UPDATED 6:55 P.M. EDT (U.S.A.) A garden-variety, lawful protest commonly received in mailrooms within the halls of power? A self-serving, reality-inverting tale of the civil-forfeiture case against the proceeds of an alleged $110 million autosurf Ponzi scheme? A backdoor bid to end-run rulings made by the U.S. Judiciary and hand an invoice to the U.S. Congress for purported damages and financial penalties against public officials sprouting from the government’s alleged mishandling of the ASD case?

The staff of Senate Judiciary Committee Chairman Patrick Leahy, D-Vermont, did not immediately respond to a PP Blog request for comment this afternoon on a document apparently tabled by the panel after it was received in April after having been submitted by American-International Business Law Inc.

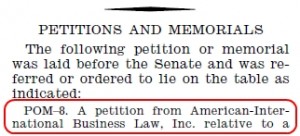

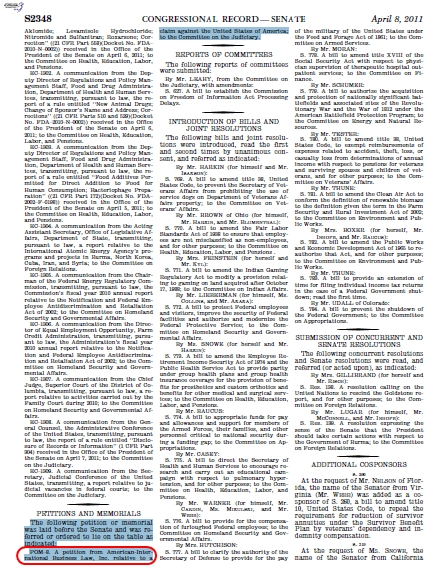

AdSurfDaily figure Kenneth Wayne Leaming, a purported “sovereign citizen,” is listed in Washington state records (as “Kenneth Wayne”) as the chairman and president of American-International Business Law Inc. The firm’s name appears in the Congressional Record of April 8 as the presenter of a “petition . . . relative to a claim against the United States of America.”

Among other things, Leaming, who once was convicted of piloting an airplane without a license, also was accused of practicing law without a license. He has purported to be a specialist in admiralty law — and has advertised the availability of a lower rate for “prepaid” clients.

Details about the April document were not provided in the Congressional Record entry, and Leahy’s committee staff was unable to provide details immediately. The Blog asked the staff staff to provide a copy of the claim and, if possible, forward it to the Blog. Whether the staff will be able to accommodate the request was not immediately clear.

Leaming and ASD member Christian Oesch unsuccessfully sought to sue the United States last year in the U.S. Court of Federal Claims, apparently seeking the staggering sum of more than $29 TRILLION — more than twice the U.S. Gross Domestic Product in 2009.

Their lawsuit targeted federal employees who had a role in the civil-forfeiture case filed against tens of millions of dollars alleged to be the proceeds of a massive Ponzi scheme conducted by Florida-based ASD. About $65.8 million was seized by the U.S. Secret Service from the personal bank accounts of ASD President Andy Bowdoin, and federal prosecutors in the District of Columbia scored a clean sweep in forfeiture-related litigation. The government now holds title to about $80 million seized from ASD-related bank accounts.

The lawsuit came in the form of purported “Certificates of Default” issued against public officials on Feb. 16, 2010, by Tina M. Hall, a notary public with ties to Leaming.

Hall’s notary license was revoked by the state of Washington in October 2010, about three months after Leaming and Oesch filed their lawsuit. The PP Blog reported yesterday that the license of Kathryn E. Aschlea, a second notary with a tie to Leaming and American-International Business Law Inc., also had her license revoked by the state of Washington.

When Judge Christine Odell Cook Miller dismissed the Leaming/Oesch lawsuit in December 2010, she noted that the complaint included a claim by Hall that the officials had failed to respond to “claims in admiralty.”

“At this point the complaint deteriorates into rambling,” the judge wrote in her dismissal order.

Whether the Judiciary Committee received a similar rambling narrative from Leaming and Oesch and one or more notaries public is unclear.

See February 2009 story about ASD-related letter-writing campaign to Sen. Leahy by ASD figure “Professor” Patrick Moriarty. See follow-up editorial by PP Blog. Read May 2009 “Poof Penalty” story. Click here to read a Congressional Record PDF that includes the American-International Business Law Inc. reference.

UPDATED 2:49 P.M. EDT (U.S.A.) A pitchfest for an apparent cycler matrix called “Fast Profits Daily” has begun on the TalkGold Ponzi forum. Fast Profits Daily shares a street address in Delaware with another apparent matrix program known as “2X2 Prosperity Formula” and a purported vacation program known as “DREAM STYLE VACATIONS, LLC,” according to research.

UPDATED 2:49 P.M. EDT (U.S.A.) A pitchfest for an apparent cycler matrix called “Fast Profits Daily” has begun on the TalkGold Ponzi forum. Fast Profits Daily shares a street address in Delaware with another apparent matrix program known as “2X2 Prosperity Formula” and a purported vacation program known as “DREAM STYLE VACATIONS, LLC,” according to research.

URGENT >> BULLETIN >> MOVING: The price of Brett Blackman’s serial scamming finally has been determined: $54.2 million.

URGENT >> BULLETIN >> MOVING: The price of Brett Blackman’s serial scamming finally has been determined: $54.2 million. He once had command of legions — and AdSurfDaily members lined by the hundreds and waited in line for hours to pay Andy Bowdoin to give them a chance to “build wealth.” At its peak in the summer of 2008, ASD reportedly was posting tens of millions of dollars a week in revenue.

He once had command of legions — and AdSurfDaily members lined by the hundreds and waited in line for hours to pay Andy Bowdoin to give them a chance to “build wealth.” At its peak in the summer of 2008, ASD reportedly was posting tens of millions of dollars a week in revenue.