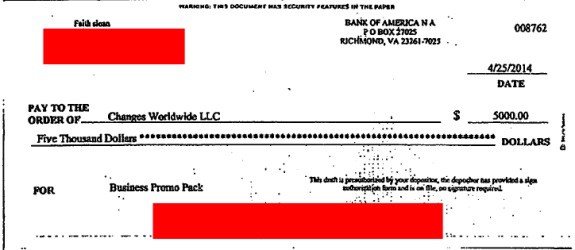

UPDATED 12:14 P.M. EDT U.S.A. Back in April 2014, the SEC charged online huckster Faith Sloan with fraud for pushing the TelexFree scheme. Two month later, in June 2014, the SEC accused Sloan of violating the TelexFree asset freeze by sending nearly $15,000 to an online scheme known as Changes Worldwide LLC for the purchase of “business promo packs.”

She also was accused of violating the freeze by sending $3,990 to an entity known as Changes Trading. There has been concern for years about serial MLM HYIP participants proceeding from fraud scheme to fraud scheme to fraud scheme. This sometimes is described as “whack-a-mole.”

Now, the U.S. Commodity Futures Trading Commission has charged both Changes Trading and Changes Worldwide with fraud. Also charged were Changes operator Timothy Baggett of Lakeland, Fla., and Kimball Parker of Lehi, Utah, along with Parker’s Utah company, MakeYourFuture LLC.

The CFTC prosecution appears not to be related to the SEC’s TelexFree case, except in the sense that it demonstrates a continuing need for discernment and that discernment may be in short supply. Sloan is not a CFTC defendant.

From the CFTC (italics added):

The CFTC Complaint alleges that the Defendants engaged in a fraudulent scheme to misrepresent the profitability and success of a futures trading system that they sold to customers, including making fraudulent representations in marketing materials, on their websites, and in one-on-one communications with customers and prospective customers regarding the profitability of their trading system. According to the Complaint, from at least March 2014 through the present, the Defendants induced at least 289 customers to pay them more than $853,294.98 for the trading system.

Specifically, as alleged, the Defendants made material, false representations in his solicitations of customers and prospective customers, including that their trading system had “never had a losing month,” and generated “300% annual returns.” According to the Complaint, to support these claims, Defendants posted so-called “documented and verifiable results” on their websites showing returns of between 11% and 68% each month from January through December 2014.

However, as the Complaint further alleges, Defendants’ “documented and verifiable results” were false and did not reflect any actual trading of real money in any futures account. Meanwhile, according to the Complaint, Parker and Baggett consistently lost money trading futures in their personal accounts, and customers also consistently lost money attempting to trade according to the system, a fact that Defendants were made aware of by customer complaints.

A bogus “live training room” and “robot” also were part of the scheme, the CFTC alleged.

Kenneth D. Bell, the receiver in the Zeek Rewards Ponzi- and pyramid case, has raised the issue of promoters/participants jumping to new schemes. Robert Craddock, a figure in the Zeek scheme later charged with ripping off the Deepwater Horizon oil-spill fund, once had an association with Changes Worldwide.

BehindMLM.com has some history on the Changes-related companies and notes Baggett also allegedly was involved in the BidsThatGive scheme.

Read the CFTC complaint, which explains how Baggett’s MLM business purportedly selling vitamins and vacations allegedly ended up getting involved in the futures business.