If you’ve been following TelexFree developments, you’ve probably heard about “Operation Orion,” the code name for the investigation that led to raids against TelexFree’s Ympactus arm last week by the Brazilian federal police. The Orion name was chosen, police said, because it fit splendidly within the context of a pyramid-scheme case.

How so? The Pyramids of Giza in Egypt were aligned with the Orion constellation, police explained.

Our analysis of the “Operation Orion” name is that it shows heady messaging by Brazilian police. It is direct in the sense that TelexFree, after all, may be the world’s largest MLM HYIP pyramid scheme. And it’s subtle in the sense that so many pyramid-scheme participants have bright stars in their eyes that blind them to the realities of mathematics.

Here we’ll point out that, for whatever reason, someone within the TelexFree sphere got the head-scratching idea earlier this year to use an image of the Pyramids of Giza in a promo for TelexFree during an active pyramid-scheme probe in Brazil.

We believe it notable that Brazilian police also referenced the Pyramids of Giza, given their presence in a TelexFree promo.

For newer readers, we’ll also point out that the HYIP sphere is infamous for taunting the law-enforcement community. Like TelexFree, a “program” known as WCM777 also came under investigation in multiple countries earlier this year. Naturally someone within the WCM777 sphere shoved an image of a pyramid down the throat of law enforcement after word of the investigations became public.

Second Tour (At Least) For ‘Operation Orion’

Did you know that the code name “Operation Orion” chosen by Brazilian police previously had been used by the United States in a major law-enforcement action, albeit in a completely different context? (More on the 2012 U.S. action below.)

What’s your thinking? Are two Operation Orions in two years coincidence?

And did you know that the U.S. Department of Homeland Security (DHS), which has its own TelexFree probe, has an office in Brasilia and a history of cooperating with Brazil’s federal police — and that some criminal investigators from outside the United States receive training at the DHS Federal Law Enforcement Training Center in Glynco, Ga? (The U.S.-sponsored training also sometimes occurs in countries that host the United States. Some Brazilian investigators, for example, have received U.S. training in Peru. See photo below.)

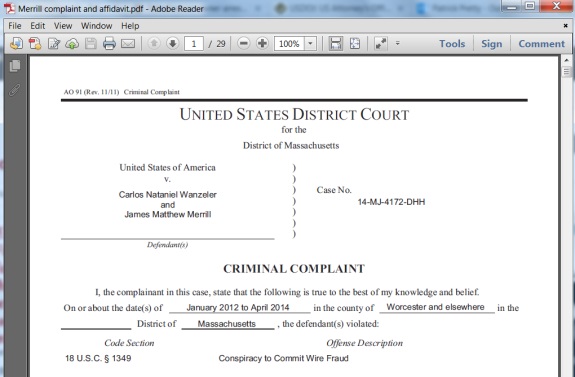

U.S. prosecutors did not respond to a request for comment on whether there was any coordination between the United States and Brazil last week on TelexFree-related events: the indictment of TelexFree figures James Merrill and Carlos Wanzeler in the United States, and the public announcement of “Operation Orion” in Brazil.

What’s In A Code Name?

U.S.-based police, prosecutorial and regulatory agencies regularly conjure up operational names to distill the essence of the law-enforcement goal and to send a message that fraudsters never should be confident. Agencies also sometimes engage in something we’ll describe as reverse black comedy whose purpose is to accent the absurdities of scams and scammers. In New Jersey last year, for example, a law-enforcement action targeted at alleged booze diluters was memorably named “Operation Swill.”

It was an instant classic.

A long-running FBI operation targeted at dozens of penny-stock fraudsters a few years ago was dubbed “Operation Shore Shells,” in part because the probe occurred near the sea and in part because the fraud involved the use of shell companies, often a nemesis of legitimate commerce. The SEC, which regulates the U.S. securities markets, once dubbed an action directed at hundreds of companies ripe for pump-and-dump swindles “Operation Shell Expel.”

To out illegal gambling conduits reaching into the United States, DHS once set up a sting operation and “obtained a business address near Atlantic City, New Jersey” to bolster undercover operatives’ street cred. As part of the operation, the Feds created a bogus “payment processor” known as Linwood Payment Solutions to “negotiate contracts and terms of the processing, and to handle the intricate movement and processing of collection and payment data from the gambling organizations to the banks.”

The U.S. Marshals Service, in charge of rounding up fugitives, once famously conjured up a sting dubbed “No Such Thing as a Free Lunch” that operated as part of a larger sting dubbed FIST — for Fugitive Investigative Strike Teams.

As part of a six-year FIST operation in the 1980s, marshals created a fake business known as “Flagship International Sports Television Inc.,” obtained the last-known addresses of more than 3,000 wanted persons and sent brunch “invitations” that promised free food and free National Football League game tickets to those addresses. The marshals also offered a shot at free Super Bowl tickets.

The free-food sting netted 100 arrests. FIST overall netted more than 14,700.

Undercover TelexFree Probe

It is known that DHS conducted a TelexFree-related undercover operation that lasted for months. Whether the operation extended to foreign soil and had a formal name is unclear. Based on its research, the PP Blog believes that undercover stings (named and unnamed) operated by U.S. government agencies and aimed at HYIPs have been operating continuously in the United States since at least 2006.

One of the reasons is that the schemes put banks in the line of fire and often target disadvantaged populations. Beyond that, HYIP schemes have a history of trading on the names of the White House and U.S. government agencies, thus confusing people across the world. TelexFree promoters, for instance, traded on the names of President Obama, the cabinet-level office of the U.S. Attorney General, the SEC and Massachusetts Commonwealth Secretary William Galvin. Why? To cloak themselves in a veneer of legitimacy and to drive money to a scheme that purportedly returned $1,040 in a year to people who paid in $289, $5,200 to people who paid in $1,375 and $57,200 to people who paid in $15,125.

Even Bernard Madoff would gag at the thought.

With the Internet emerging as the favored delivery vessel of both clever and unclever fictions aimed at transferring great sums of wealth and putting unwarranted financial power in the hands of criminals and criminal enterprises, the need has arisen to pursue cross-border frauds aggressively. The only way to minimize the mushroom effect of fraud schemes operating on the Internet is through international cooperation at the highest levels of government and law enforcement.

Put another way, your latest recruit could be a Fed. The person you instructed not to “call it an investment” (as part of a ham-handed cover-up bid) could be a Fed. The person sitting next to you at a hotel “extravaganza” of some sort could be a Fed. So could the person in the cabin next to you on the scammers’ cruise ship. So could the recruit who, at your direction, paid you personally while joining, instead of paying the company. That upline guy — the one who sponsored you and asked you to pay him personally — could have one or more Feds in his downline. Those Feds could be “placing ads” for the program and keeping notes on whether anybody signed up under them.

Channeling?

Could Brazilian authorities who selected the name “Operation Orion” and referenced the Pyramids of Giza perhaps been channeling their U.S. counterparts and engaging in some reverse black comedy to point out the absurdity of scams? Man, we hope so.

As noted above, someone within the TelexFree sphere showcased the Pyramids of Giza during a pyramid-scheme probe in Brazil. Apparently no one in TelexFree thought it prudent, say, to stop the scheme during the Brazilian probe.

Because the HYIP sphere is populated by the most disingenuous “businesses” and people you’ll ever encounter, it’s easy enough to read such an act as telling law enforcement to shove it. Fractured thinking and taunts at law enforcement are core signatures of HYIP frauds, perhaps characteristics every bit as defining as preposterous daily payout rates of between .50 and 2.75 percent.

Good fortune certainly did not shine down on TelexFree from Orion on July 23, the date of the U.S. indictments. Nor did it shine down on July 24, the date the “Operation Orion” pyramid probe was announced in Brazil.

In our view, the name “Operation Orion” selected by Brazilian police was practically perfect.

In addition to being a star constellation, Orion is the great hunter from Greek mythology. With Brazil’s “Operation Orion,” alleged pyramid schemers became the hunted.

Alleged child predators were the hunted in the U.S. version of “Operation Orion,” a 2012 sting engineered by DHS. Arrests were made in the United States, Spain, the Philippines, Argentina and the United Kingdom. The DHS agency that launched the 2012 version of “Operation Orion” is known as Immigration and Customs Enforcement — or ICE for short. Homeland Security Investigations (HSI) is an ICE directorate.

From ICE (italics/bolding added):

HSI investigates immigration crime, human rights violations and human smuggling, smuggling of narcotics, weapons and other types of contraband, financial crimes, cybercrime and export enforcement issues. ICE special agents conduct investigations aimed at protecting critical infrastructure industries that are vulnerable to sabotage, attack or exploitation.

In addition to ICE criminal investigations, HSI oversees the agency’s international affairs operations and intelligence functions. HSI consists of more than 10,000 employees, consisting of 6,700 special agents, who are assigned to more than 200 cities throughout the U.S. and 47 countries around the world.

U.S. court records show that HSI started the undercover investigation into TelexFree at least by October 2013. Other records show HSI has an attaché office in Brasilia, the capital of Brazil.

ICE and HSI have a history of cooperating with Brazil’s federal police. Recent examples include the May 2014 return to the government of Brazil of a smuggled painting linked to a bank fraud investigation. In April 2014, ICE agents returned to Brazil a man arrested in the United States and wanted on murder charges in Brazil.

In May 2014, ICE and HSI announced they had cooperated with federal police in Brazil in a sting known as “Operation Proteja Brasil,” described as aimed at protecting against child porn.

From ICE (italics/bolding added):

Some of the warrants executed during this operation were the direct result of leads provided by HSI Brasilia and the National Center for Missing & Exploited Children (NCMEC).