EDITOR’S NOTE: The “story” below is not real. The PP Blog occasionally presents fantasy posts, parody and satire as a means of advancing the discussion about issues in the world of online crime and marketing schemes.

EDITOR’S NOTE: The “story” below is not real. The PP Blog occasionally presents fantasy posts, parody and satire as a means of advancing the discussion about issues in the world of online crime and marketing schemes.

SOUTH FLORIDA (PPBlog) — Phil Pumpernickel, the unapologetic scammer who once started an “opportunity” that hawked caskets MLM-style after telling the world he was moved to do so after being reduced to tears by the “fine Christian” conducting his “sainted grandmother’s” funeral, is getting in the “troll spray” business.

Pumpernickel said he decided to “seize the moment” and launch a new frauduct after being impressed by a photographic depiction of troll spray used as an avatar on Scam.com by a fellow MLM aficionado doing battle with critics.

“Those people who speak out against MLM and all the so-called ‘scams’ are just a bunch of bigots,” Pumpernickel said. “They’re all a bunch of mindless trolls. Many of them not only are anti-MLM, but are anti-American.

“I mean, they actually think Obama was born in the United States,” he protested. “I’m so glad I saw that avatar. It’s important for trolls to be put in their place and dressed down in public. All the best MLMers are doing that now — that and coming up with great, highly descriptive terms such as ‘bigots’ and ‘haters’ and ‘whiners’ to describe the self-appointed critics. All of these things are helping to paint MLM in the most favorable light. The pro-MLMers at Scam.com are PR geniuses, I’ll tell you, and I can’t thank them enough. In any event, I decided to build an entire new scam around a ‘troll-spray’ theme.”

Although the MLM casket business failed during “prelaunch” in no small measure “because of the trolls,” Pumpernickel said, the troll-spray business would be different.

“What I’m going to do,” he said, “is plant the seed that affiliates should use more pictures of Donald Trump this time to help sanitize the opportunity. I can get the ‘Birthers’ that way, and make people believe Trump has endorsed the program.”

The failure of affiliates to take full advantage of Trump’s celebrity to hawk the casket “opportunity” was one of its biggest shortcomings, Pumpernickel conceded.

“People can call me a lot of things — and I’m well aware of my reputation as a serial scammer — but they’ll never be able to claim this time that my affiliate’s efforts to trade on Trump’s name without authority were insufficient,” the celebrated scammer said. “My fellow scammers made it perfectly clear to me that I need to ‘Trump’ up my next fraud scheme, and I listened.”

Pumpernickel added that he was considering advice from a “group” of fellow scammers who recommended he add the names and images of Oprah Winfrey and former Presidents Bill Clinton and George W. Bush to the troll-spray promos. He declined to name members of the group, except to say “they are all veteran scammers who’ve made millions and millions and millions.”

But Pumpernickel hinted that there is some early dissension in the ranks about how best to proceed with the troll-spray scam.

“Some of these people are convinced that trading on Oprah’s name without permission ‘works’ because of the chain-letter scams and the impressive success of the recent acai-berry scams,” Pumpernickel said. “My take is a bit different at the moment, given what the FTC did in the acai cases, but I’ve agreed to take the matter under advisement. In this early, pre-prelauch stage, though, I’m given to believe that Oprah may be a little too hot right now. The FTC is playing hardball.”

Pumpernickel said he was less concerned about using the names of the former presidents.

“Hey,” he said, “the Mantria people used Clinton. And the AdSurfDaily people used Bush. No one can doubt the success of those schemes — and the scams are old enough now that trotting out the Presidents again to plant the seed that they endorse troll spray just might be viewed as a fresh approach.”

Among the lies he intended to make go viral were that the troll-spray product not only was useful in keeping anti-MLM trolls at a distance in person and on forums, but also could be used to improve a car’s gas mileage, grow apples the size of “Washington state” and cure cancer, Pumpernickel said.

“What I’ll do,” he revealed, “is simply plant the seed that the product has all of these benefits. My affiliates have proven over time that they can be relied upon to do no checking or independent research whatsoever. Marketing online is beautiful in this way. They’ll take the ideas I plant, and before it’s all over, they’ll have Trump as the president of the company, Bush as director emeritus and a famous cancer hospital not only saying the product cures the disease, but also that the entire hospital staff is warding off the disease by consuming apples that are bigger than pumpkins.”

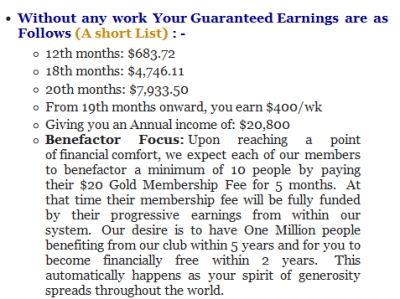

Ultimately, Pumpernickel said, “the goal of any good scam is to plant the seed that fabulous wealth is possible.

“We’ll do that, too, of course,” he promised. “I’ve had success in the past by rambling on and on about commissions 10 levels deep and talking about the ‘millions’ I’ve made. But the best viral scams are the ones that mix those elements with what I call the ‘Real Unreal.’

“For example, Trump is a ‘real’ person,” Pumpernickel said, “but it’s ‘unreal’ that he”ll be involved in the troll-spray product. My best promoters will be the ones who make the best use out of all the ‘Real-Unreal’ elements out there. I mean, the possibilities are endless.”

Pumpernickel said he was in the process of negotiating with a vendor to brand and package the troll spray, which a newly created shell company likely would market for $19.95 per can, with volume discounts if the product is purchased by the case.

Prospects will be told they can join the opportunity for “free” and will be encouraged to invite their mothers to do so.

“It’s always best when we have a good group of mothers helping us market our scams,” Pumpernickel said. “We should be ready to start the prelaunch by Father’s Day next month. If something goes wrong with the actual prelaunch and launch and people don’t get paid, I’ll just change the rules and tell the folks to pretend it never happened. I learned that by observing the launch and prelaunch of Data Network Affiliates last year.

“And if people ask too many questions,” he concluded, “I’ll plant the seed that I know leg-breakers and call all the critics ‘bigots.’ It’s great PR.”

BULLETIN: Raj Rajaratnam has been found guilty of all 14 counts of conspiracy and securities fraud filed against him in the Galleon Group insider-trading case.

BULLETIN: Raj Rajaratnam has been found guilty of all 14 counts of conspiracy and securities fraud filed against him in the Galleon Group insider-trading case.