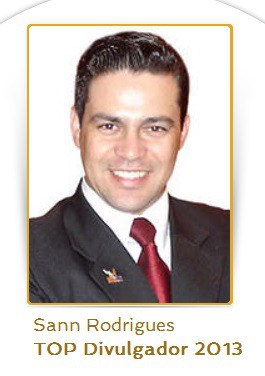

Let’s begin by pointing out that Daniil Shoyfer and Scott Miller have not been charged by the SEC in its 2014 TelexFree action. There are asset freezes aplenty in that government-brought case, including freezes against alleged promoters Sann Rodrigues, Faith Sloan, Randy Crosby and Santiago De La Rosa.

Let’s begin by pointing out that Daniil Shoyfer and Scott Miller have not been charged by the SEC in its 2014 TelexFree action. There are asset freezes aplenty in that government-brought case, including freezes against alleged promoters Sann Rodrigues, Faith Sloan, Randy Crosby and Santiago De La Rosa.

The asset restraints imposed yesterday by U.S. District Judge Timothy S. Hillman against Shoyfer (of New York) and Miller (of Indiana) flow from an altogether different case: a proposed class-action brought by plaintiffs last year.

Indeed, private plaintiffs represented by private attorneys — as opposed to government plaintiffs represented by government attorneys — have now managed to persuade a judge to block the flow of funds alleged to be tainted by fraud.

This is horrible news if you’re a serial promoter of MLM fraud schemes or Ponzi-board “programs” because it demonstrates that the government no longer is your singular worry. Put another way, even if the SEC or some other agency “misses” you, aggressive class-action attorneys may not.

They even may be tracking you as you move from scheme to scheme — and, of course, agencies such as the SEC follow court filings in related actions closely.

Even though the private lawyers did not get everything they sought in yesterday’s order by Hillman, they got enough to seriously complicate the lives of their targets. Although the judge did not restrain assets with no nexus to the alleged $3 billion TelexFree Ponzi- and pyramid scheme, both Shoyfer and Miller now must make monthly financial reports to the court.

From the order:

“Each Individual Defendant shall file a statement of accounting with the Court, under seal, on the last day of each month by 5:00 p.m. EST, setting forth all monetary expenditures and the sale and/or transfer of all assets made in the prior month . . . To the extent that any Individual Defendant seeks to expend money or to sell, transfer dissipate, assign, pledge, alienate, encumber, diminish in value, or otherwise dispose of any funds or other assets which they would not be permitted to do under the terms of this Order, such defendant may file a motion with the Court setting forth, in detail the nature of the transaction.”

And, the judge continued, “The Individual Defendants may petition the Court to exempt from this Order any fund or other assets in any bank, brokerage or other financial institution accounts and any other assets held by of for the benefit of such defendant on the grounds that such assets are not traceable to monies received by him in connection with his involvement with TelexFree. The Individual Defendants shall submit detailed financial statements and/or other documentary evidence to establish the funds held or assets in question are funds or assets were acquired independently. The Individual Defendants shall also submit an accompanying affidavit signed under the pains and penalties of perjury attesting to the authenticity and truth of the evidence submitted in support of their motion to exempt. All filings made pursuant to this section shall be filed under seal. After reviewing the filing, the Court will determine whether notice to the Plaintiffs, discovery and/or a hearing will be required.”

The class-action lawyers already have accused Shoyfer of promoting “MyAdvertisingPays” on the heels of TelexFree. They alleged MAPS, as it is known, is another Ponzi scheme.

So, under the terms of the order, it would appear that, if Shoyfer wants to keep any MAPS income that flowed to him on the grounds it did not originate with TelexFree, he would have to petition the court to do so.

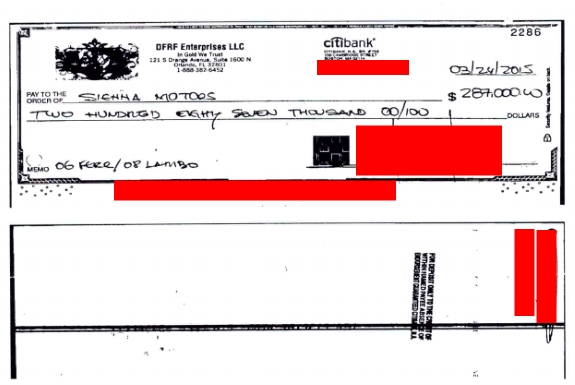

Miller, known for telling a “Carlos Danger” joke to a TelexFree audience and pitching the program to Americans while it was under investigation in Brazil amid reports of threats against a judge and prosecutor, was part of an effort to solicit sums as high as $15,125 from TelexFree prospects. Viewers were told their $15,125 would return at least $1,100 a week for a year.

In restraining the assets of Miller and Shoyfer, Hillman found that the plaintiffs likely would prevail on the merits. Unlike Shoyfer. Miller did not seek to block the preliminary injunction.

But Hillman also cautioned the plaintiffs that more work was needed and that the “depiction of Shoyfer as a ‘Top Level Promoter’ who swindled TelexFree victims out of millions of dollars is, on the current record, nothing more than unsupported rhetoric.”

NOTE: Our thanks to the ASD Updates Blog.

UPDATED 1:56 P.M. ET U.S.A. TelexFree figure Sann Rodrigues could have been sentenced to 10 years for immigration fraud. Instead, he was sentenced yesterday to time served. The office of U.S. Attorney Carmen Ortiz of the District of Massachusetts said early this afternoon that Rodrigues ended up spending 57 days behind bars after his May 2015 arrest on the immigration charge.

UPDATED 1:56 P.M. ET U.S.A. TelexFree figure Sann Rodrigues could have been sentenced to 10 years for immigration fraud. Instead, he was sentenced yesterday to time served. The office of U.S. Attorney Carmen Ortiz of the District of Massachusetts said early this afternoon that Rodrigues ended up spending 57 days behind bars after his May 2015 arrest on the immigration charge.

Let’s begin by pointing out that Daniil Shoyfer and Scott Miller have not been charged by the SEC in its

Let’s begin by pointing out that Daniil Shoyfer and Scott Miller have not been charged by the SEC in its  EDITOR’S NOTE: As the PP Blog

EDITOR’S NOTE: As the PP Blog

It’s another MLM legal and PR catastrophe.

It’s another MLM legal and PR catastrophe.