Ripple Labs’ Settlement Agreement With Feds References Alleged Transaction With Roger Ver, American Expat Known As ‘Bitcoin Jesus’

From a settlement agreement between the U.S. Department of Justice and Ripple Labs. Red highlight by PP Blog. Source: U.S. Attorney’s Office for the Northern District of California.

EDITOR’S NOTE: Will MLM/network-marketing hucksters pushing UFunClub/UToken find any value in the story below?

Ripple Labs Inc., based in San Francisco, “developed and sold virtual currency known as ‘XRP,'” but didn’t follow the law and “failed to establish and maintain an appropriate anti-money laundering program,” the U.S. Department of Justice said.

If Ripple’s name sounds familiar, perhaps it’s because the company sued the Rippln MLM “opportunity” in late 2013, alleging trademark infringement. In a statement, the Justice Department makes a veiled reference to that action, something that put Ripple on the radar.

At some point, Ripple became the subject of a criminal investigation led by the office of U.S. Attorney Melinda Haag of the Northern District of California. The IRS Criminal Investigation Division also participated.

As the investigation proceeded, the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) became involved on the civil front.

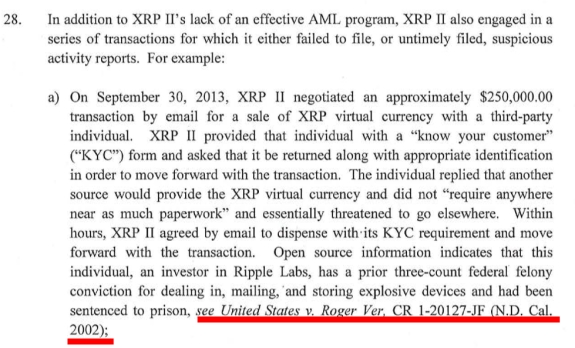

Of particular note in the Justice Department’s news release about a settlement agreement with Ripple that ended the criminal probe was an allegation that a second Ripple subsidiary known as XRP II in late 2013 allegedly “negotiated a $250,000 transaction with an individual who had prior felony convictions for dealing in explosive devices and had been sentenced to prison.”

Based on information in the Ripple settlement agreement, the government appears to believe this individual is Roger Ver, sometimes described as “Bitcoin Jesus.”

Ver was convicted in 2002 on charges of selling explosive devices on eBay.

XRP II appears to have constituted an effort on Ripple’s part to address FinCEN money-laundering concerns, but the subsidiary failed to “follow its own internal ‘know your customer’ requirements,” the Justice Department said.

“Virtual currency exchangers must bring products to market that comply with our anti-money laundering laws,” said Director Jennifer Shasky Calvery of FinCEN. “Innovation is laudable but only as long as it does not unreasonably expose our financial system to tech-smart criminals eager to abuse the latest and most complex products.”

From a Justice Department statement on the settlement (italics added).

Ripple Labs Inc. and its wholly-owned subsidiary, XRP II LLC, formerly XRP Fund II LLC, have agreed to resolve a criminal investigation in exchange for a settlement agreement calling for a series of substantial remedial measures, including a migration of a portion of Ripple’s virtual currency business to a separate entity, the company’s ongoing cooperation in other investigations, an extensive remedial framework to ensure future compliance with federal laws and forfeiture and penalties totaling $700,000.

NOTE: Our thanks to the ASD Updates Blog.

There’s an article on CoinDesk or such that said Ver bought 250K worth of XRP as an investor, and Ripple Labs never filled out a Suspicious Activity Report as required by FinCEN. Don’t have the link right now.

Why would it file any report? XPR was created by Jed McCaleb to specifically conduct money laundering, otherwise there is no point of virtual currency use ,

$ denominated FinCEN registered businesses would fill any other legitimate demand (bitcoin defenders use a lot of naive excuses to cover up the true nature of virtual currency)

Maybe I wanted to see Ripple Labs as a good guy because it sort of contributed to the death of Rippln. :D