URGENT >> BULLETIN >> MOVING: (UPDATED 11:58 A.M. ET (U.S.A.) The SEC has gone to federal court in the Western District of North Carolina to oppose a motion by Zeek “winners” to appoint an “examiner” over all Zeek affiliates. In a blistering, 12-page memo, the agency accused Zeek figure Robert Craddock of encouraging Zeek affiliates “not to cooperate” with Kenneth D. Bell, the court appointed receiver.

URGENT >> BULLETIN >> MOVING: (UPDATED 11:58 A.M. ET (U.S.A.) The SEC has gone to federal court in the Western District of North Carolina to oppose a motion by Zeek “winners” to appoint an “examiner” over all Zeek affiliates. In a blistering, 12-page memo, the agency accused Zeek figure Robert Craddock of encouraging Zeek affiliates “not to cooperate” with Kenneth D. Bell, the court appointed receiver.

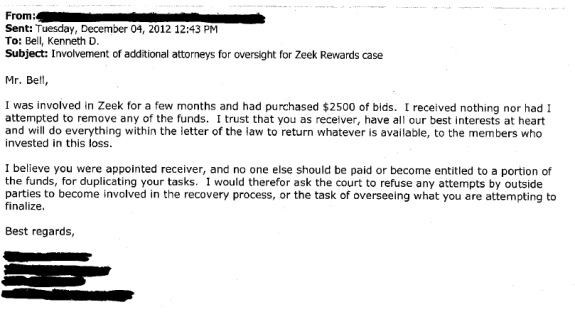

“Moreover,” the SEC claimed, “Craddock has asserted (incorrectly) that the SEC has acknowledged to his lawyers that the SEC has doubts or concerns about its case and is looking for ways to ‘back out’ in order to allow ZeekRewards to re-start its operations. Another Quilling client, David Kettner has repeated assertions similar to those made by Craddock in written communications to former ZeekRewards affiliates.”

The agency also confirmed in its filing that its Zeek investigation was ongoing. The “confidential nature” of the probe, the agency said, potentially could make it difficult to respond to motions filed by opposition attorneys.

There could come a time, the SEC said, that it would ask “to provide the Court with additional information under seal or in a closed hearing.”

The SEC’s filing was dated yesterday — the same day Bell also asked Senior U.S. District Judge not to approve the sought-after appointment of Dallas attorney Michael J. Quilling as examiner. Quilling, Bell said, had an obvious conflict of interest. The SEC argued along the same lines.

Quilling, the SEC said, is representing “certain significant net ‘winners’ in the ZeekRewards Ponzi scheme alleged in the Complaint” and seeks “to have himself appointed ‘Representative for Affiliates,’ provided with counsel, and compensated out of the Receivership Estate.”

From the SEC’s motion (italics added):

The Quilling Motion suffers from several obvious flaws:

(1) The Motion offers no compelling factual or legal basis for the Court to consider appointing a “Representative for Affiliates” – the Commission continues to work closely with and monitor the Receiver to ensure that as much money as possible is returned to injured investors in the most efficient manner possible;

(2) Appointment of a “Representative for Affiliates” would serve only to complicate this already complex matter, obstruct the Receiver’s ability to efficiently marshal Receivership Assets, and significantly and unnecessarily deplete the pool of assets available to be distributed to injured investors (given that Quilling and [Charlotte attorney Rodney E.] Alexander seek to be compensated from Receivership Assets); and

(3) The interests of Quilling and Alexander’s current clients – significant net “winners” in the Ponzi scheme alleged in the Complaint – are diametrically opposed to the vast majority of ZeekRewards investors that were net “losers” in the Ponzi scheme.

One of the potential issues is whether Craddock — through his Florida-based entity Fun Club USA — gathered money from Zeek losers and used it to bolster the aims of Zeek winners in the early days after the SEC’s Aug. 17 Ponzi complaint. Such an act potentially could have put losers in opposition to their own best interests, given that Bell intends to file clawback lawsuits against winners to help fund the receivership estate.

In its motion, the SEC said that Fun Club USA appears to have been formed 11 days after the SEC’s actions and that it and other nonparties had “yet to explain why an entity formed after the Court froze ZeekRewards assets and appointed the Receiver should be heard on the subject matter” of the motion to appoint an examiner.

Read the SEC motion.