EDITOR’S NOTE: As the PP Blog reported Wednesday, HYIP Ponzi-scheme pitchman Matthew John Gagnon has been sentenced to five years in federal prison. On Thursday, the SEC released the statement reproduced below. Here’s hoping it will be the shot heard around the HYIP Ponzi World.

Still pushing HYIPs on your websites and social-media sites, in your emails and on the Ponzi boards? Still pushing them after the Legisi, AdSurfDaily, Zeek Rewards and Profitable Sunrise debacles? Is someone like “Ken Russo” or “10bucksup” or “strosdegos” enlisting you to enter Ponzi World?

Are you listening to Faith Sloan, when she shows you an investment-earnings calculator and plants the seed that the TelexFree action in Brazil is a yawner because it was brought in a “small” state that’s “literally in the middle of the jungle” — all while she further risks offending one-fifth of the world’s population by advising you not to engage in a “panic-like-Chinese-fire-drill” over your legitimate TelexFree concerns?

If you are turning a blind eye to all the incongruities of HYIP Ponzi Land, you may have the chance to be the next Matt Gagnon, meaning the next several years of your life will be consumed by court actions. First, you’ll watch your “program” get sued by the SEC. After that, you’ll get sued by the SEC and a court-appointed receiver. On top of those unpleasantries, you’ll be called a threat to the investing public in newspaper stories across the land, then charged criminally, and then sent to jail for years you’ll never get back while being ordered to pay back either the money you stole or the money you helped someone else steal.

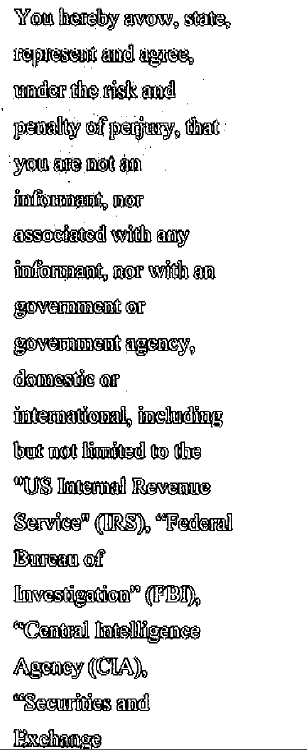

A final note: More than FIVE years after the SEC filed the first of the Legisi-related fraud charges in May 2008, Legisi victims continue to visit the PP Blog for updates on the various Legisi-related actions, including the multiple actions against Gagnon. Scams may fall out of the headlines for a while — but the fleeced masses never forget them. For posterity, the PP Blog has inserted a section of a Legisi evidence exhibit into the SEC’s statement. It may be the strangest Terms of Service you’ve ever read.

** ______________________________________ **

U.S. SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 22749 / July 11, 2013

Securities and Exchange Commission v. Matthew J. Gagnon, Civil Action No. 10-cv-11891 (E.D. Mich.)

Serial Fraudster Matthew J. Gagnon Sentenced to Five Years in Prison

The Securities and Exchange Commission announced that on July 9, 2013, the Honorable Mark A. Goldsmith of the United States District Court for the Eastern District of Michigan sentenced Matthew J. Gagnon to five years of incarceration followed by three years of supervised release and ordered Gagnon to pay over $4.4 million in restitution to his victims. Gagnon, 45, of Portland, Oregon, pleaded guilty to one count of criminal securities fraud for promoting a securities offering without fully disclosing the amount of his compensation in connection with his promotion of the $72 million Legisi Ponzi scheme in 2006 and 2007, in violation of Section 17(b) of the Securities Act of 1933.

The criminal charges arose out of the same facts that were the subject of a civil injunctive action that the Commission filed against Gagnon on May 11, 2010. The Commission’s complaint alleged that since 1997, Gagnon had billed himself as an Internet business opportunity expert and his website as “the world’s first and largest opportunity review website.” According to the SEC’s complaint, from January 2006 through approximately August 2007, Gagnon helped orchestrate a massive Ponzi scheme conducted by Gregory N. McKnight and his company, Legisi Holdings, LLC, which raised a total of approximately $72 million from over 3,000 investors by promising returns of upwards of 15% a month. The complaint also alleged that Gagnon promoted Legisi but in doing so misled investors by claiming, among other things, that he had thoroughly researched McKnight and Legisi and had determined Legisi to be a legitimate and safe investment. The complaint alleged that Gagnon had no basis for the claims he made about McKnight and Legisi. Gagnon also failed to disclose to investors that he was to receive 50% of Legisi’s purported “profits” under his agreement with McKnight. According to the complaint, Gagnon received a net of approximately $3.8 million in Legisi investor funds from McKnight for his participation in the scheme.

The SEC’s complaint further alleged that beginning in August 2007, Gagnon fraudulently offered and sold securities representing interests in a new company that purportedly was to develop resort properties. The complaint alleged that Gagnon, among other things, falsely claimed that the investment was risk-free and “SEC compliant,” and guaranteed a 200% return in 14 months. In reality, however, Gagnon sent the money to a twice-convicted felon, did not register the investment with the SEC, and knew such an outlandish return was impossible. Gagnon took in at least $361,865 from 21 investors.

The SEC’s complaint further alleged that beginning in August 2007, Gagnon fraudulently offered and sold securities representing interests in a new company that purportedly was to develop resort properties. The complaint alleged that Gagnon, among other things, falsely claimed that the investment was risk-free and “SEC compliant,” and guaranteed a 200% return in 14 months. In reality, however, Gagnon sent the money to a twice-convicted felon, did not register the investment with the SEC, and knew such an outlandish return was impossible. Gagnon took in at least $361,865 from 21 investors.

The SEC’s complaint also alleged that in April 2009, Gagnon began promoting a fraudulent offering of interests in a purported Forex trading venture. Gagnon guaranteed that the venture would generate returns of 2% a month or 30% a year for his investors. Gagnon’s claims were false, and he had had no basis for making them because Gagnon never reviewed his friend’s trading records before promoting the offering, which would have shown over $150,000 in losses over the previous nine months.

The SEC’s complaint charged Gagnon with violating Sections 5(a), 5(c), 17(a) and 17(b) of the Securities Act of 1933 and Sections 10(b) and 15(a)(1) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder. The complaint sought preliminary and permanent injunctions, disgorgement, and civil penalties from Gagnon. On May 24, 2010, the SEC obtained an emergency order freezing Gagnon’s assets and other preliminary relief. Subsequently, on August 6, 2010, the Court granted an order of preliminary injunction against Gagnon pursuant to his consent. On March 22, 2012, the Court granted the SEC’s motion for summary judgment and entered a final judgment against Gagnon. The Court found that Gagnon violated the registration, anti-fraud, and anti-touting provisions of the federal securities laws. The Court’s final judgment against Gagnon permanently enjoined him from future violations of Sections 5(a), 5(c), 17(a) and 17(b) of the Securities Act of 1933 and Sections 10(b) and 15(a)(1) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder, and ordered Gagnon to pay $3,613,259 in disgorgement, $488,570.47 in prejudgment interest, and a $100,000 civil penalty.

On May 2, 2012, the SEC instituted related administrative proceedings against Gagnon to determine what, if any, remedial action was appropriate and in the public interest. On July 31, 2012, the SEC issued an Order Making Findings and Imposing Sanctions by Default barring Gagnon from association with any broker or dealer.

For further information regarding this case, see Litigation Releases No. 21532 (May 25, 2010), and 22310 (March 27, 2012).

See also: SEC Complaint

http://www.sec.gov/litigation/litreleases/2013/lr22749.htm