In the aftermath of the SEC’s securities-fraud action against him last year and a judicial ruling this year that he was opertaing a Ponzi scheme, Traffic Monsoon’s Charles Scoville has blanketed social media with claims he was not offering investments.

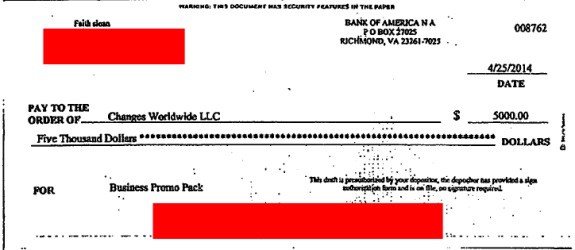

But Scoville told PayPal that “Traffic Monsoon’s business was “Investments – general” when he opened an account for the “program” in 2014, according to a proposed class-action lawsuit against the payment processor for aiding and abetting Scoville’s alleged fraud.

This happened after PayPal had “previously banned Scoville from using its services following allegations that his prior pay-to-click businesses, which also purportedly sold advertising businesses with revenue sharing, were Ponzi/pyramid schemes,” according to the lawsuit.

Whether the SEC would seize on the claim as the agency’s case against Scoville and Traffic Monsoon works its way through the courts was not immediately clear. Investigators potentially could argue that Scoville was telling investors one thing while telling PayPal another.

Likely because of a court-imposed stay of litigation against Scoville and Traffic Monsoon while Scoville appeals judicial findings against him in the SEC case, neither Scoville nor Traffic Monsoon is named a defendant in the proposed class action.

Named defendants are PayPal Inc. and PayPal Holdings Inc. Plaintiffs are Chukwuka Obi and Kingsley Ezeude. The case was filed May 4 in U.S. District Court for the Northern District of California.

From the complaint (italics added/light editing performed):

The [Traffic Monsoon] scheme lasted from September 2014 through July 2016. During this time, Traffic Monsoon duped investors into believing it was “a specialized advertising and revenue sharing company” that operated a pay-to-click and Internet traffic exchange program. On its website, Traffic Monsoon falsely told investors that it was not selling investments or operating a Ponzi/pyramid scheme that would pay returns to existing investors with money from new investors . . .

Traffic Monsoon also concealed from its investors that Scoville, its sole member and operator, had a prior history of defrauding investors through similar pay-to-click investment “businesses.” Unbeknownst to investors – but known to PayPal – Traffic Monsoon was not Scoville’s first fraudulent investment scheme disguised as a “pay-to-click” program. In fact, just as he did with Traffic Monsoon, Scoville ran his prior pay-to-click schemes with PayPal’s support and through PayPal’s infrastructure. Indeed, in 2011 PayPal had banned Scoville from using its services following allegations that Scoville was operating a substantially similar – and similarly fraudulent – “pay-to-click” investment scheme. Yet, despite its knowledge of Scoville’s past pay-to-click schemes and its knowledge that pay-to-click websites have Ponzi/pyramid scheme features, PayPal failed to enforce its own ban and allowed Scoville to open an account for Traffic Monsoon in September 2014, using PayPal’s infrastructure to perpetrate and profit from his new – but similar in its material respects – “pay-to-click” investment fraud.

The 52-page complaint argues that the left hand at PayPal didn’t know what the right had was doing with respect to doing business with and applying policies to Scoville.

From the complaint (italics added/light editing performed):

PayPal was aware that Scoville had previously operated similar pay-to-click businesses that PayPal banned from using its services following allegations that the businesses were Ponzi/pyramid schemes. PayPal is also aware that pay-to-click businesses raise concerns regarding fraud and that some have Ponzi/pyramid scheme features. Indeed, PayPal has placed holds or bans on other pay-to-click businesses. Yet PayPal did not enforce its own ban on Scoville’s use of its services.

By knowingly allowing Scoville’s new pay-to-click scheme, Traffic Monsoon, to use its services, PayPal departed from its own policy that prohibits the use of its services for “transactions that . . . support pyramid or ponzi schemes.” (PayPal Acceptable Use Policy.) . . .

PayPal was aware that Traffic Monsoon was falsely representing to investors that it sold advertising services, not investments. Scoville told PayPal (but not investors) that Traffic Monsoon offered investments, which PayPal noted in PayPal Account 7752. When PayPal reviewed Traffic Monsoon’s website to verify the information provided by Scoville, PayPal learned that Traffic Monsoon was a pay-to-click scheme; represented to investors that Traffic Monsoon sold advertising services, not investments; and promised to make payments to investors in pyramid scheme fashion . . .

PayPal also knew that Traffic Monsoon was a Ponzi/pyramid scheme. PayPal actively monitored Traffic Monsoon’s PayPal account. It was aware of each investment and each withdrawal from the account. PayPal was aware that Traffic Monsoon was making Ponzi/pyramid scheme payments to investors and that Traffic Monsoon’s Ponzi/pyramid scheme was growing exponentially in classic Ponzi/pyramid scheme fashion.

PayPal told Bloomberg that it looked forward to refuting the claims.

The complaint is posted on Dropbox.

EDITOR’S NOTE: Traffic Monsoon is a Utah company. The firm also has purported business operations in the United Kingdom and Dubai. Details about the offshore operations are murky.

EDITOR’S NOTE: Traffic Monsoon is a Utah company. The firm also has purported business operations in the United Kingdom and Dubai. Details about the offshore operations are murky.

A “program” known as ViziNova was both a cross-border pyramid scheme and a reload scam aimed at victims of the

A “program” known as ViziNova was both a cross-border pyramid scheme and a reload scam aimed at victims of the  Paul Burks will be sentenced Feb. 13 for his criminal role in Zeek Rewards, and the court-appointed receiver is soliciting letters from victims of the combined Ponzi- and pyramid scheme that affected hundreds of thousands of people.

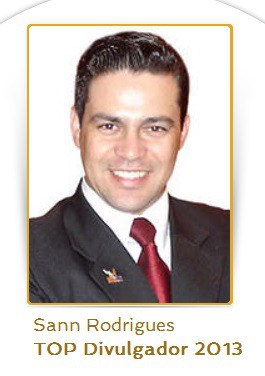

Paul Burks will be sentenced Feb. 13 for his criminal role in Zeek Rewards, and the court-appointed receiver is soliciting letters from victims of the combined Ponzi- and pyramid scheme that affected hundreds of thousands of people. UPDATED 1:56 P.M. ET U.S.A. TelexFree figure Sann Rodrigues could have been sentenced to 10 years for immigration fraud. Instead, he was sentenced yesterday to time served. The office of U.S. Attorney Carmen Ortiz of the District of Massachusetts said early this afternoon that Rodrigues ended up spending 57 days behind bars after his

UPDATED 1:56 P.M. ET U.S.A. TelexFree figure Sann Rodrigues could have been sentenced to 10 years for immigration fraud. Instead, he was sentenced yesterday to time served. The office of U.S. Attorney Carmen Ortiz of the District of Massachusetts said early this afternoon that Rodrigues ended up spending 57 days behind bars after his

UPDATED 3:51 P.M. EDT U.S.A. Peggy Hunt, a partner at Dorsey & Whitney in Salt Lake City, is the court-appointed receiver in the

UPDATED 3:51 P.M. EDT U.S.A. Peggy Hunt, a partner at Dorsey & Whitney in Salt Lake City, is the court-appointed receiver in the  EXHIBIT: The government may introduce a photo of Merrill posing with a Hummer vehicle in TelexFree promos.

EXHIBIT: The government may introduce a photo of Merrill posing with a Hummer vehicle in TelexFree promos.