In a bizarre and disturbing video playing on YouTube, a former Profitable Sunrise pitchman claims a new “program” he joined is operating from Hong Kong and is purveyed by an unidentified “doctor.”

The purported opportunity is “1,000 percent better” than Profitable Sunrise or Zeek Rewards, according to the video.

News of the video first was reported on the RealScam.com antiscam forum.

Pitchman John Schepcoff did not identify the new “program” in the 14:32 video. But he described it as invitation-only. Zeek made similar claims, according to the SEC’s August 2012 Ponzi- and pyramid action against the North Carolina-based firm and accused operator Paul. R. Burks. The SEC described Zeek as a $600 million fraud scheme.

In April 2013, the agency described Profitable Sunrise as a pyramid scheme that may have gathered tens of millions of dollars, in part through using financial conduits in the Czech Republic, Australia, Panama and China.

“There’s a litttle bit of a [learning] curve, like also Zeek Rewards in a way, but he made it 1,000 percent better,” Schepcoff said of the new Hong Kong “program.”

Earlier in the video, Schepcoff claimed the new program was “1,000 percent better” than Profitable Sunrise.

Schepcoff put $8,225 into the new program, he claimed in the video. He further claimed he’d potentially lost more than $193,500 in Profitable Sunrise but is holding out hope that “Roman Novak” somehow will resurrect the “program.”

It is unclear whether “Roman Novak” actually exists, according to court filings.

Among other things, Schepcoff claims in the video that Profitable Sunrise participants need to accept personal responsibility for their losses in the “program” and should not blame individuals such as himself or Profitable Sunrise pitchwoman Nanci Jo Frazer.

“Stop blaming people, and say, ‘I am responsible,’” Schepcoff coached. Other people who should not be blamed include “Roman Novak,” he noted.

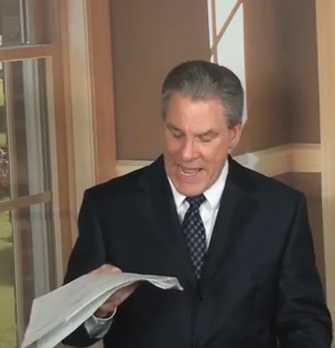

And Schepcoff claimed he is “so happy” and “really, really happy” he got into the new program. Smiles, however, are absent from his face throughout the video.

With respect to Profitable Sunrise, Schepcoff described the “program’s” scheme that purportedly permitted “compound[ing]” at a daily interest rate of between 2.15 percent and 2.7 percent as a “no-brainer” for a coach and mentor in finance such as himself.

“And I teach people about the . . . way how things are done,” he said.

When he heard about Profitable Sunrise in December 2012, Schepcoff said, “I basically ran to my bank, and I couldn’t get the money in fast enough.”

Just four months earlier — in August 2012 — the SEC said Zeek duped people into believing they were receiving a legitimate return of about 1.5 percent a day. The Profitable Sunrise “Long Haul” plan purported almost to double Zeek’s purported daily payout.

“I kept putting wire transfers after wire [transfer]” into Profitable Sunrise,” Schepcoff said, suggesting he took money out of retirement accounts to do so.

“Greed” that became like a “cancer” controlled his behavior in Profitable Sunrise, he said. Schepcoff did not explain what was driving his behavior in sending funds to the purported Hong Kong “program” purportedly purveyed by the “doctor.”

The new program apparently relies on a secret strategy designed to prevent links from being shared publicly and is “amazing” in “what it does,” he said. “There’s people — I can tell you this — that are bringing out only in five months over [$]40,000.”

One person, according Schepcoff, told him that he’d taken out “over [$]200,000” from the new program in a single day.

Some HYIP “programs” are pitched by “sovereign citizens” and political extremists who divine a construction by which participants are “free” to spend their money as they see fit and that specific word combinations insulate purveyors from any liability if a “program” collapses or becomes the subject of an action by law enforcement.

HYIP scams typically are promoted on social-media sites such as YouTube, Twitter and Facebook, FINRA said in a 2010 warning.