The court-appointed receiver in the Zeek Rewards Ponzi- and pyramid case says his “multitilayered investigation into [Zeek operator Rex Venture Group] and its insiders, advisors, and financial institutions” continues.

The court-appointed receiver in the Zeek Rewards Ponzi- and pyramid case says his “multitilayered investigation into [Zeek operator Rex Venture Group] and its insiders, advisors, and financial institutions” continues.

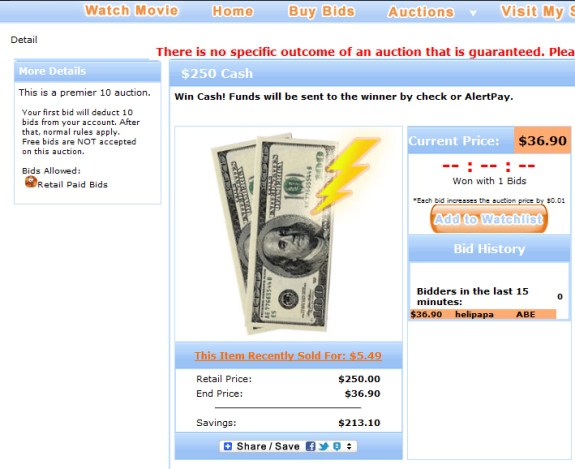

Receiver Kenneth D. Bell has been at the helm since the epic collapse of the Zeek MLM HYIP scheme in August 2012. The SEC initially filed civil charges to halt the $850 million fraud. A parallel criminal probe by federal prosecutors in North Carolina to date has resulted in the arrest and prosecution of two Zeek insiders, both of whom pleaded guilty.

Bell did not say in his May 7 report to Senior U.S. District Judge Graham C. Mullen precisely who the receivership was investigating. Zeek is known to have had members and vendors in common with the $119 million AdSurfDaily Ponzi scheme, which collapsed in 2008.

Bell so far has sued several members of ASD who became alleged winners in Zeek. (See March 3, 2014, PP Blog story and Comments thread.) Zeek also had members in common with TelexFree, an alleged Ponzi- and pyramid scheme that gathered more than $1.2 billion. Class-action attorneys have alleged RICO violations at TelexFree involving vendors and MLM attorney Gerald Nehra, who also performed work for Zeek, according to Zeek promos.

“The Receiver has begun to investigate possible claims against financial institutions that facilitated the [Zeek] scheme,” Bell advised Mullen. “If the Receiver becomes convinced that there are colorable causes of action against banks and other financial institutions, he will solicit other law firms to undertake this work.”

And, Bell noted, “The Receiver continues to evaluate potential claims against RVG’s third-party advisors, consultants, and others who received fraudulent transfers but who were not Affiliate Investors.

“These claims,” he continued, “are varied in light of the diverse range of involvement these parties had with RVG. The Receiver intends to file multiple third-party actions, likely grouping defendants in these actions based on the similarity of claims asserted against them.”

Moreover, Bell said, he “has been investigating allegations that certain insiders and net winners may be sheltering, hiding, or dissipating assets fraudulently transferred or held. The Receiver intends to fully pursue legal recourse in these situations so that funds are preserved and may be returned to victims of the ZeekRewards scheme.”

Bids to flummox the receivership were not limited to insiders and winners, Bell said.

“The Receiver Team also identified one creditor that appears to have taken numerous actions that were in direct violation of the Freeze Order and greatly damaged the estate,” Bell said. “The Receiver is in the process of determining what actions should be taken in regard to these violations.”

Bell did not identify the creditor.

An examination of of transactions that occurred at offshore processors such as Payza and SolidTrustPay continues, Bell said.

“The Receiver Team is continuing its investigation of and pursuit of any outstanding funds, including any potential transfers or withdrawals, from Payza and Solid Trust Pay,” Bell said.

Foreign transactions involving Payment World and CyberProfit also are under scrutiny, Bell said.

In addition, he asserted that his team “is investigating potential improper transfers totaling approximately $5.8 million from a Trust Account set up by Preferred Merchants’ CEO Jaymes Meyer for which Rex Venture Group was the beneficiary,” Bell said. “The Receiver Team has issued a subpoena to Preferred Merchants to obtain additional information and is engaged in conversations with Preferred Merchants’ counsel regarding these transfers and the production of this information.”

Transactions at Plastic Cash International also are under scrutiny, Bell said.

‘The Receiver Team is investigating potential improper transfers or withdrawals from Plastic Cash International,” Bell said. “This inquiry includes an analysis of the flow of funds through Network Merchants and SecureNet, which facilitated the flow of funds between Rex Venture Group and Plastic Cash International.”

Meanwhile, scrutiny of transactions involving NXPay, another Zeek Vendor, continues, Bell said.

“The Receiver Team completed its reconciliation of account information for NxPay, determining an outstanding amount of over $13 million, including improper post-freeze Order disbursements, and is analyzing potential options to recover this outstanding amount,” Bell said.

Negotiations with various parties over document production and information-sharing continue, Bell said.

“As part of this effort, the Receiver recently conducted an interview of a key fact witness with knowledge of the scheme,” Bell said.

He did not identify the individual.

Read Bell’s May 7 report. Visit the receivership website.

Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012.

Payza, an HYIP-friendly payment processor that recently bragged on Twitter about its attendance at an event for the teetering TrafficMonsoon scheme, has advised a federal judge that it is not responsible for millions of dollars that allegedly went missing in the Zeek Rewards’ scheme taken down by the SEC in 2012.

BULLETIN: New court filings in the Zeek Rewards’ Ponzi- and pyramid-scheme case brought by the SEC in 2012 say Zeek receiver Kenneth D. Bell may ask a federal judge for a finding of contempt against Payza, a payment processor.

BULLETIN: New court filings in the Zeek Rewards’ Ponzi- and pyramid-scheme case brought by the SEC in 2012 say Zeek receiver Kenneth D. Bell may ask a federal judge for a finding of contempt against Payza, a payment processor.