U.S. SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 22992 / May 13, 2014

Securities and Exchange Commission v. TelexFree, Inc. et al., Civil Action No. 1:14-cv-11858-DJC (United States District Court for the District of Massachusetts)

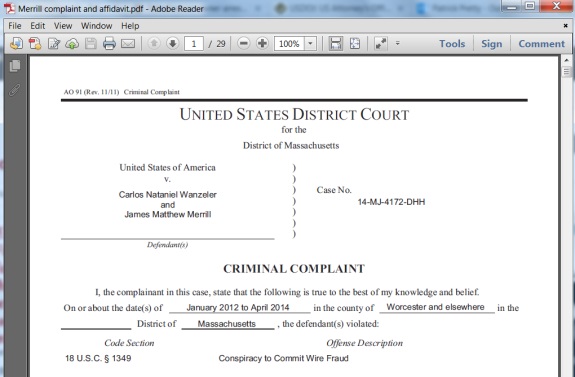

United States v. Carlos Nataniel Wanzeler and James Matthew Merrill, Case No. 14-MJ-4172-DHH (United States District Court for the District of Massachusetts)

Criminal Charges Filed Against Two Principals of Massachusetts-Based Telexfree

On Friday, May 9, 2014, the U.S. Attorney for the District of Massachusetts charged James M. Merrill, of Ashland, Massachusetts, and Carlos N. Wanzeler, of Northborough, Massachusetts, with conspiracy to commit wire fraud in connection with the alleged TelexFree pyramid scheme previously charged by the Securities and Exchange Commission. Federal authorities arrested Merrill on Friday, and an arrest warrant was issued for Wanzeler, who the Department of Justice announced is a fugitive. The Department of Justice also announced it has executed 37 seizure warrants seizing assets relating to the fraudulent pyramid scheme.

The criminal charges against Merrill and Wanzeler related to the same conduct charged in a civil enforcement action filed by the SEC on Tuesday, April 15, 2014, against Merrill, Wanzeler, and others. Those charges were filed under seal, in connection with the Commission’s request for an immediate asset freeze. That asset freeze, which the U.S. District Court in Boston ordered on Wednesday, April 16, secured millions of dollars of funds and prevented the potential dissipation of investor assets. After the SEC staff implemented the asset freeze, at the SEC’s request the Court lifted the seal on April 17. On April 30, 2014, the Court entered preliminary injunctions extending the asset freeze as to defendants Santiago De La Rosa, of Lynn, Massachusetts, and Randy N. Crosby, of Alpharetta, Georgia. On May 8 and 9, the Court entered preliminary injunctions extending the asset freeze as to all the remaining defendants (Merrill, Wanzeler, TelexFree, Inc., TelexFree, LLC, Joseph H. Craft, of Boonville, Indiana, Steve Labriola, of Northbridge, Massachusetts, Faith R. Sloan, of Chicago, Illinois, and relief defendants (TelexFree Financial, Inc., TelexElectric, LLLP, and Telex Mobile Holdings, Inc.).

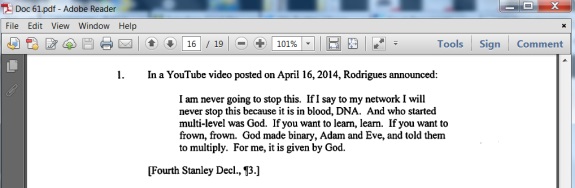

The SEC alleges that TelexFree, Inc. and TelexFree, LLC claim to run a multilevel marketing company that sells telephone service based on “voice over Internet” (VoIP) technology but actually are operating an elaborate pyramid scheme. In addition to charging the company, the SEC charged several TelexFree officers and promoters, and named several entities related to TelexFree as relief defendants based on their receipt of investor funds. According to the SEC’s complaint filed in federal court in Massachusetts, the defendants sold securities in the form of TelexFree “memberships” that promised annual returns of 200 percent or more for those who promoted TelexFree by recruiting new members and placing TelexFree advertisements on free Internet ad sites. The SEC complaint alleges that TelexFree’s VoIP sales revenues of approximately $1.3 million from August 2012 through March 2014 are barely one percent of the more than $1.1 billion needed to cover its promised payments to its promoters. As a result, in classic pyramid scheme fashion, TelexFree was paying earlier investors, not with revenue from selling its VoIP product but with money received from newer investors.

In related proceedings, on May 6, 2014, the U.S. Bankruptcy Court in the District of Nevada granted the SEC’s motion to transfer venue of those proceedings from Nevada to Massachusetts. The SEC had contended that the TelexFree entities hastily filed for bankruptcy in Nevada on Sunday night, April 13, 2014, in a transparent attempt to avoid Massachusetts. The SEC had noted that TelexFree does virtually no business in Nevada but rather was headquartered in Marlborough, Massachusetts. The SEC also argued that TelexFree did not have a legitimate business capable of reorganization under the bankruptcy code. The bankruptcy case will be transferred to Massachusetts for all further proceedings.

Source: http://www.sec.gov/litigation/litreleases/2014/lr22992.htm