UPDATED 12:23 P.M. ET (MARCH 4, U.S.A.) A 10-hour video of the TelexFree confab in Spain Saturday and Sunday has emerged, apparently a recording of a once-live feed.

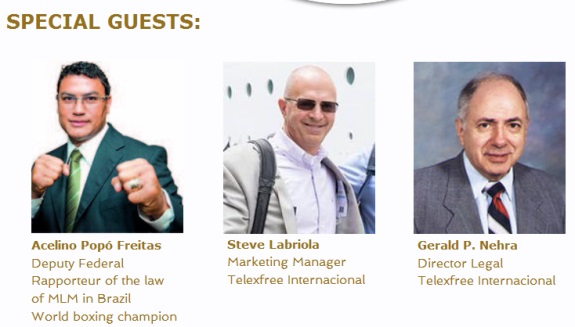

After being billed as headliners, neither Brazil-based TelexFree executive Carlos Costa nor American MLM lawyer Gerald Nehra appeared on the stage to accept awards.

U.S.-based TelexFree marketing executive Steve Labriola walked onto the stage to accept Nehra’s award.

“This is for Jerry,” he said. “I was asked to come up and receive this for Jerry.”

Labriola did not say who asked him to accept the award on Nehra’s behalf.

Nehra does “most of our corporate law,” Labriola said. “He’s a great man. And he also works long hours, like all of you out there, and I [will] be honored to give this to him.”

Whether Nehra was in Spain was not immediately clear. He’d been billed by a website styled ConventionTelexFree.com as a “Special Guest” at the Madrid event.

Labriola then accepted an award for himself.

“Somebody said to me once — ‘Network marketing: it’s a get-rich-quick scheme,’” Labriola recalled in accepting the award. “But let me tell you, if you talk to any of the leaders or anybody that is working their business, there is no get-rich-quick. There is long hours.”

The claim was at odds with various claims online that TelexFree produces “passive” income. Labriola hinted that the firm was attempting to address inappropriate marketing. Whether he’ll clash horns with American MLMer Faith Sloan, with whom he’s been pictured, wasn’t immediately known.

Among Sloan’s claims in 2013 was that TelexFree produced “100% Passive Income.”

TelexFree says it’s in the VOIP business and is expanding into cell phones.

Labriola and other TelexFree “leaders” recently ventured to Haiti, Labriola said, suggesting it could be a warm market for TelexFree, which purportedly is changing people’s lives.

“We drove through some areas that could see . . .” he said, his voice trailing off.

“There’s places in this world that need help,” Labriola continued. “It’s up to all of you to keep working your business. Keep your products and services out there. Make sure that you’re helping people where they need help. And every person that you reach out and touch and help save their life and help move them forward will help your life get a little bit better.”

Haiti is perhaps the poorest country in the Western Hemisphere. Its neighbor — the Dominican Republic — may be emerging as a TelexFree stronghold.

“Don’t worry about the Bloggers online and the things that they’re saying, because we will keep doing the right things in moving forward,” Labriola said.

The PP Blog reported Friday — on the eve of the TelexFree confab in Spain — that the firm was under investigation in the United States. It’s also under investigation in Africa and South America. Brazilian investigators say TelexFree is a pyramid scheme.

Carlos Wanzeler, another TelexFree executive at the Madrid event, appears to have accepted awards on behalf of himself and fellow TelexFree executive Carlos Costa, perhaps the firm’s most well-known executive.

Whether Costa was in Spain was not immediately clear. Like Nehra, he’d been billed as a star attraction.

Among the other TelexFree honorees was Sann Rodrigues, a former defendant in a pyramid-scheme and affinity-fraud case filed by the SEC in 2006. Rodrigues was accused of targeting the Brazilian community in an affinity-fraud scheme that involved telephone cards.

TelexFree President James Merrill also appeared at the confab and received an award.

“Carlos Wanzeler was up here talking about Carlos Costa . . . two of the greatest leaders that I’ve met in my life,” Merrill said. “They’re very strong. They’re courageous, and they’re fighting for you. And I want you all to know that they didn’t join my team, I joined their team. OK. They’re great leaders.”

Merrill predicted that the excellent lawyering and marketing-consulting TelexFree has received will make TelexFree one of the great MLM companies of all time. Helping drive growth, he said, would be the former president of Excel Communications.

Excel, according to its Wikipedia entry, once used an MLM compensation structure, but suffered when margins on long-distance phone service dropped precipitously. A bankruptcy filing followed.

From the Wikipedia entry (italics added):

Excel sought to be released from its contracts with its independent representatives. This allowed it to continue to receive revenue from its large base of installed customers without paying eternal commissions to the franchisees. Excel continued to operate but ceased to be a multi-level marketing company. Although the change created much cash enabling it to pay creditors, it was seen as shortsighted by the franchisee association because it removed the primary source of sales and customer loyalty.