It may be a first in MLM clawback cases.

It may be a first in MLM clawback cases.

Dwayne Jones, an alleged winner of more than $561,000 in the judicially declared TelexFree Ponzi- and pyramid scheme, is trying to sue Trustee Stephen B. Darr for “Emotional Distress and Anticipated Attorney & Court Costs.”

In a proposed defendant class-action, Darr sued Jones and dozens of other alleged winners earlier this year for return of their gains. Jones was sued at a New York address. Acting pro se, he appears to have responded to Darr’s adversary complaint filed in Massachusetts federal bankruptcy court with a kit pleading from Maryland federal bankruptcy court in which he denied he was a TelexFree winner, raised jurisdictional claims and asserted the emotional-distress counterclaim against Darr.

Darr responded on June 6, saying he “denies in full the sole allegation in the defendant’s Counterclaim, that the defendant is entitled to unspecified damages for emotional distress and anticipated attorney and court costs arising out of this litigation.”

The trustee also entered affirmative defenses.

Class-action cases filed by Darr against alleged TelexFree winners potentially affect nearly 100,000 participants globally who gained more from TelexFree than they paid in. The scheme allegedly created hundreds and hundreds of thousands of losers.

Chief U.S. Bankruptcy Judge Melvin S. Hoffman of Massachusetts is presiding over the cross-border TelexFree case and adversary proceedings.

On May 24, Hoffman asked judicial authorities in the Dominican Republic for assistance in serving process on more than a dozen clawback defendants located there.

Darr contends TelexFree generated more than $3 billion in illicit business worldwide and that winners must return their gains.

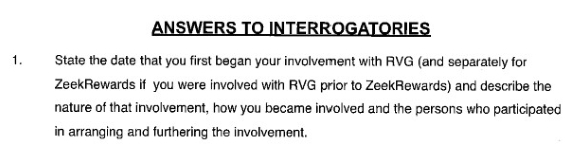

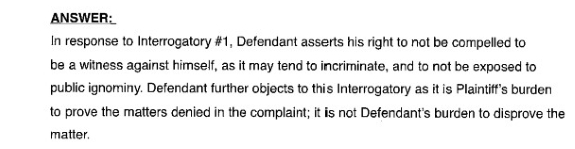

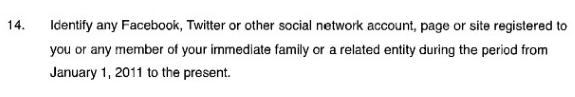

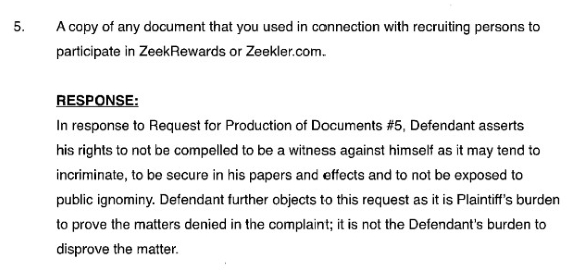

Kenneth D. Bell, the receiver in the Zeek Rewards case, also has brought clawback claims against alleged domestic and international winners in that scheme. Zeek is alleged to have gathered on the order of $897 million.

Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012.

Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012. UPDATED 11:53 A.M. EDT U.S.A. Sept. 23, 2016: The claims deadline has been extended until Dec. 31, 2016, at 4:30 p.m. Prevailing Eastern Time. Claims must be filed through

UPDATED 11:53 A.M. EDT U.S.A. Sept. 23, 2016: The claims deadline has been extended until Dec. 31, 2016, at 4:30 p.m. Prevailing Eastern Time. Claims must be filed through

URGENT >> BULLETIN >> MOVING: (6th Update 8 p.m. EDT U.S.A.) TelexFree Trustee Stephen B. Darr has sued MLM attorney Gerald Nehra and the Nehra and Waak law firm, alleging they were “actively involved” in promoting TelexFree’s Ponzi scheme and “duping” participants.

URGENT >> BULLETIN >> MOVING: (6th Update 8 p.m. EDT U.S.A.) TelexFree Trustee Stephen B. Darr has sued MLM attorney Gerald Nehra and the Nehra and Waak law firm, alleging they were “actively involved” in promoting TelexFree’s Ponzi scheme and “duping” participants.

UPDATED 3:11 P.M. EDT U.S.A. A report dated today at ShanghaiDaily.com says an individual “surnamed Xu” and associated with “World Capital Market Inc.” is “now in custody” after a police action against a “pyramid scheme” in China.

UPDATED 3:11 P.M. EDT U.S.A. A report dated today at ShanghaiDaily.com says an individual “surnamed Xu” and associated with “World Capital Market Inc.” is “now in custody” after a police action against a “pyramid scheme” in China. Roger Alberto Santamaria Del Cid, an apparent nominee director for offshore companies who is listed as a corporate “subscriber” for VX Gateway in Panamanian business records, is referenced at least three times in the “Panama Papers.”

Roger Alberto Santamaria Del Cid, an apparent nominee director for offshore companies who is listed as a corporate “subscriber” for VX Gateway in Panamanian business records, is referenced at least three times in the “Panama Papers.”

On April 20, the

On April 20, the