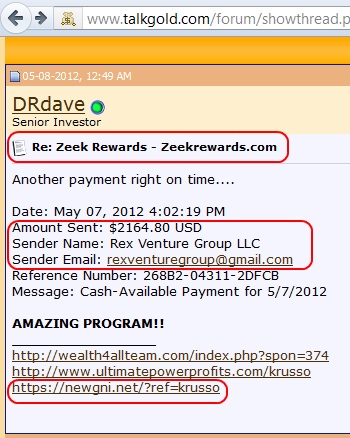

The PP Blog has received a report that some members of Zeek have received subpoenas issued by the court-appointed receiver in the Zeek Rewards Ponzi scheme case. The SEC alleged in August that Zeek was a $600 million Ponzi and pyramid scheme operated by Paul R. Burks and Rex Venture Group LLC.

Receiver Kenneth B. Bell said earlier this week that a first round of about 1,200 subpoenas would be issued to “affiliates who profited most from ZeekRewards.”

Early details are sketchy about precisely what information the subpoenas demand. Bell wrote on the receivership website that recipients “are required to fully respond to the subpoena.

“If you do not have possession, custody or control of any of the documents requested simply say so in responding to the subpoena. However, you are required to make a full reasonable effort to locate all documents requested, including electronic documents and email,” Bell wrote.

The issuance of the subpoenas demonstrates that online HYIPs dressed up as multilevel-marketing “programs” can — at a minimum — create civil exposure for participants. Profits received from such schemes are viewed as ill-gotten gains subject to clawback.

In an Oct. 8 court filing, Bell advised Senior U.S. District Judge Graham C. Mullen that he planned to pursue Zeek winners and others through common-law and and clawback claims “under applicable fraudulent transfer statutes.”

In addition to Zeek winners, potential clawback targets include Zeek officers, employees and professionals who benefited from the scheme, according to Bell’s Oct. 8 filing. As many as 100,000 people potentially received ill-gotten gains from Zeek, while about 800,000 Zeek members experienced losses.

Zeek wrapped itself in the American flag while pitching its offer globally, claiming among other things that winners of its Zeekler auctions for sums of U.S. cash would be paid through offshore payment processors. North Carolina-based Zeek has never explained the striking incongruity of auctioning U.S. cash and offering to deliver it via payment processors linked to fraud scheme after fraud scheme promoted on Ponzi scheme forums such as TalkGold and MoneyMakerGroup.

Auctions for cash mysteriously went missing from Zeek in June. On Aug. 4, 13 days before the SEC filed an emergency action to halt the alleged Zeek Ponzi scheme, the company publicly complained about “North Carolina Credit Unions” that were warning customers about Zeek.

On June 5, the company bizarrely planted the seed that, if Zeek instructed members to change their preference in dispensing toilet paper, they should do it to demonstrate how coachable they are. Just days earlier — on May 28, Memorial Day — the company claimed it was closing two U.S. bank accounts and urged members to cash commission checks by June 1 or they would bounce.

Zeek’s auction arm was known as Zeekler and was married to Zeek Rewards, the MLM side of the business. The SEC said in August that Zeek commingled funds and that Burks “unilaterally and arbitrarily” determined Zeek’s daily dividend rate so that it averaged “approximately 1.5% per day, giving investors the false impression that the business is profitable.”

In 2008 and 2009, the U.S. Secret Service made similar allegations against AdSurfDaily and operator Andy Bowdoin. Bowdoin, 77, was charged criminally in December 2010. He pleaded guilty to a Ponzi-related charge of wire fraud in May 2012. Bowdoin was sentenced in August 2012 to 78 months in federal prison.

ASD operated as an “autosurf” HYIP that planted the seed that members would receive a return of 1 percent a day.

Precisely how many Zeek members live outside the United States and benefited from the scheme is unclear. In July, the PP Blog reported that a Zeek-related article carried on Google News claimed that Zeek had 100,000 members in Brazil alone.

An issue that potentially could emerge in the coming weeks is whether the receiver will be successful in seeking clawbacks from non-U.S. members of Zeek who received more from the scheme than they put in. How many Zeek members fit the profile is not yet known.

HYIPs that operate across borders on the Internet introduce the specter of international red tape and also potentially bring language barriers into play. In the days after the SEC brought the Zeek case, some purported international members of Zeek effectively thumbed their noses at the United States and Zeek victims, crowing on Ponzi-scheme forums that they’d keep their Zeek money no matter what.

Zeek presented in online pitch as “Passive Income!” opportunity.

Zeek presented in online pitch as “Passive Income!” opportunity. For starters, Zeek affiliates being approached by upline sponsors and email/website appeals to send in money “to defend Zeek Rewards and all of our independent businesses as per our legal rights of due process” might want to read this

For starters, Zeek affiliates being approached by upline sponsors and email/website appeals to send in money “to defend Zeek Rewards and all of our independent businesses as per our legal rights of due process” might want to read this