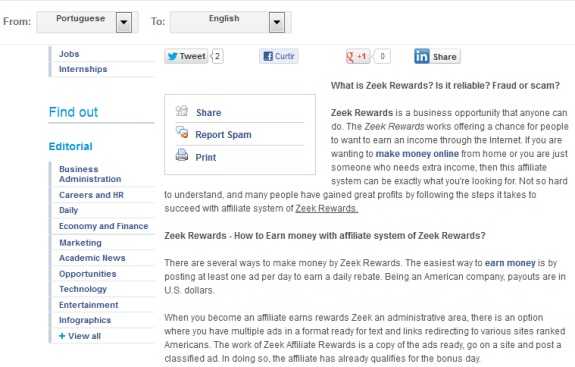

UPDATED 1:59 P.M. EDT (U.S.A.) An article on Google News by an apparent Portuguese-speaking affiliate of the U.S.-based Zeek Rewards MLM “program” that is married to a penny-auction site known as Zeekler claims that Zeek has more than 100,000 members in Brazil alone.

Meanwhile, a promo by an American affiliate dated July 7 on YouTube describes Zeek as an investment program — before the affiliate backtracks and says Zeek is not an investment program. The YouTube development first was reported by BehindMLM.com. (Link at bottom of story.)

Portuguese is the official language of Brazil, the largest country in South America. The claim of 100,000 Brazilian members could not immediately be confirmed, and no breakdown of the specific Zeek membership ranks Brazilian members had chosen was provided in the article. Zeek categorizes members as “Free,” “Silver” ($10 a month), “Gold” ($50 a month) and “Diamond” ($99 a month).

In addition to selecting a membership rank within the Zeek MLM organization, affiliates can opt to send the company up to $10,000 as a means of gaining a daily share of what is known as the Retail Points Pool (RPP). Those shares later can be converted to cash payouts that correspond to an annualized return in the hundreds of percent. The RPP program has led to questions about whether Zeek is selling unregistered securities as investment contracts and using linguistic sleight-of-hand in a bid to avoid regulatory scrutiny.

Zeek, purportedly part of Rex Venture Group LLC, is based in North Carolina. On June 20, the office of North Carolina Attorney General Roy Cooper said it had concerns about the company, which plants the seed that members can earn a return of between 1 percent and 2 percent a day but denies it is offering an investment program. Zeek’s business model resembles that of AdSurfDaily, which the U.S. Secret Service said in 2008 was a massive, online Ponzi scheme that was offering securities and disguising itself as an “advertising” program.

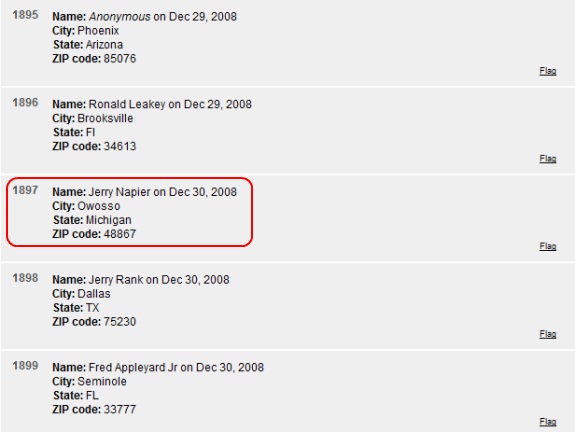

ASD President Andy Bowdoin is now jailed in the District of Columbia after pleading guilty to wire fraud in the ASD Ponzi case in May 2012. ASD’s purported payout of 1 percent a day was on par with Zeek’s purported daily payout. Because it is known that some affiliates of the ASD Ponzi scheme also are promoting Zeek and because Zeek has highlighted some of those ASD promoters on its website, questions have been raised about whether a core group of MLMers who move individually or as part of “teams” from one investment scheme to another is engaging in willful blindness by promoting Zeek, which is similar to ASD in key respects.

And because the U.S. government returned millions of dollars to ASD victims last year in the form of remissions payments that came from funds seized in the ASD Ponzi case, questions have been raised about whether Zeek’s growth has been fueled at least in part by the funds originally seized in the ASD case. The government is believed to have returned about $59 million to former ASD members.

Although Zeek says it is not offering a return on investment and instead is offering revenue-sharing program, the resultant payouts correspond to figures typically associated with HYIP Ponzi investment schemes. Like Zeek, ASD also claimed to be a revenue-sharing program.

The English version of the Portuguese article for Zeek, according to Google Translate, includes this line: “The easiest way to earn money is by posting at least one ad per day to earn a daily rebate.” (Emphasis added by PP Blog.)

ASD also called its payouts to members “rebates.” The affiliate article for Zeek in Portuguese includes this phrase: “uma bonificação diária.” The phrase, according to Google Translate, means “a daily subsidy” or “a daily rebate.”

In the ASD case, federal prosecutors said use of the word “rebate” was a means of masking the investment element of the ASD “program.”

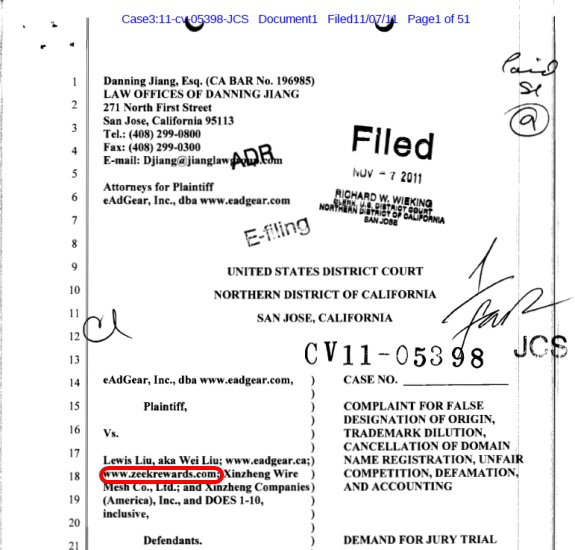

Zeek also may have a presence in Portugal itself, according to text below a YouTube video (www.youtube.com/watch?v=w07uP5XF39w) in which former ASD pitchman Todd Disner appears. Disner speaks in English in the video, but others appear to be speaking Portuguese and a link below the video points to a website styled in part as zeekportugal.com. Other text at the YouTube site points to a YouTube site styled “parttimezeekrewards’s channel.”

Disner and former ASD member Dwight Owen Schweitzer sued the United States in November 2011, claiming that ASD was a legitimate business and that government undercover agents who joined ASD had a duty to identify themselves to ASD management. Schweitzer also is promoting Zeek, according to an online promo on a classified-ad site.

ASD’s Andy Bowdoin’s guilty plea and acknowledgement ASD was a Ponzi scheme were recorded in May 2012, about six months after Disner and Schweitzer sued the government. Both men are seeking to press forward with the lawsuit, despite Bowdoin’s guilty plea to wire fraud and Ponzi concession. The duo claims the seizure of information from ASD’s database by the government was unconstitutional under the 4th Amendment. A federal judge in Florida is expected to rule soon on whether the Disner/Schweizer claims can proceed.

Virality And Customer-Service Concerns

The article on Google News that claims that Zeek has 100,000 members in the Portuguese-speaking country of Brazil may speak to the virality of the “program” on the Internet. At the same time, it may explain — at least in part — why Zeek’s customer-support systems appear to be severely taxed if not broken, with Zeek instructing its members to go to their uplines for support. Requests for help through Zeek itself have backed up for weeks or even months. Some English-speaking members of Zeek have complained their support tickets were ignored or closed without explanation.

Having thousands or even tens of thousands of affiliates in countries whose citizens may not be fully conversant in English leads to questions about whether Zeek has both the resources and the infrastructure to support a global membership base, even as some Zeek members who may not speak English are sending the company one-time sums of up to $10,000 and monthly fees on top of that. It also leads to questions about whether Zeek can police its own global network of affiliates, whether Zeek has the capacity to adequately monitor claims about the “program” in languages other than English and whether Zeek can determine whether its U.S. domestic and international affiliates are operating in “teams” to engage in downline “stacking” designed to concentrate earnings in favored familial or local pools.

Like ASD, Zeek has instructed members not to describe the “opportunity” as an investment program. But BehindMLM reported yesterday that a Zeek member on YouTube was doing just that before catching himself and going into backtrack mode. From BehindMLM.com, quoting from a Zeek affiliate’s July 7 YouTube promo (italics added):

[8:58] Do it, I did it! Do it and you’ll see how quickly you can recoup your investm..recoup your investment-ahh, I’m sorry, it’s not an investment – your original purchasing of bids.

Visit this story thread on BehindMLM.com.