BULLETIN: (Updated 2:35 p.m. EDT U.S.A. Aug. 29) Lyoness, the purported “Plan B” scheme of Zeek Rewards and AdSurfDaily figure Keith Laggos, has been charged in Australia with operating a pyramid scheme.

BULLETIN: (Updated 2:35 p.m. EDT U.S.A. Aug. 29) Lyoness, the purported “Plan B” scheme of Zeek Rewards and AdSurfDaily figure Keith Laggos, has been charged in Australia with operating a pyramid scheme.

News of the Australian prosecution was published tonight by BehindMLM.com.

The Australian Competition and Consumer Commission (ACCC) has issued a statement on the Lyoness prosecution. It appears below (italics added):

The Australian Competition and Consumer Commission has instituted proceedings against Lyoness International AG, Lyoness Asia Limited, Lyoness UK Limited and Lyoness Australia Pty Limited (together ‘Lyoness’) for operating a pyramid selling scheme and engaging in referral selling.

Although Lyoness has been investigated by regulators for conduct in other countries, this is the first court action taken against Lyoness alleging that the Lyoness Loyalty Program constitutes a pyramid scheme.

Pyramid schemes involve new participants providing a financial or other benefit to other existing participants in the scheme. New participants are induced to join substantially by the prospect that they will be entitled to benefits relating to the recruitment of further new participants. Pyramid schemes may also offer products or services, but making money out of recruitment is their main aim, and often the only way for a member to recover any money is to convince other people to join up. In contrast, people in legitimate multi-level marketing schemes earn money by selling genuine products to consumers, not from the recruiting process.

The ACCC alleges that Lyoness has operated the scheme in Australia from mid-2011 and that it continues to operate the scheme. The scheme offers ‘cash back’ rebates to members who shop through a Lyoness portal, use Lyoness vouchers or present their Lyoness card at certain retailers.

Whilst cash back offers themselves are not prohibited by the Australian Consumer Law (ACL), the ACCC alleges that the Lyoness scheme also offers commissions to members who recruit new members who make a down payment on future shopping.

“Pyramid schemes are often sophisticated and may be operated under the guise of a legitimate business. Although these schemes can appear to be legitimate, the most significant inducement for new members to get involved is to earn ‘residual’ or ‘passive’ income from new members signing up,” ACCC Chairman Rod Sims said.

“The concern with pyramid schemes is that the financial benefits held out to induce potential members to join up rely substantially on the recruitment of further new members into the scheme. For these schemes to work so that everyone can make a profit, there would need to be an endless supply of new members.”

“Under the Australian Consumer Law, it is illegal not only to establish or promote a pyramid scheme, but also to participate in one in any capacity,” Mr Sims said.

The ACCC also alleges that the conduct by Lyoness breached the ACL prohibition on ‘referral selling’, where a consumer is induced to buy goods or services by the promise of a commission or rebate contingent on a later event.

The ACCC is seeking declarations, pecuniary penalties, injunctions, an order requiring the Lyoness website to link to the case report and costs.

As Lyoness International AG, Lyoness Asia Limited and Lyoness UK Limited are located overseas, the ACCC will be making arrangements for service on those entities.

The first Directions Hearing in these proceedings will be at 9.30am on 16 September, 2014 before Justice Flick in Sydney.

Among other things, Lyoness traded on the name of Nelson Mandela.

Laggos pushed Lyoness as a “Plan B” to members of Zeek Rewards, suggesting in 2012 that it could be used as a “passive” hedge in case things went south at Zeek. Indeed, things did go south at Zeek: The U.S. Securities and Exchange Commission (SEC) described it as an international Ponzi- and pyramid scheme that had gathered hundreds of millions of dollars while engaging in securities fraud and selling unregistered securities as investment contracts.

Among the tips Laggos provided Zeekers on a Lyoness conference call was this: “Don’t put no more than 70 percent back in [Zeek]. Take out 20 or 30 percent [on] a daily basis. [Unintelligible.] This would be a good place. But, by the same token, if you put $10,000 in Zeekler, if nothing happens over the next year, you’ll probably make $30,000 or $40,000, if that’s all you do without building the front end, the matrix . . . The same amount of money in Lyoness, you’re looking . . . and not doing anything else, without single sponsoring . . . you can probably make a quarter-million dollars.”

Also see Aug. 3, 2014, PP Blog story: ANOTHER MLM PR TRAIN WRECK: Receiver Alleges Clawback Defendants May Be ‘Serial’ Participants In Zeek-Like ‘Revenue Sharing’ Schemes, Asks Court To Take ‘Judicial Notice’ Of T. LeMont Silver Videos

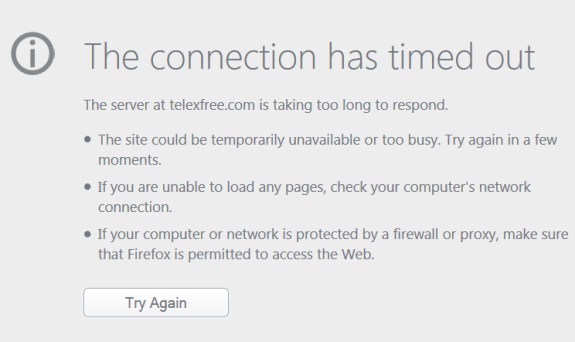

News of the Lyoness action in Australia was received on the same day that TelexFree was squaring off against both the SEC and federal prosecutors in Boston over matters pertaining to scheduling. TelexFree was charged by the SEC in April 2014 with operating a massive Ponzi- and pyramid scheme. The agency had charged Zeek less than two years earlier

TelexFree figures James Merrill and Carlos Wanzeler were indicted in July 2014 on criminal charges of wire fraud and wire-fraud conspiracy.

Lawyers from both sides are battling over contentious issues such as whether the SEC’s civil case should be stayed (delayed indefinitely) in favor of the criminal case and whether Merrill can receive a speedy, fair trial on the criminal side of things.

An enormous amount of evidence remains to be sifted through by both sides.

“The United States Attorney’s office has contacted the parties indicating that it intends to seek a stay of these proceedings while the criminal case is pending and sought assent from the parties,” the SEC and defense attorneys said in a joint filing in the agency’s civil case today. “The parties have not unanimously assented to a stay.”

On the criminal side of things, Merrill contended today that his right to a fair trial would be put at risk if prosecutors were permitted to use “additional press releases and newspaper notices” to contact potential TelexFree victims.

“Every press release and/or newspaper notice issued by the government will likely repeat the government’s characterization of TelexFree and Mr. Merrill” as a pyramid scheme and a pyramid schemer, Merrill attorney Robert Goldstein contended.

And, Goldstein argued, “Mr. Merrill hereby respectfully opposes the government’s motion for complex case designation and exclusion of time . . . wherein the government seeks the exclusion of 90 days commencing on September 10, 2014, and instead respectfully asks the Court to defer a ruling regarding the exclusion of any time until the September 10, 2014 status conference (i.e., after the defense has had at least a minimal amount of time to review the government’s automatic discovery production, which was received today.”

The office of U.S. Attorney Carmen Ortiz asked for the complex-case designation and to carve out an exception to the Speedy Trial Act earlier this month.

Among other things, prosecutors contended that “evidence underlying this case is closely tied to certain foreign countries, especially Brazil” and that “it is likely that the parties will need to review evidence in foreign countries and arrange for foreign witnesses and/or law enforcement officers to travel to the United States to testify at trial.”

Schemes that operate over the Internet may grow to affect hundreds of thousands of people. Cases can become extremely complex if a pyramid or Ponzi scheme (or both) are alleged.

Regulators have warned for years that the schemes may use intricate disguises and exceptionally complex mechanics to ward off prosecutions. Cross-border schemes can pose monumental challenges to law enforcement.

NOTE: Our thanks to the ASD Updates Blog.

UPDATE 7:18 A.M. EDT U.S.A. Lyoness has denied the ACCC allegations. See denial in story at News.com.au.

BULLETIN: Federal authorities have arrested a man and have found $20 million allegedly linked to TelexFree in a box spring in an apartment in Westborough, Mass. Agents have seized the cash and charged Cleber Rene Rizerio Rocha, 28, with conspiring to commit money-laundering.

BULLETIN: Federal authorities have arrested a man and have found $20 million allegedly linked to TelexFree in a box spring in an apartment in Westborough, Mass. Agents have seized the cash and charged Cleber Rene Rizerio Rocha, 28, with conspiring to commit money-laundering.

DEVELOPING STORY: (Updated 9:23 p.m. ET U.S.A.) A TelexFree rep being sued by the court-appointed bankruptcy trustee for the return of more than $2.6 million in alleged winnings from the

DEVELOPING STORY: (Updated 9:23 p.m. ET U.S.A.) A TelexFree rep being sued by the court-appointed bankruptcy trustee for the return of more than $2.6 million in alleged winnings from the