UPDATED 10:56 A.M. EDT (U.S.A.) The ASA Monitor Ponzi and criminals’ forum now is redirecting to a website operated by CashX.com, a Canadian payment processor that hawks MasterCard debit cards and says it permits customers to withdrawn money to Liberty Reserve.

Liberty Reserve is a Ponzi-friendly payment processor purportedly headquartered in Costa Rica after earlier operating from Panama.

Meanwhile, confessed Ponzi schemer Arthur Nadel — who briefly went on the lam from Florida in early 2009 as his $390 million scheme was disintegrating and became known as one of the original “mini-Madoffs” — has been sentenced by a federal judge in New York to 14 years in prison.

It is effectively a life sentence for Nadel, who is 77 and one of several senior citizens implicated in U.S. Ponzi schemes.

At the same time, a former clergyman from Indiana who told congregants it was their “Christian responsibility” to become pitchmen for his then-undiscovered bond scheme has been convicted of nine counts of securities fraud.

Vaughn Reeves, 66, is scheduled to be sentenced next month. The jury deliberated only four hours before returning the verdict against Reeves, himself a senior citizen. Congregants believed they were helping raise money for church-building projects, but it was a scam that led to foreclosure proceedings against eight places of worship. (See link to AP report below.)

Claims made by Reeves are similar to claims made by the Data Network Affiliates (DNA) MLM program, which told members that churches had the “MORAL OBLIGATION” to help bring business to the Florida-based firm and qualify for commissions ten levels deep. DNA purports to be in the license-plate data collection business, claiming it can help law enforcement and the AMBER Alert program recover abducted children.

Incongruously, DNA also purports to sell a “protective spray” that shields cameras from taking photographs of license plates. Equally incongruously, the company said that it could offer a free cell phone with unlimited talk and text for $10 a month. The company later backtracked on the claim, bizarrely saying it studied pricing structures only after announcing it had become the world’s low-price leader while acknowledging it hadn’t vetted its purported vendor for the service.

DNA figure Phil Piccolo later threatened to sue critics. Earlier, Dean Blechman, who said he was the company’s CEO before resigning in February, threatened to sue critics. DNA withheld the announcement of Blechman’s departure for nearly a week and then misspelled his name. DNA also described Blechman as the “future” CEO, even though Blechman had described himself as the current CEO.

Blechman complained to the PP Blog about “bizarre” events at DNA.

ASA Monitor, which is referenced in court filings as a place from which the alleged Pathway To Prosperity (P2P) Ponzi scheme was pitched and was a site from which the purported “grocery” MLM operated by Florida-based MPB Today was pitched, suddenly announced on Oct. 12 that it was closing.

Like MPB Today, DNA also was pitched from Ponzi and criminals’ forums.

The ASA Monitor closure announcement coincided with a flap in which an ASA forum moderator sought to muzzle critics of the MPB Today program, which is being targeted at Christians, foreclosure subjects, Food Stamp recipients, senior citizens, people of color and members of the alleged AdSurfDaily (ASD) Ponzi scheme.

ASD also operated from Florida before the U.S. Secret Service seized tens of millions of dollars in August 2008, amid allegations of wire fraud and money-laundering. Robert Hodgins, an international fugitive wanted by Interpol in a narcotics-trafficking and money-laundering case filed after an undercover probe by the U.S. Drug Enforcement Administration in Connecticut, provided debit cards to ASD, members said.

Nadel’s scheme, meanwhile, operated in the Sarasota area.

“Through his massive Ponzi scheme, Arthur Nadel greased his own pockets and financed his lavish lifestyle, using money his clients relied on him to invest,” said U.S. Attorney Preet Bharara of the Southern District of New York.

“He cheated his elderly and unwitting victims out of their retirement savings and consigned others to poverty,” Bharara said. “The message of [yesterday’s] sentence should be loud and clear — we will continue to work with our partners at the FBI to find the perpetrators of financial fraud and use every resource we have to bring them to justice.”

U.S. District Judge John G. Koeltl ordered Nadel to forfeit $162 million, five airplanes, a helicopter and real estate in Florida, North Carolina and Georgia.

The prosecution of Nadel was brought in coordination with President Obama’s Financial Fraud Enforcement Task Force. U.S. Attorney General Eric Holder traveled to Florida earlier this year to warn fraudsters that the United States was serious about putting scammers in prison.

By September, an affiliate of MPB Today had created a video in which Obama was depicted as a left-handed saluting Nazi who cowered to U.S. Secretary of State Hillary Clinton, who was depicted as a drunk. First Lady Michelle Obama, the mother of two daughters, was depicted as having experienced an embarrassing gas attack in the Oval Office after sampling beans at a Sam’s Club store.

Clinton, depicted in the sales promo as “Hitlary,” knocked out Michelle Obama after barging into the Oval Office bawling and carrying a bottle of wine. Clinton, the mother of one, was the first woman ever appointed to the Walmart board of directors.

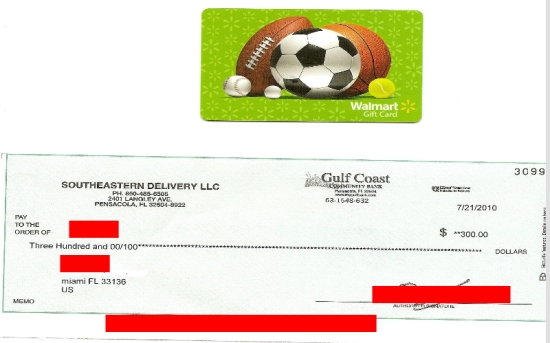

Some MPB Today affiliates have claimed Walmart is affiliated with MPB Today and that the government backs the MLM program, which appears to have accounts at at least two banks in the Pensacola area. One of the banks is operating under a consent agreement with the FDIC.