On Feb. 13, the PP Blog reported that a federal judge who was quoting from a pleading by AdSurfDaily figure and purported “sovereign citizen” Kenneth Wayne Leaming had referenced a domain styled peoplestrust1776.org.

On Feb. 13, the PP Blog reported that a federal judge who was quoting from a pleading by AdSurfDaily figure and purported “sovereign citizen” Kenneth Wayne Leaming had referenced a domain styled peoplestrust1776.org.

U.S. District Judge Ronald B. Leighton declared Leaming’s filing, which apparently cited the Uniform Commercial Code (UCC), “undecipherable.” The judge exempted prosecutors from responding to a series of recent bizarre pleadings from Leaming, who is jailed near Seattle on charges of filing false liens against public officials in the AdSurfDaily Ponzi case. Leaming, 57, also is accused of other crimes.

Like other purported “sovereigns,” the judge observed, Leaming is “fascinated” by capital letters.

Some “sovereign citizens” appear to believe that pleadings that include capital letters or make UCC claims provide defenses or remedies for everything from murder charges to charges of targeting public officials in harassment campaigns.

Less than two days after the PP Blog published its most recent story about Leaming’s strange defense efforts in the Western District of Washington, the Blog received a would-be comment it is treating as spam because it purported to be in response to a reader who left a comment on the PP Blog nearly two years ago on a different subject. Received at 2:55 a.m. ET today, the unpublished, would-be comment included a link to a post on a Blog whose URL was formed in part with the words “the-full-details-of-kidnapping-of.”

One had to visit the site to determine who allegedly was kidnapped.

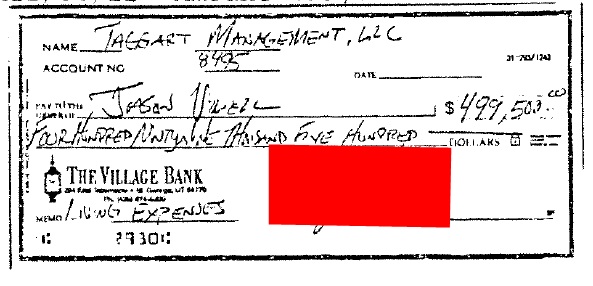

The PP Blog visited the link and found a post about Patrick Cody Morgan, a purported Texas “sovereign” who was convicted last year of conspiracy and nine counts of bank fraud in a real-estate swindle involving repeated bids to scam residential mortgage lenders and FDIC-insured banks between 2004 and 2007. The scam involved “trust accounts” and “straw buyers,” prosecutors said. The PP Blog wrote about the Morgan convictions on Nov. 2, 2012. No readers left comments in the thread below the story.

In any event, the would-be commentator apparently wants to generate discussion about the Morgan case and to enlist support for Morgan. Notably, the spammed link received by the PP Blog includes references to the same peoplestrust1776.org domain Leaming cited in an apparent defense bid in his criminal case.

Content on the site whose post link was spammed to the PP Blog overnight appears to be designed to paint government officials or agencies involved in the Morgan case as “the Accused.” Apparently among the purported “Accused” are U.S. Attorney General Eric Holder, FBI Director Robert Mueller, U.S. District Judge Lynn N. Hughes of the Southern District of Texas and others. The site also published florid legalese attributed to Morgan that, like Leaming’s prose, made liberal use of capital letters.

Legalese attributed to Morgan asserts he is “Patrick-Cody: Family of Morgan”; Leaming’s legalese asserts he is “Kenneth Wayne, born free to the family Leaming.”

Some “sovereigns” appear to believe that using exceptionally formal prose, capital letters and/or specific forms of punctuation in court filings somehow provide for a winning defense.

Leighton characterized Leaming’s prose as “gobbledygook.”

Morgan — in his apparent defense — appears to claim he was the victim of criminals working for the government. Leaming has made similar arguments in Washington state.

Precisely what role, if any, peoplestrust1776.org is playing in the Morgan and Leaming cases is unclear.