BULLETIN: (UPDATED 2:34 P.M. ET U.S.A.) The court-appointed receiver in the Zeek Rewards Ponzi scheme case has advised a federal judge that he “has obtained information indicating that large sums of Receivership Assets may have been transferred by net winners to other entities in order to hide or shelter those assets.”

BULLETIN: (UPDATED 2:34 P.M. ET U.S.A.) The court-appointed receiver in the Zeek Rewards Ponzi scheme case has advised a federal judge that he “has obtained information indicating that large sums of Receivership Assets may have been transferred by net winners to other entities in order to hide or shelter those assets.”

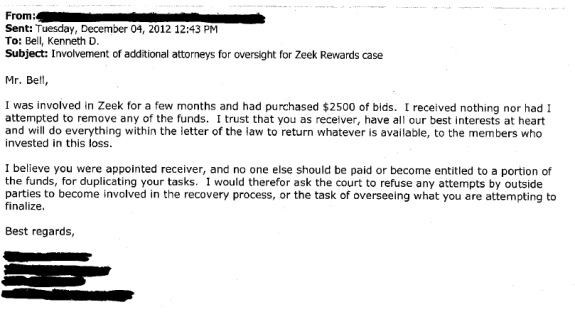

The dramatic assertion by receiver Kenneth D. Bell that Zeek winners may have hidden cash appeared in a motion to Senior U.S. District Judge Graham C. Mullen to compel certain alleged Zeek “winners” to produce documents in advance of anticipated clawback actions.

Bell’s move may send shudders across the HYIP sphere because it signals an effort to unmask bids by willfully blind hucksters and professional Ponzi players — known derisively as “pimps” — to benefit from serial scamming on a national and international scale. It is known, for instance, that some Zeek participants also pitched AdSurfDaily, which the U.S. Secret Service described in 2008 — at least two years before the launch of Zeek — as an international Ponzi scheme that had gathered tens of millions of dollars.

ASD operator Andy Bowdoin pleaded guilty to wire fraud in May. In August, he was sentenced to 78 months in federal prison.

HYIP schemes thrive in part because serial scammers race from scheme to scheme to scheme while turning blind eyes to obvious markers of fraud, including purported returns that dwarf the marketplace and are unusually consistent. Zeek planted the seed that it provided a daily return of between 1 percent and 2 percent. In August, the SEC said Zeek’s payout “consistently has averaged approximately 1.5% per day.”

Zeek operator Paul R. Burks, the SEC charged, “unilaterally and arbitrarily” determined the daily dividend rate to give “investors the false impression that the business is profitable.”

In 2009, the U.S. Secret Service effectively accused Bowdoin of doing the same thing. ASD purported to pay 1 percent a day. In August 2012, the Secret Service said it also was investigating Zeek. Court filings in the ASD case show that some members of ASD established entities through which to receive proceeds from ASD. One was described as a “ministry of giving,” for instance. Another was described as a nonprofit religious entity.

The Secret Service described ASD as a “criminal enterprise” that directed tainted proceeds potentially to thousands and thousands of participants while scamming the very people it purported to be helping earn money through its 1-percent-a-day revenue-sharing “program.”

Zeek also described itself as a revenue-sharing program and, like ASD, preemptively denied that anything untoward was occurring. Burks did not contest the SEC’s case against his firm, neither admitting nor denying wrongdoing. ASD’s Bowdoin eventually acknowledged that he was at the helm of a massive Ponzi scheme and that ASD had never operated lawfully from its inception in 2006 through it collapse in 2008.

Bell also revealed in the filing that he had filed paperwork in “all” 94 U.S. federal court districts to inform judges and court officials that he was presiding over the receivership ordered by Mullen in August after the SEC described Zeek as a $600 million Ponzi- and pyramid scheme operated through Rex Venture Group LLC (RVG) and Burks. The move was designed to consolidate jurisdiction over clawback actions in a single place: Mullen’s courtroom in the Western District of North Carolina, the home base of Zeek.

Among other things, Bell is seeking “All documents constituting or relating to any communication involving or related to RVG.”

“The Receiver has asked for these documents to learn more about how the recipient was involved in Zeek, portrayed the scheme to others, solicited others, and otherwise conducted activities related to Zeek,” Bell said in court filings.

Meanwhile, Bell is seeking “All documents constituting or related to any communication to any affiliate, vendor, customer or client of RVG related to RVG.” At the same time, he is seeking “Documents sufficient to show all user names, passwords, email addresses and accounts used . . . in connection with RVG.”

That information is needed because many “individuals used multiple user names, and this information will clarify which user names a given net winner used,” Bell advised Mullen. “In addition, the account information will help to allow the Receiver to verify the financial figures calculated from RVG’s records.”

Bell’s motion to compel specifically references Zeek affiliates Robert Craddock, David Sorrells, David Kettner and Mary Kettner as the recipients of subpoenas from the receivership. In October, Bell mailed a first wave of subpoenas to about 1,200 Zeek affiliates. He effectively is seeking the same information from them that he is seeking from Craddock, the Kettners and Sorrells.

Craddock, the Kettners and Sorrells “have failed to produce any of the documents requested by the Receiver despite multiple requests,” Bell advised Mullen. “Therefore, the Receiver has filed a motion to compel production of a portion of the documents originally requested by the Receiver.”

The Kettner and Sorrells potentially have nearly $2 million in combined clawback exposure, according to court filings. Craddock’s exposure is unclear. He has referred to himself as a Zeek “consultant.”

One of the authorities Bell pointed to in advance of Zeek clawback actions and in his motion to compel the production of documents is a case involving Michael Quilling, an attorney for Craddock, the Kettners and Sorrells. Quilling himself has presided over SEC receiverships.

Bell pointed out to Mullen that Quilling once sued the estate of a a deceased individual who’d received proceeds from the Frederick J. Gilliland Ponzi scheme in 2002. That lawsuit was filed on the same legal theory Bell is pursuing in the Zeek case: that recipients of fraudulent proceeds from a Ponzi scheme are not entitled to keep them.

See post on ASDUpdates.