EDITOR’S NOTE: Jeremy Johnson and associated companies were accused civilly by the FTC in December 2010 of orchestrating a massive fraud scheme involving hundreds of millions of dollars. At the moment, Johnson, 35, faces a single criminal charge of mail fraud. He denies wrongdoing on both the criminal and civil fronts and has painted himself a victim of an evil government and a court-appointed receiver run amok.

EDITOR’S NOTE: Jeremy Johnson and associated companies were accused civilly by the FTC in December 2010 of orchestrating a massive fraud scheme involving hundreds of millions of dollars. At the moment, Johnson, 35, faces a single criminal charge of mail fraud. He denies wrongdoing on both the criminal and civil fronts and has painted himself a victim of an evil government and a court-appointed receiver run amok.

About three weeks prior to the release of the court-appointed receiver’s report that is the subject of the story below, the government signaled that new criminal charges will be forthcoming and that those charges will apply to Johnson and unnamed “others” within his business web.

“The United States’ criminal investigation is expected to continue for some months,” prosecutors said in a Jan. 12 court filing.

A devastating 79-page report filed Friday by the court-appointed receiver in the Jeremy Johnson/IWorks case paints a picture of an incredibly elaborate domestic and international fraud scheme — one that only grew as the government moved in.

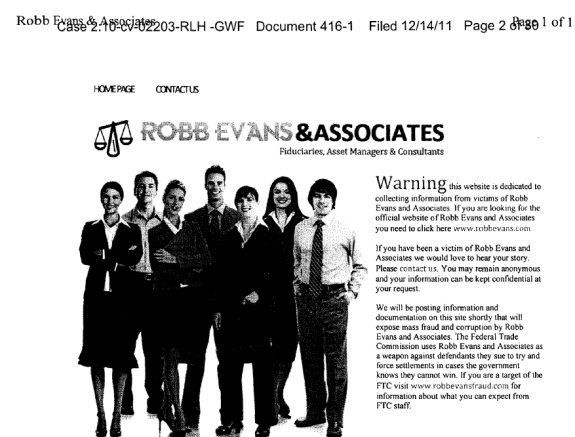

The issuance of the report by receiver Robb Evans occurred against the backdrop of an ongoing advertising campaign — apparently conducted by a person or persons within Johnson’s camp — that plants the seed that Evans is presiding over a fraudulent company. The ad campaign, which is taking place on Google’s network, initially started on a web domain whose root was formed in part with the receiver’s first and last names, followed by the word “fraud.” (See Dec. 22 editorial.)

That campaign appears to have been moved to a different domain that does not use Evans’ name to form its root, but instead marries the words “receiver” and “fraud” and asks, “Are you a victim of Robb Evans?”

“We want to hear from you!” the ad exclaims.

Evans is one of the financial analysts who helped unravel the infamous BCCI banking scandal in the 1990s. His bona fides are firmly established in the courts, and he has been a receiver or fiduciary in numerous cases.

Receiver’s Feb. 3 Update To The Court

Scores of business entities effectively were used as chess pieces to stymie investigators, keep the money wheels of key Johnson associates greased and disguise and conceal the ownership of assets, according to the report.

At least six people with business and/or personal ties to Johnson either have invoked their Fifth Amendment right against self-incrimination or informed the receiver that they would if asked questions about certain transactions, according to the report.

Included among this group were Johnson’s parents, a CPA, a notary public, a former banker and a man who’d served jail time for a previous felony conviction, according to the report.

Among the former convict’s duties was to open domestic bank or trading accounts at the prompting of other Johnson business associates, according to the report.

Through the efforts of yet another Johnson business associate, millions of dollars ended up in places such as Cyprus and Andorra, a small principality in southwest Europe bordered by France and Spain. The associate claimed to have conducted a “world tour” to open bank accounts, according to the report.

Here is how Evans, referring to both an earlier report to U.S. District Judge Roger L. Hunt and the new report issued last week, described his actions to date in reverse-engineering the alleged fraud. (Italics/emphasis added):

“This process thus far has included an analysis and review of more than 265 bank accounts and other records from 35 financial institutions and 25 other businesses. In addition to 115 affiliated entities and shell companies of the Receivership Defendants as reported in the Receiver’s first report, the Receiver also discovered at least another 65 entities that were involved in moving funds and concealing the assets of Receivership Defendants.”

And here is one of the receiver’s conclusions:

“There can be no commercially reasonable explanation for the number of entities and individuals through which funds were routed and re-routed. The only plausible explanation is that these funds are assets of Jeremy Johnson and some of the individuals were paid to shield those assets.”

There can be no doubt that the report will raise alarm bells in the U.S. Congress and official Washington because of the security implications of an alleged fraud scheme in which proceeds also made their way into a troubled Utah bank already reeling from the recession and stress on real-estate prices. The bank later failed, but not until Johnson allegedly had acquired a 19 percent stake in part through alleged nominee purchases of stock by relatives and “structured” transactions designed to ward off the FDIC.

Among other things, the report by Evans ties both Johnson and SunFirst Bank of St. George to the poker scandal playing out in New York amid Ponzi allegations. Johnson allegedly paid a bribe to John Campos, a former SunFirst banker indicted in the poker case, according to the report.

What allegedly happened at Sun First Bank, however, was only one of the events addressed in the report.

Read the receiver’s Feb. 3, 2012, report.

Prosecutors Say New Criminal Charges Coming

In a separate court filing in Nevada last month, federal prosecutors advised Hunt that the government is “conducting an extensive criminal investigation for the purpose of superseding the original indictment with a more comprehensive indictment charging Johnson, iWorks, Inc., and others with a widespread pattern of federal criminal violations.”

The others were not named in the prosecution filing.

Johnson currently is facing a single count of mail fraud, in addition to the FTC’s civil charges.

Separately, the FTC said in court filings last month that Johnson had engaged in an improper subpoena blitz in the civil case while discovery was stayed by the Nevada federal court.

Johnson, according to the FTC, sent a subpoena to the private, D.C. metro-area residence of FTC Chairman Jon Leibowitz. The subpoena, which was quashed, demanded that Leibowitz appear in St. George at 9 a.m. on Jan. 27 to be deposed.

Johnson also improperly sought to subpoena FTC commissioner Julie Brill, demanding that she appear in St. George to attend a deposition a few days after Leibowitz, according to the FTC’s filing. That subpoena also was quashed.

Like all FTC commissioners, Leibowitz and Brill are Presidential appointees. Neither is required to jump on cue from Johnson. Discovery will continue when the stay is lifted on a schedule the court — rather than Johnson — sets.

See earlier editorial that lists some of the domain names that use the names of the FTC or FTC officials in forming all or parts of their roots. The domains allegedly were acquired by Johnson or persons in his camp. At least one domain that used the name of the FDIC was formed, according to court filings: EvilFDIC.

Among the many domains that use the FTC’s name is CorruptFTC, along with at least three domains formed with the proper names of FTC staff attorneys.

Each of the domains allegedly was acquired before the receiver filed his Feb. 3 report.

A federal judge has ordered the sale of helicopters, airplanes, houseboats, vintage cars and real estate allegedly linked to a massive fraud scheme engineered on the Internet by Utah resident Jeremy Johnson and dozens of corporations, including at least 51 shell companies.

A federal judge has ordered the sale of helicopters, airplanes, houseboats, vintage cars and real estate allegedly linked to a massive fraud scheme engineered on the Internet by Utah resident Jeremy Johnson and dozens of corporations, including at least 51 shell companies.