Dear Readers,

The PP Blog’s choice for the “Most Important” story to appear on the Blog in 2012 is this one, dated July 28: “Site Critical Of Zeek Goes Missing After HubPages Receives Trademark ‘Infringement’ Complaint Attributed To Rex Venture Group LLC — But North Carolina-Based Rex Not Listed As Trademark Owner; Florida Firm That IS Listed As Owner Says It Has ‘No Knowledge’ Of Complaint.”

The story tells the bizarre tale of how purported Zeek “consultant” Robert Craddock, beginning on July 22, tried to gag K. Chang, a Zeek critic.

Our reasoning for selecting the Craddock tale appears below . . .

** __________________________________ **

UPDATED 1:30 P.M. ET (U.S.A.) This Blog is well aware that some MLMers would have you believe that nothing that appears here is important. The “case” against the Blog normally involves ad hominem attacks, along with bids to change the subject or cloud issues. Some of the campaigns against the PP Blog have been almost comical, falling along lines such as these: ASD can’t be a Ponzi scheme because it rained on Tuesday. Your [sic] an idiot and looser [sic] !!!!!

UPDATED 1:30 P.M. ET (U.S.A.) This Blog is well aware that some MLMers would have you believe that nothing that appears here is important. The “case” against the Blog normally involves ad hominem attacks, along with bids to change the subject or cloud issues. Some of the campaigns against the PP Blog have been almost comical, falling along lines such as these: ASD can’t be a Ponzi scheme because it rained on Tuesday. Your [sic] an idiot and looser [sic] !!!!!

Other campaigns have been much more menacing.

One of the least-appreciated aspects of the Zeek Rewards story is that Zeek launched after Bernard Madoff made the word “Ponzi” a part of the national (and international) consciousness. Setting aside Zeek’s epic legal problems, Zeek and its “defenders” have a PR problem from which they’ll never recover. In short, it is fatal. The reason that it’s fatal is that it creates a dynamic that is virtually unique to the MLM HYIP sphere: While the rest of the world rails against Ponzi schemes and Ponzi schemers, the MLM HYIP sphere defends them.

But it gets stranger than that. Certain inhabitants of the HYIP sphere in effect are lobbying for the legalization of Ponzi schemes to make their lives more convenient. To this group, the answer to Ponzi schemes is even more Ponzi schemes. Their message is remarkably similar to the message of the gun lobby, which appears to be arguing that the answer to gun violence is even more guns — in strategic locations, of course, perhaps in educational institutions at the grade-school level through college. (And maybe at movie theaters and at the scene of rural house fires, in case first responders such as firefighters and EMTs encounter an ambush.)

You’ve heard by now that the rural town of Webster, N.Y., turned into Israel last week, we’re sure.

In fairness to the gun lobby, it must be pointed out that HYIP “defenders” who are lobbying for more Ponzi schemes even as the gun lobby lobbies for more guns have less legal standing than the gun lobby. Guns already are legal. Ponzi schemes are not.

But, getting back to Zeek’s PR problem . . .

Madoff was exposed in 2008 as a Ponzi schemer, a financial criminal of unprecedented hubris. Not only did Zeek debut after Madoff, it came after Scott Rothstein was exposed (in 2009) as a racketeer/Ponzi schemer — and after AdSurfDaily, a purported MLM “advertising” company, was exposed (in 2008 and 2009) as the largest online Ponzi scheme ever and was sued by its own members amid allegations of racketeering.

For some Zeek promoters, this well-known fact set makes them vulnerable to charges they are nothing less than members of an organized mob of habitual criminals who thrive by choosing to be willfully blind.

But, incredibly, it gets even stranger . . .

Zeek had members in common with AdSurfDaily and, like AdSurfDaily, told members that a purported “advertising” function was central to its business model. Meanwhile, Zeek became popular in North Carolina, after the infamous Black Diamond Ponzi caper was exposed in that very state. (Among other things, the Back Diamond fraud led to criminal charges being filed against a bank.)

Along those lines, Zeek (in May) began to show signs that it was experiencing banking problems after it had become popular in a region known to have served up another colossal mess, this one in nearby South Carolina. (The South Carolina mess was known as the “3 Hebrew Boys” scheme. It resulted in the longest Ponzi scheme sentences in the history of the South Carolina federal courts and, like AdSurfDaily and Zeek, served up a heaping helping of the bizarre, including claims by “sovereign citizens” that prosecutors had no authority over them.)

Moreover, the Zeek scheme for which some “defenders” continue to cheer featured recruitment commissions on two levels (like AdSurfDaily) and an “RPP” payout (like ASD’s 1-percent-a-day “rebates”). Finally, the Zeek scheme came to the fore after the U.S. Secret Service described ASD as a “criminal enterprise” and after the Attorney General of the United States made a special public appearance in Florida — fertile recruitment grounds for schemes such as Zeek and the stomping grounds of Madoff and Rothstein — to announce that the Justice Department was serious about putting people in jail for ravaging the U.S. economy with their Ponzi schemes.

“Palm Beach is, in many respects, ground zero for the $65 billion Ponzi scheme perpetrated by Bernard Madoff — the largest investor fraud case in our nation’s history,” Eric Holder said on Jan. 8, 2010, in southern Florida. “Before the house of cards Madoff built collapsed in 2008, before he was sentenced to 150 years in prison last June, before he became a notorious criminal on the cover of newspapers around the world, he was one of your neighbors.

“His former home sits just north of us,” Holder continued. “An 8,700-square-foot mansion that’s worth . . . well, we’ll know what its worth once the U.S. Marshals Service auctions it off and the proceeds are distributed to Madoff’s victims.”

Holder’s words are best viewed as a warning against willful blindness: Neither victim nor perpetrator be. There is unqualified pain and misery for both.

Despite Holder’s appearance in Florida — despite his reference to Madoff’s “house of cards” — AdSurfDaily promoters Todd Disner and Dwight Owen Schweitzer later sued the United States, claiming that its Ponzi case against ASD was a “house of cards.” Naturally they made this claim even as they were promoting Zeek.

And from what region were they promoting Zeek? Why, Southern Florida, of course, the same region Holder visited in 2010 to throw down the gauntlet against Ponzi schemers and their enablers.

Amid the historical circumstances cited above, Zeek Rewards began to encounter some heat from the media and from its own members. Some of the members did not understand why things at Zeek appeared to be so circuitous and why they were being asked to use payment processors such as AlertPay and SolidTrustPay that had been associated with fraud scheme after fraud scheme operating online, including ASD.

What to do if you’re Zeek?

Well, according to Florida resident Robert Craddock, a self-described Zeek consultant, you hire, well, Robert Craddock — and you use Robert Craddock to go after Zeek critics such as K. Chang.

The Most Important Story Of 2012

In the PP Blog’s view, the most important story to appear on the Blog in 2012 is this one, titled, “Site Critical Of Zeek Goes Missing After HubPages Receives Trademark ‘Infringement’ Complaint Attributed To Rex Venture Group LLC — But North Carolina-Based Rex Not Listed As Trademark Owner; Florida Firm That IS Listed As Owner Says It Has ‘No Knowledge’ Of Complaint.”

The story details efforts in July by Craddock to have K. Chang’s Zeek “Hub” at HubPages removed from the Internet just weeks before the SEC accused Zeek of being a $600 million Ponzi- and pyramid fraud. By early estimates, the alleged Zeek fraud was about five times larger than ASD in pure dollar volume ($600 million compared to $120 million) and perhaps 20 times larger in terms of the membership base (2 million compared to 100,000).

Incredibly, Craddock went after K. Chang after Deputy Attorney James Cole, speaking in Mexico, said that international fraud schemes have been known to “bring frivolous libel cases against individuals who expose their criminal activities.” And Cole also pointed out that fraudsters have a means of “exploit[ing] legitimate actors” and may rely on shell companies and offshore bank accounts to launder criminal proceeds.

If ever a company exploited legitimate actors, it was Zeek. Kenneth D. Bell, the court-appointed receiver, says there were approximately 840,000 Zeek losers who funded the ill-gotten gains of 77,000 winners. And Bell also says he has “obtained information indicating that large sums of Receivership Assets may have been transferred by net winners to other entities in order to hide or shelter those assets.”

There can be no doubt that some of those winners are longtime residents of the woeful valley of willful blindness. Not only do they “play” HYIP Ponzis for profit, they now publicly announce their intent to keep their winnings. Zeek has exposed the epicenter of willful blindness, the criminal underworld of the Internet. It is easy enough to view Craddock’s efforts as a means of institutionalizing willful blindness, first by seeking to chill speech and, second, by scrubbing the web of information that encourages readers to be discriminating so they won’t be duped by a Ponzi fraudster.

Bizarrely, it appears as though someone inside of Zeek believed it prudent to hire Craddock to go after K. Chang. If that weren’t enough, only days later Zeek used its Blog to plant the seed that unnamed “North Carolina Credit Unions” were committing slander against Zeek.

After the SEC brought the Zeek Ponzi complaint in August, Craddock quickly went in to fundraising mode. As incredible as it sounds, ASD’s Todd Disner — also of Zeek — was on the line with him.

What Craddock did was deplorable. It was as though he slept through the past four years of Ponzi history, all the cases that showcase the markers of fraud schemes and all the government warnings to be cautious. (Nongovernment/quasigovernment entities such as FINRA also publish such warnings, like this one on HYIP fraud schemes outlined by the PP Blog.)

The FINRA warning was published in 2010, prior to Zeek but after the Legisi, Pathway To Prosperity and ASD schemes were exposed. Legisi operator Gregory McKnight potentially faces 15 years in federal prison. He was charged both civilly (SEC) and criminally (U.S. Secret Service) — and Legisi pitchmen Matthew John Gagnon also was charged civilly and criminally by the same agencies. The SEC called Gagnon a “threat to the investing public.”

Any number of Zeek promoters pose a similar threat. They are at least equally willfully blind.

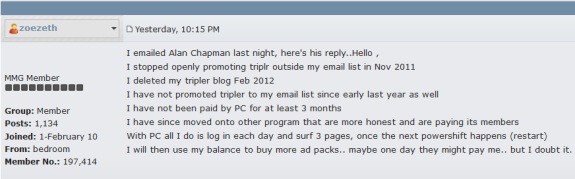

It is clear that some Zeek promoters also were promoting JSSTripler/JustBeenPaid, the debacle-in-waiting purportedly organized by Frederick Mann, a former ASD promoter. JSS/JBP has morphed into “ProfitClicking” amid reports of the “retirement” of Mann. Now, ProfitClicking “defenders” are threatening lawsuits against critics.

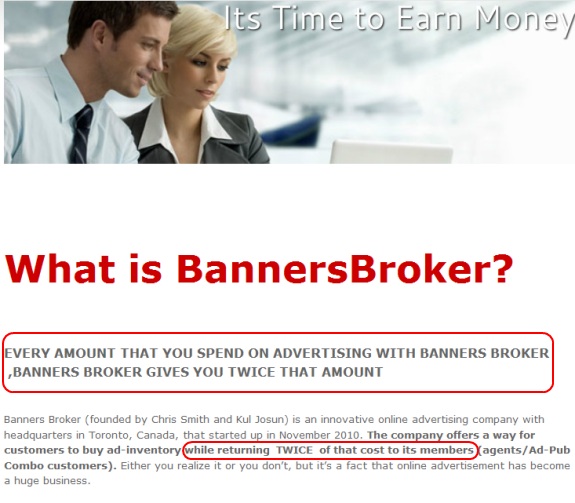

Naturally the stories advanced by ProfitClicking “defenders” are being improved by “defenders” of other obvious fraud schemes such as BannersBroker. A BannersBroker “defender” is over at RealScam.com — an antiscam site — suggesting that RealScam is a terrorist organization.

My God.

These claims are being made just days after Zeek figure Robert Craddock suggested he had contacts in law enforcement who were going to charge Blogger Troy Dooly with cyber harassment.

It wouldn’t sell as fiction.

Craddock’s bid to gag K. Chang easily was the most important story on the PP Blog in 2012. It’s the one that signaled that things are destined only to get crazier in MLM La-La Land and that the threat to U.S. national security only will grow.

UPDATED 7:06 P.M. ET (U.S.A.) The PP Blog today began to receive bizarre spam related to the purported BannersBroker “program,” a Ponzi-forum darling.

UPDATED 7:06 P.M. ET (U.S.A.) The PP Blog today began to receive bizarre spam related to the purported BannersBroker “program,” a Ponzi-forum darling.