BULLETIN: The court-appointed receiver in the Zeek Rewards Ponzi- and pyramid case says millions of dollars in Zeek assets were transferred from the United States to the Cook Islands in the South Pacific by a former Zeek vendor known as Preferred Merchants Solutions LLC. At least part of the money allegedly then was used to purchase and renovate a “water-view vacation home” in the Turks and Caicos Islands in the North Atlantic.

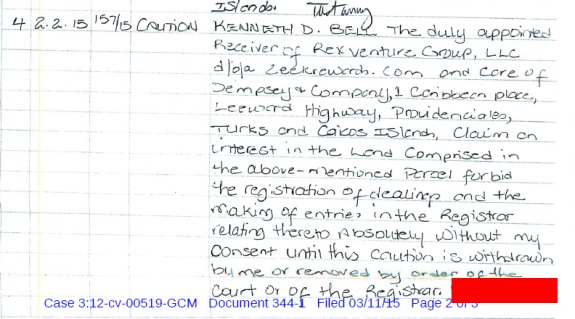

Receiver Kenneth D. Bell hired local counsel in the Turks and Caicos to bottle up the property through the filing of a “Caution,” which Bell says “forbids any action with respect to the title of the Turks & Caicos Property” until the matter is resolved in the United States.

Senior U.S. District Judge Graham C. Mullen has frozen the island property, which Bell said he intends to sell to benefit Zeek victims.

Zeek was operated by Paul R. Burks through Rex Venture Group LLC. Preferred is operated by Jaymes Meyer of Napa, Calif.

Events that led to the island freeze involve a bizarre circumstance that allegedly occurred in June 2012, when tens of millions of dollars in undeposited checks — enough to fill six to eight mail bins — had backed up at Zeek, starving the Rex enterprise for cash during a period in which Zeek was having banking problems in North Carolina and its alleged Ponzi was crumbling.

As the PP Blog reported in October 2014, Burks allegedly hired Preferred to solve the problem and also to provide trust services. Bell contends that Preferred effectively transferred Zeek Ponzi cash to itself after it learned from the SEC on Aug. 16, 2012, that an order freezing Zeek assets was imminent.

Bell now says Preferred Merchants, “a single-member LLC owned entirely by Jaymes Meyer, transferred $7,737,402 of RVG assets from an RVG trust account . . . for which Preferred Merchants served as trustee. Prior to receiving the RVG Trust Funds, Preferred Merchants had a total of $2,790 in its bank account on August 1, 2012. Preferred Merchants is Meyer’s only source of income.”

The SEC moved against Zeek on Aug. 17, 2012, securing an asset freeze.

“On October 5, 2012,” according to Bell, “Meyer transferred $300,000 from Preferred Merchants to a Scottrade account held in the name of Fidus, LLC, a Delaware entity for which Meyer is the managing member, but was owned by ‘The Spiritum Holdings Irrevocable Trust,’ . . . a ‘Cook Islands Trust’ that Meyer set up in September 2012” after the Zeek freeze.

“On October 9, 2012, Meyer transferred an additional $6,100,000 from Preferred Merchants to the Scottrade Fidus account,” Bell said. “All or nearly all of the money held or transferred by Preferred Merchants or Meyer to the Scottrade Fidus account were RVG Trust Funds.”

More asset-shielding shenanigans occurred as 2013 was getting under way, months after the court-imposed freeze in August 2012, Bell alleged.

“On February 21, 2013, Meyer wired $6,000,000 from the Scottrade Fidus account to an account owned by the Spiritum Trust at Capital Security Bank Limited located in the Cook Islands,” Bell alleged. “On July 3, 2013, Meyer wired the $400,000 remaining in the Scottrade Fidus accounts to the same Spiritum Trust account in the Cook Islands.

“On or about June 28, 2013, Bella Vita Ltd., an entity in the Turks & Caicos Islands that was created and owned by the Spiritum Trust, purchased real property in the Turks & Caicos Islands designated as Title # 60609/24/Norway & Five Cays Section / Providenciales Island (‘Turks & Caicos Home’).”

What are the specs on the home?

It “is described as a 5 bedroom 5 bath home, which Meyer testified has views of the water,” Bell said. “The money used to purchase this real property were RVG Trust Funds that Meyer had deposited into various accounts owned by the Spiritum Trust.”

What else did Zeek victims allegedly pay for?

“Since the purchase of the Turks & Caicos Home, Meyer has coordinated and supervised improvements and renovations to the home and property, purchased furniture and fixtures, and purchased a boat, scuba equipment, and other personal property to be used with the Turks & Caicos Home . . .

“Meyer claims that over $1.5 million . . . has been spent ‘renovating’ the property and making these additional purchases,” Bell said. “All of these purchases were made with RVG Trust Funds that had come directly or indirectly from the Spiritum Trust or Meyer. However, Meyer and Preferred Merchants disclaim any ownership interest or control over Bella Vita, Ltd. or the Turks & Caicos Property.”

Bell has asked Mullen to “impose and enforce an equitable lien by ordering transfer of title to the Turks & Caicos Property to the Receivership Estate to ensure that there is no more evasion or hindrance of the Receiver’s recovery of these assets by Preferred Merchants and Meyer. The Receiver can then sell the Turks & Caicos Property to collect additional funds for the benefit of the victims of the ZeekRewards scheme.”

NOTE: Our thanks to the ASD Updates Blog.