UPDATED 11:51 A.M. EDT U.S.A. Zeek Rewards’ receiver Kenneth D. Bell had no comment this morning on reports that some Zeek clawback defendants also were participants in Traffic Monsoon, alleged last week by the SEC to have been a Ponzi scheme that had gathered at least $207 million.

UPDATED 11:51 A.M. EDT U.S.A. Zeek Rewards’ receiver Kenneth D. Bell had no comment this morning on reports that some Zeek clawback defendants also were participants in Traffic Monsoon, alleged last week by the SEC to have been a Ponzi scheme that had gathered at least $207 million.

The reports appeared on RealScam.com.

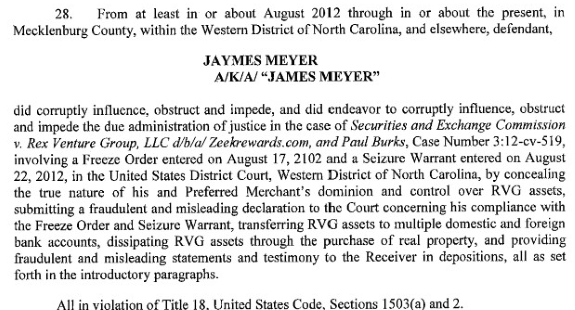

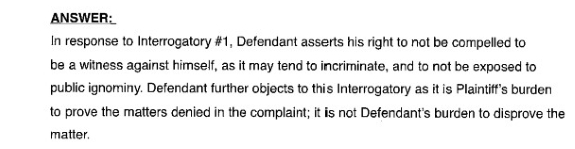

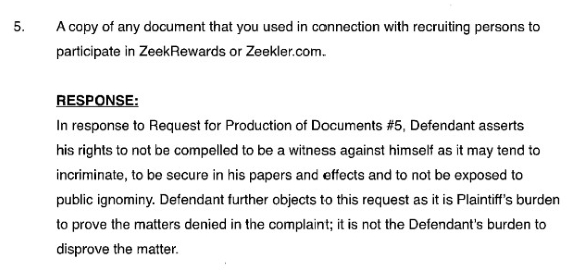

In March 2015, Bell sued Adrian Hibbert of the United Kingdom, alleging he had received more than $82,000 in Ponzi proceeds from Zeek. Zeek was charged with fraud by the SEC in August 2012.

Another Zeek promoter listed by Bell as a winner in that scheme — Frank Calabro Jr. of the United States — also promoted Traffic Monsoon. Bell has expressed concern about online pitchmen moving from one fraud scheme to another.

“Winnings” from MLM or direct-sales fraud schemes may be subject to return through clawback litigation.

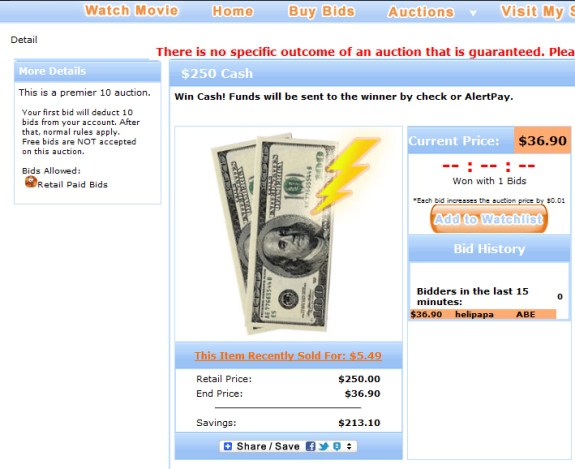

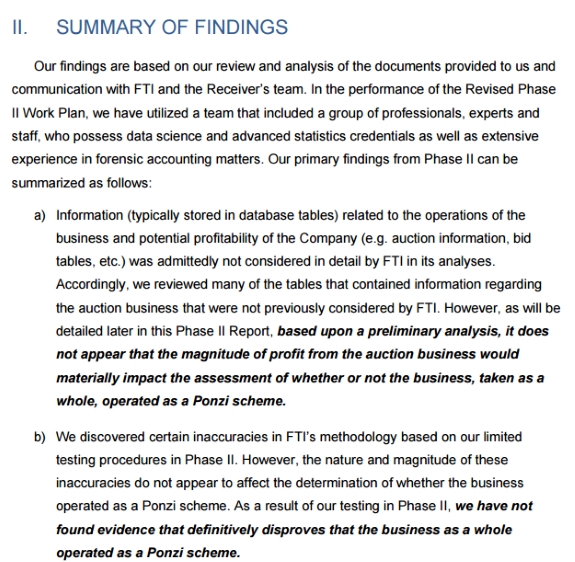

Both Zeek and Traffic Monsoon were purported “revenue sharing” programs. Paul Burks, the operator of Zeek Rewards, potentially faces a long prison term after his conviction earlier this month on multiple fraud counts.

On July 26, the SEC civilly charged alleged Traffic Monsoon operator Charles Scoville of Utah with fraud. He has not been charged criminally and is believed to be residing overseas.

Peggy Hunt of the Salt Lake City office of the Dorsey & Whitney law firm has been appointed receiver over Traffic Monsoon. Neither she nor the firm responded immediately this morning to a request for comment on the issue of common promoters between Traffic Monsoon and Zeek.

The law firm confirmed to the PP Blog last week that there would be a receivership website for Traffic Monsoon, but the site was not yet live. The URL has not been released.

Some Zeek clawback defendants also were participants in the AdSurfDaily Ponzi scheme. ASD was a “program” similar to Traffic Monsoon broken up by the U.S. Secret Service in 2008 in a highly publicized action.

In U.S. domestic clawback litigation and in cases filed against non-U.S. residents, Bell has sued thousands of alleged Zeek winners for return of their gains and interest.

Hunt’s plans with Traffic Monsoon are unclear.

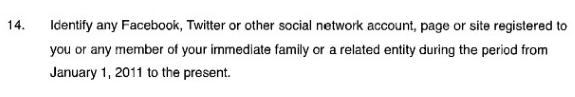

Hibbert appears also to have a page promoting the “My Advertising Pays” scheme. MAPS, as it is known, has caught the attention of class-action attorneys involved in litigation against the TelexFree scheme broken up by the SEC and the U.S. Department of Homeland Security in 2014. The litigation also includes Zeek figures.

TelexFree and Zeek may be the two largest combined Ponzi- and pyramid schemes in history, generating on the order of $4 billion in illicit, cross-border business and affecting hundreds and hundreds of thousands of people.

The MAPS’ page attributed to Hibbert claims that MAPs operator Mike Deese “has been in the trenches with Zeek, ASD, Banners Broker, Ad Hit Profits, and many other advertising revenue sharing companies some of which continue to thrive and some that are not.”

AdHitProfits also was a Scoville scheme. BannersBroker was a cross-border fraud that led to arrests in Canada.

Separately, the Zeek page attributed to Hibbert claims, “If you want to make money and get paid everyday, you have to look at Zeek Rewards and understand how it works.”

The SEC and federal prosecutors in the Western District of North Carolina said Zeek worked as a Ponzi scheme.

Visit the TrafficMonsoon thread at RealScam.com.

It may be a first in MLM clawback cases.

It may be a first in MLM clawback cases. Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012.

Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012.

URGENT >> BULLETIN >> MOVING: (6th Update 8 p.m. EDT U.S.A.) TelexFree Trustee Stephen B. Darr has sued MLM attorney Gerald Nehra and the Nehra and Waak law firm, alleging they were “actively involved” in promoting TelexFree’s Ponzi scheme and “duping” participants.

URGENT >> BULLETIN >> MOVING: (6th Update 8 p.m. EDT U.S.A.) TelexFree Trustee Stephen B. Darr has sued MLM attorney Gerald Nehra and the Nehra and Waak law firm, alleging they were “actively involved” in promoting TelexFree’s Ponzi scheme and “duping” participants.

UPDATED 3:32 P.M. EDT U.S.A. Faith Sloan received $710,319 from the TelexFree Ponzi- and pyramid scheme, according to filings by TelexFree bankruptcy Trustee Stephen B. Darr.

UPDATED 3:32 P.M. EDT U.S.A. Faith Sloan received $710,319 from the TelexFree Ponzi- and pyramid scheme, according to filings by TelexFree bankruptcy Trustee Stephen B. Darr.