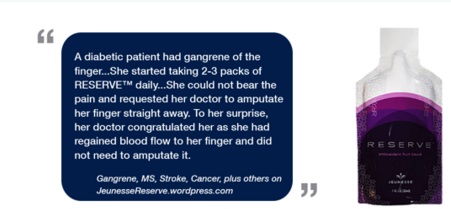

On Oct. 24, the PP Blog reported that Truth In Advertising (TINA.org) had raised concerns about health-related claims surrounding the Jeunesse MLM, including a claim from an apparent rep that a product known as Jeunesse Reserve had reversed the course of gangrene in a patient with diabetes who was facing an amputation.

Today the PP Blog is reporting that an apparent Jeunesse rep with a Twitter handle and email addresses that suggests he is a lawyer may be trying to raid downlines at MLMs such as Vemma, Usana, Amway, Mary Kay, Zhulian and others.

Jeunesse did not respond immediately to a request for comment from the PP Blog. We’ll publish the comment, if received.

Earlier today the Blog observed a Twitter promo from an account under the name “DH-mlm-lawyer.tk.” This was the headline in part: “ZHULIAN, VEMMA,USANA,AMWAY,MARYKAY [SIC] -REGSITER [SIC] AND CONVERT DOWN-LINES INTO OVERNITE WEALTH.” Included was a link to an affiliate site at JeunesseGlobal.com. The affiliate ID was “smcmktg,” with the rep listed as “David.”

Included among the graphics of the promo was one that read “MLM Transfer Your Downline Into Overnight Millions.” Another graphic suggested that MLMers who moved to Jeunesse and took their downlines from other companies with them could earn more than $270,000 in two weeks and $800,000 in a month.

Another graphic listed the names of Zhulian, Avon, Amway, Mary Kay, Herbalife, Shaklee, Nuskin, Vemma and Usana. It further claimed Jeunesse produced “OVERNIGHT MILLIONAIRES” and that people who moved their downlines from other companies to Jeunesse could “convert” those downlines into “millions” of dollars.

Avon, Herbalife, Shaklee, NuSkin and Usana are publicly-traded companies. Vemma is the current subject of an FTC pyramid-scheme prosecution.

Another promo for Jeunesse on the “DH-mlm-lawyer.tk” Twitter account suggested that Jeunesse somehow was affiliated with the Nobel Prize.

The “DH-mlm-lawyer.tk” Twitter account also promoted a URL styled “mlm-lawyer.tk.”

This post read, “Need MLM-Network marketing Help or advise? [Sic] How about an answer to EBAY PROBLEMS:”

When the PP Blog visited the site, it was greeted by images of law books and a prompt that read, “FREE INITIAL 1/2-HOUR CONSULTATION.” “TK” is the top-level domain for Tokelau, a New Zealand territory of 1,300 inabitants CNN described in 2012 as “The tiny island with a huge Web presence.”

The purported MLM law site, however, appears to use a phone number in Thailand while not listing any professional credentials commonly associated with attorneys or a street address. A headline on a Blog associated with the site reads, “JEUNESSE GLOBAL DARLING OF WALL STREET.”

Jeunesse is not a publicly traded company.