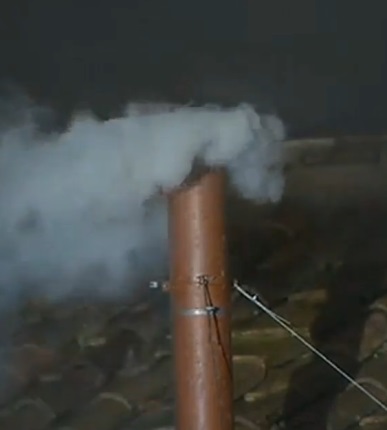

A new Pope has been elected. He is Jorge Mario Bergoglio of Argentina and will be known as Francis I.

A new Pope has been elected. He is Jorge Mario Bergoglio of Argentina and will be known as Francis I.

Francis is the first Pope from South America.

In a development that could give pause to promoters of the purportedly “private” Profitable Sunrise scheme now on the radar of regulators in North America and Europe, a Florida man has been sentenced to 10 years in federal prison for his role in pitching a purported “opportunity” known as Queen Shoals.

In a development that could give pause to promoters of the purportedly “private” Profitable Sunrise scheme now on the radar of regulators in North America and Europe, a Florida man has been sentenced to 10 years in federal prison for his role in pitching a purported “opportunity” known as Queen Shoals.

The announcement of the prison sentence of Gary D. Martin, 61, was made by U.S. Attorney Anne M. Tompkins of the Western District of North Carolina. She was joined by Roger A. Coe, acting special agent in charge of the FBI office in Charlotte, and North Carolina Secretary of State Elaine F. Marshall.

Marshall’s office issued a cease-and-desist order late last month to Profitable Sunrise, a purportedly “private” program. Tompkins’ office, meanwhile, is involved in the probe of the alleged Zeek Rewards Ponzi scheme, which described itself as a “private” program, according to court files. In August 2012, the SEC said Zeek was selling unregistered securities as investment contracts and had gathered at least $600 million.

While Profitable Sunrise is alleged by regulators to be offering returns in excess of 300 percent a year, Queen Shoals promised a much lower annualized percentage of between 8 percent and 24 percent.

The $32.5 million Queen Shoals Ponzi scheme was operated by Sidney Hanson. Martin formed an LLC with a similar name and pitched Queen Shoals from Florida. Federal prosecutors effectively accused him of passing along lies told by Hanson to fleece investors, including senior citizens.

Chief U.S. District Judge Robert J. Conrad Jr., who ruled in August 2011 that promises of “guaranteed” annual earnings were used by Martin to lure customers into the fraud, described the effect as devastating

“People in their 60’s, 70’s, 80’s and even 90’s lost everything because Hanson and Martin defrauded them,” prosecutors quoted Conrad as saying.

And, prosecutors said, Conrad also noted that Martin “went into homes, got people to rely on him and told them things that weren’t true, and based on false representations, many lost their life savings . . . He is seriously culpable.”

Conrad ordered Martin to pay more than $31.7 million in restitution and to serve two years’ probation upon completion of the prison sentence.

The Martin case speaks to the issue of how a lack of due diligence on the part of promoters can cause problems if a scheme later turns out to be a scam, perhaps especially if promoters add their own lies to a pitch and recruit other pitchmen.

From a statement by prosecutors (italics/bolding added):

Court records show that although Hanson never directly told Martin that Queen Shoals was a Ponzi scheme, Martin induced victims to invest in the Queen Shoals Ponzi scheme through a series of false and fraudulent representations. Specifically, Martin falsely claimed that QSC had over 20 years’ experience in financial services and international finance and that he had a vast background in financial services, including the silver, gold and foreign currency trading markets. In fact, Martin had no such experience, held no professional licenses related to finance or investments and had never engaged in any silver, gold or foreign currency trading.

According to court documents, Martin, through the QSC web site and other means, also made false claims about QSC’s financial expertise in “Self-Directed IRA Strategies and Fixed Rate Accounts.” Martin held QSC out as “leaders in Professional Private Placement Retirement Planning” and falsely claimed that QSC had a “proven method of diversification [that] spreads the risk nicely for a balanced portfolio,” when, in fact, QSC offered no such diversification and funneled victim funds solely into the Queen Shoals Ponzi scheme. Court records show that Martin routinely vouched for the success and reliability of Queen Shoals by claiming to have personally invested a significant amount of his own money into Queen Shoals when, in fact, Martin personally invested only $4,000.

According to filed documents and today’s sentencing hearing, Martin engaged in money laundering transactions by utilizing the referral fees he received from Hanson to pay commissions to himself and the so-called QSC consultants. From in or about 2007 to in or about 2009, Martin received over $1.9 million in referral fees from Hanson and paid the consultants over $1.5 million during the relevant time period in return for inducing victims to invest in the Queen Shoals Ponzi scheme. These payments caused QSC consultants to induce additional victims to invest in the Queen Shoals Ponzi scheme, thereby perpetuating the scheme.

In March 2011, Hanson, then 63, was sentenced to 22 years in federal prison.

BULLETIN: Jeffrey Allen Wright, a purported “sovereign citizen” wanted on arrest warrants for counterfeiting, was shot and killed March 8 after pointing a pistol at a Sheriff’s SWAT Team in Navarre, Fla., the Santa Rosa County Sheriff’s Office said.

BULLETIN: Jeffrey Allen Wright, a purported “sovereign citizen” wanted on arrest warrants for counterfeiting, was shot and killed March 8 after pointing a pistol at a Sheriff’s SWAT Team in Navarre, Fla., the Santa Rosa County Sheriff’s Office said.

Wright, 55, had previous clashes with the Sheriff’s Office, the agency said.

From a statement by the Sheriff’s Office (Italics added):

The warrants for Wright’s arrest were for five counts of Counterfeiting, and five counts of Passing a Counterfeit Bill (both 3rd degree felonies). Wright has had confrontations in the past with the Sheriff’s Office, claiming that he is a “Sovereign Citizen” and denounced his United States Citizenship.

Wright has also told the Sheriff’s Office that he does not acknowledge State Laws and that he doesn’t have to comply with law enforcement because their requests are “unlawful”. Due to Wright’s perception of law enforcement, numerous deputies went to his residence to facilitate the arrest. When Wright was encountered by deputies, Wright produced a black object from his pocket, appearing to be a firearm, and concealed it behind his back. Wright then fled into the garage area and went up the stairs to the second floor. Wright then began to barricade the stairway so that deputies could not approach.

Wright then discharged a firearm one time. Wright made statements that he was “not a U.S. citizen, but a sovereign citizen, and that he would not be a servant of the king”. Wright also stated that if any deputies came up the stairwell, they would “not come back down”. Wright also stated that if deputies “if you ever want to see your families again, you will leave”.

Deputies withdrew from the immediate area and called a SWAT Team and negotiators, the Sheriff’s Office said.

“Wright refused to continue conversing with negotiators, and continued to state that deputies would have to ‘come up and get me,’” the agency said. “As the situation progressed, and due to Wright being armed, the SWAT team deployed gas into the second story of the garage. Wright was continuously given commands to come out, unarmed; however Wright would continue to yell ‘come and get me.’

Matters then turned even worse, the agency said.

“Wright then began to break out windows with a semi-automatic pistol,” the Sheriff’s Office said. “Wright then went to the top of the stairwell and began to remove the items he had used to barricade the entrance. Wright sat down at the top of the stairs, holding a handgun. While refusing to obey lawful commands to surrender, Wright raised the pistol and pointed it directly at SWAT team members at the bottom of the stairwell. Due to there being a great danger of being shot, three SWAT deputies simultaneously discharged their firearms at Wright.”

The purported “sovereign” was pronounced dead at the scene.

As is typical in officer-involved shootings, the three deputies have been placed on paid administrative leave, the agency said.

The Florida Department of Law Enforcement (FDLE) is conducting an investigation, the sheriff’s office said.

DEVELOPING STORY: It is early and facts remain unclear. What’s known, according to local news reports, is that the FBI notified local police in the area of Chester County in southeastern Pennsylvania that agents would be operating in the region.

DEVELOPING STORY: It is early and facts remain unclear. What’s known, according to local news reports, is that the FBI notified local police in the area of Chester County in southeastern Pennsylvania that agents would be operating in the region.

Late yesterday — sometime after 11 p.m. while some residents were sleeping — explosions were heard in the area of Valley Creek Park. The explosions appear to have been controlled detonations by law enforcement, which earlier had found dozens of pipe bombs in a storage unit near the town of Malvern. Members of bomb squads were seen in the area.

The storage unit was rented in the name of Istvan Merchenthaler, an accused Ponzi schemer.

From Malvern Patch (italics added):

Around 8:30 p.m., bomb squads from Montgomery County and Philadelphia began hauling the explosives from the storage facility to nearby Valley Creek Park. The explosives were transported inside large metal containers on trailers, and each trip involved a convoy of fire engines, ambulances and police vehicles.

From Chester County Daily Local News (italics added):

The source, who asked to remain anonymous due to the ongoing and sensitive nature of the investigation, said that the storage locker was registered to 42-year-old Istvan [Merchenthaler], a Chester County man facing federal charges in connection to a Ponzi scheme that officials say defrauded investors of about $2 million over the past seven years.

Officials close to [Merchenthaler]’s case said the suspect was connected to similar explosive investigations in other states, and added that he is facing charges in multiple jurisdictions throughout the east coast.

RECOMMENDED READING: From the Salt Lake Tribune:

http://www.sltrib.com/sltrib/money/55960572-79/johnson-works-attorney-swallow.html.csp

Also see Deseret News story and AP report in the San Francisco Chronicle.

URGENT >> BULLETIN >> MOVING: The state of Alabama has issued a warning on Profitable Sunrise. The move follows on the heels of a cease-and-desist order issued last week by North Carolina.

URGENT >> BULLETIN >> MOVING: The state of Alabama has issued a warning on Profitable Sunrise. The move follows on the heels of a cease-and-desist order issued last week by North Carolina.

The warning comes in the form of an “investor alert” issued by the office of Joseph Borg, the director of the Alabama Securities Commission.

“We want to make our citizens aware of the potential perils of web-based investment marketing,” said Borg. “As with all investment opportunities, investors should thoroughly scrutinize any offer, especially if it comes from a foreign country,” Borg said. “Most investment offerings, as well as the person making an investment offering, must be registered with the Alabama Securities Commission. This is a critical first step in protecting the public from con artists and investment fraud.”

Borg urged “anyone in Alabama who has invested with Profitable Sunrise to contact the ASC’s Enforcement Division at 1-800-222-1253.”

From ASC (italics added):

An investigation of Roman Novak, Radoslav Novak and their company, Inter Reef, Ltd., doing business as Profitable Sunrise, revealed that the men allegedly promoted at least five different “investment plans” through a website that offered rates of return ranging from 1.6% per business day to 2.7% per business day for periods of from between 180 to 240 business days. Investors were told that their money would be used to fund short-term, “risk-free” loans to businesses, and that “all funds deposited with us are insured against loss” by a leading investment bank. Further investigation revealed that victims had been instructed to wire money to financial institutions in Eastern Europe, including one bank identified as being in the Czech Republic. ASC records revealed that neither of the men, nor the company they represent, are registered to conduct securities business in Alabama, as required by the Alabama Securities Act.

Read the ASC warning.

Zeek Rewards likely had a presence in all 50 U.S. states, plus U.S. territories. The High Point Enterprise, a publication in Zeek’s home state of North Carolina, today has a story about a Utah man who joined the “program” just prior to the SEC bringing allegations in August 2012 that Zeek was a $600 million Ponzi- and pyramid scheme.

From the Enterprise (italics added):

During recruitment meetings at a house in Richfield, Olsen said he was approached with a soft-sale pitch to become part of Zeek Rewards. Olsen was told that his $10,000 “would build my credit in the business” and allow him to reap greater income. The recruitment of Olsen took place over a period of months, and the approach was to build a relationship of trust rather than “twist my arm,” he said. The Zeek Rewards affiliates that Olsen met emphasized that the money he provided wasn’t an investment. But when the Securities and Exchange Commission shut down Zeek Rewards, the federal agency called it an unregistered securities business.

“They said that they would be in trouble if they called it investing,” Olsen recalls.

Read the full story in the Enterprise, which described Olsen as an individual who’d just lost his job and discussed a plan with his wife by which the couple would sell a family vehicle to join Zeek.

See “Zeek, The ‘I’ Word And The Weight Of History . . .,” an editorial published by the PP Blog on July 25, 2012.

EDITORIAL NOTE: Ponzi schemes cause real pain to real people. Regardless, the Ponzi-board apologists for Zeek continue to demonize the court-appointed receiver, continue to engage in wordplay to sanitize “opportunities” and continue to fuel schemes such as Zeek by parroting disclaimers such as “don’t spend more than you can afford to lose.”

Blaming victims or insisting no victims exist is one of the most odious practices of the serial Ponzi pitchmen.