“These frauds are easily duplicated, and at times, we find ourselves playing ‘whack-a-mole,’ chasing the same set of fraudsters who, after feeling a bit of heat, simply close down one scheme and quickly set up a new one under a different name.” — Andrew Ceresney, SEC Enforcement Division director, March 2, 2016

EDITOR’S NOTE: Type “whack-a-mole” into the PP Blog’s search box near the upper-right corner to find our stories that touch on frauds rising to replace other frauds. Examples include so-called “programs” that claim to be “advertising” companies or to have an “advertising” component — for example, Zeek Rewards, TelexFree, Banners Broker and AdSurfDaily. If you’re in an “advertising” program such as MyAdvertisingPays (MAPS) or TrafficMonsoon, you should asking some serious questions and thinking about whether serial fraudsters are whacking you.

When one scheme collapses, another quickly rises to replace it. Many such schemes operate simultaneously, drafting the unwary into multiple miseries. Ill-gotten gains or losses pile up in the billions of dollars. Yes, billions.

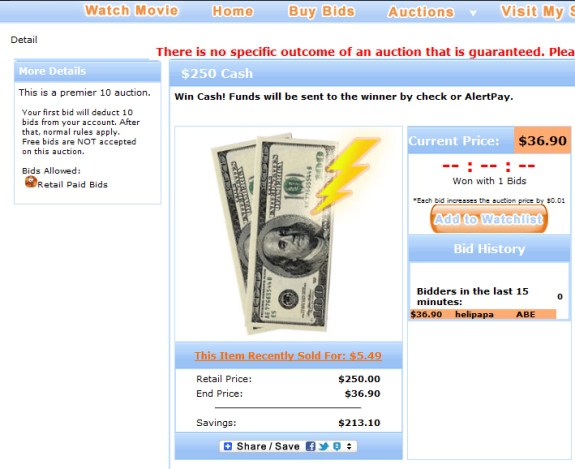

Of course, “whack-a-mole” is not limited to “advertising” schemes. There are “cycler” schemes such as “The Achieve Community” and its Ponzi-board equivalents. Meanwhile, there are HYIP schemes such as “Profitable Sunrise” and its Ponzi-board equivalents. MoneyMakerGroup and TalkGold are examples of Ponzi boards. The scammers now have added social media such as YouTube, Facebook and Twitter to their arsenal. Vulnerable people and population groups are constant targets.

Scams such as WCM777 that claim to have a “product” also are part of “whack-a-mole.”

**________________________________**

Let’s begin by encouraging you to read Andrew Ceresney’s opening remarks at a joint symposium today sponsored by the SEC and the University of Illinois at Chicago. (Link at bottom of story. Also see Twitter links.)

Let’s begin by encouraging you to read Andrew Ceresney’s opening remarks at a joint symposium today sponsored by the SEC and the University of Illinois at Chicago. (Link at bottom of story. Also see Twitter links.)

UIC promoted the event on its website, titling it “How to Detect and Combat Fraudsters Who Target Our Immigrant Groups and Affinity Communities Through Pyramid and Ponzi Schemes.” The institution notes it is “one of the most ethnically and culturally diverse universities in the country,” so it was a perfect place to host such a confab.

Ceresney is the SEC’s director of enforcement. One of the things the PP Blog noted while reading the text of his remarks is that it included a subhead titled “Pyramid Schemes and Multi-Level Marketing.”

This reflected on ongoing effort by the SEC to educate the public that the presence of a “product” in a scheme does not necessarily mean no scam is under way. Many MLMers erroneously believe that a “product” (or purported one) offered for sale cures all ills. That is simply not the case. A year ago in Congressional testimony, the director spoke about a “coordinated effort” to disrupt pyramid schemes.

Ceresney today provided more details on a new Task Force that is combating pyramid fraud. Here is part of his remarks (italics/bolding added):

After seeing an increase in complaints regarding pyramid schemes and affinity fraud, the SEC formed a nationwide Pyramid Scheme Task Force in June 2014 to provide a disciplined approach to halting the momentum of illegal pyramid scheme activities in the United States. The goal of the Task Force is to target these schemes by aggressively enforcing existing securities laws and increasing public awareness of this activity.

The Division is deploying resources to disrupt these schemes through a coordinated effort of timely, aggressive enforcement actions along with community outreach and investor education. More than fifty SEC staff members are part of the nationwide Task Force, which is enhancing its enforcement reach by collaborating with other agencies and law enforcement authorities. We are also using new analytic techniques to identify patterns and common threads, thereby permitting earlier detection of potential fraudulent schemes.

Collaboration with other regulators, including criminal authorities, is an important goal of the Task Force. To advance this goal, the Task Force has hosted an interagency summit attended by over 200 representatives from other federal and state agencies and has presented at local trainings and agency-specific conferences. And, of course, we have partnered with other regulators and criminal authorities to bring high-impact actions in this space. For example, one month after we filed our enforcement action against the operators of the TelexFree pyramid scheme, two of TelexFree’s principals were charged by the criminal authorities.

Will the “program” you’re currently pitching become the subject of a “high-impact action?” Time will tell.

In 11 SEC actions since 2012 involving pyramid operators, the damage resulted in ill-gotten gains or losses totaling more than $4.2 billion, Ceresney said today.

Read his opening remarks at today’s Chicago symposium.

Is there a double whammy in your MLM future — first being ripped off in a binary-options “program,” only to be ripped off a second time by scammers posing as government agencies and offering purported refunds for a fee?

Is there a double whammy in your MLM future — first being ripped off in a binary-options “program,” only to be ripped off a second time by scammers posing as government agencies and offering purported refunds for a fee? Let’s begin by encouraging you to read Andrew Ceresney’s opening remarks at a joint symposium today sponsored by the SEC and the University of Illinois at Chicago. (Link at bottom of story. Also see Twitter links.)

Let’s begin by encouraging you to read Andrew Ceresney’s opening remarks at a joint symposium today sponsored by the SEC and the University of Illinois at Chicago. (Link at bottom of story. Also see Twitter links.)

Let’s begin by pointing out that Daniil Shoyfer and Scott Miller have not been charged by the SEC in its

Let’s begin by pointing out that Daniil Shoyfer and Scott Miller have not been charged by the SEC in its  The SEC this afternoon declined comment on an order by a federal judge in Atlanta that could lead to the dismissal of the agency’s 2013 case against Profitable Sunrise, an alleged international pyramid scheme and offering fraud targeted at U.S. residents by one or more murky figures.

The SEC this afternoon declined comment on an order by a federal judge in Atlanta that could lead to the dismissal of the agency’s 2013 case against Profitable Sunrise, an alleged international pyramid scheme and offering fraud targeted at U.S. residents by one or more murky figures. EDITOR’S NOTE: As the PP Blog

EDITOR’S NOTE: As the PP Blog

BULLETIN: (8th Update 3:34 p.m. ET U.SA.) The SEC has gone to federal court in Minnesota, alleging that an enterprise known as “TeamVinh” that pushed something called “VPAKs” was operating a securities-fraud scheme targeted at MLMers.

BULLETIN: (8th Update 3:34 p.m. ET U.SA.) The SEC has gone to federal court in Minnesota, alleging that an enterprise known as “TeamVinh” that pushed something called “VPAKs” was operating a securities-fraud scheme targeted at MLMers.