Updated 9:23 p.m. ET U.S.A.) A TelexFree rep being sued by the court-appointed bankruptcy trustee for the return of more than $2.6 million in alleged winnings from the

DEVELOPING STORY: (Updated 9:23 p.m. ET U.S.A.) A TelexFree rep being sued by the court-appointed bankruptcy trustee for the return of more than $2.6 million in alleged winnings from the  Let’s begin by pointing out that Daniil Shoyfer and Scott Miller have not been charged by the SEC in its

Let’s begin by pointing out that Daniil Shoyfer and Scott Miller have not been charged by the SEC in its