EDITOR’S NOTE: A “program” known as Text Cash Network (TCN) that purports to share “advertising” revenue from text messages is spreading virally on the Internet. This column includes information prospective TCN members might want to consider before joining and asking others to join. There are red flags galore. Last week, the PP Blog compiled some research and sought comment from the SEC about the emerging program because the name of Brett Hudson, billed in TCN promos as the firm’s “president,” appears in a 2005 “press release” that quotes Hudson and Richard A. Altomare. The SEC acknowledged receipt of the Blog’s inquiries, but did not comment.

Altomare, of Boca Raton, Fla., was sued in this 2004 SEC action amid allegations of penny-stock fraud coupled with bogus press releases. The case, which involved an Altomare company known as Universal Express Inc., evolved to become an exceptionally ugly one. Altomare ultimately was found in contempt of court for flouting judicial orders and ordered jailed in New York. The court-appointed receiver in the case allegedly received threatening emails from individuals unhappy about the SEC’s action and follow-up events.

Here are quotes from two of the threatening emails, which allegedly were sent by investors. The quotes appear in an exhibit filed in federal court in the Southern District of New York:

1.) ” . . . you are going to be hit with a shit load of lawsuits, and if justice doesn’t prevail the good old American way then I will make it my personal duty to enforce the justice and I along with others will come and beat your ass to a bloody pulp, along with Judge (jackass) Lynch . . .”

2.) . . . you fu[!!!!!] slut . . . don’t get smart . . . you have no idea what could happen to you . . .”

Hudson, who has not been accused of wrongdoing, was not named a defendant in the SEC case. TCN promoters have identified him as president of Universal Cash Express, a company with a name similar to Altomare’s Universal Express Inc. entity. The 2005 “press release” that quotes Hudson and Altomare also identifies Hudson as the president of Universal Cash Express. Altomare’s title was not listed in the 2005 release, but the document was issued under the name of Altomare’s Universal Express entity ensnared in the SEC probe.

Until a few days ago, TCN was prominently featured on the website of OWOW (OneWorld, One Website), a site linked to Data Network Affiliates (DNA) and serial MLM scammer Phil Piccolo. Piccolo is known online as the “one-man Internet crime wave.”

Like Altomare’s Universal Express Inc. entity, DNA was registered as a Nevada company. DNA, like Universal Express Inc., also conducted business from Boca Raton. (See the Better Business Bureau listing for DNA, which purported to be in the business of helping the AMBER Alert program rescue abducted children — while also purporting to be in the cell-phone, mortgage-reduction and “resorts” businesses. Although DNA appears to be defunct, it maintains a website — one that once redirected to the OWOW website. While actively conducting its purported business, DNA made bizarre claims about “going public.” Such claims have been associated with penny-stock scams and securities fraud.)

Joe Reid, a Piccolo business associate who helped DNA flog its mind-numbing mess to the international masses, was one of the speakers on a Nov. 11 TCN conference call. TCN is proceeding out of the gate in largely the same fashion DNA came out of the gate: conference calls featuring Reid, claims of rapid expansion involving tens of thousands of new recruits in days, a launch-countdown timer (now removed), suggestions of incredible earnings potential 10 levels deep, Blog and website posts, YouTube videos.

Here, now, a list of additional red flags and some additional background . . .

RED FLAG: Piccolo has a history of threatening to sue critics and of planting the seed that, if lawsuits do not work, he knows people who can cause critics to experience physical pain. He is known to operate in the area of Boca Raton, although Piccolo also has been known to operate in California.

RED FLAG: DNA promos in 2010 referenced a purported texting and data expert by the name of Anthony Sasso. Sasso, a convicted felon arrested in a 2005 racketeering case in Broward County, Fla., was described in DNA promos as “The King Of Data For Dollars” and was said to be the “owner of the largest database of text numbers in the world.” Although Sasso appears not to have been referenced in the context of TCN, both DNA and TCN purport to be in businesses that involve texting.

RED FLAG: Early affiliates of TCN have identified Brett Hudson as the president of Text Cash Network Inc. Records in Wyoming show a company by that name was registered in the state on Nov. 8, 2011 — just days ago. Affiliates also have vaguely described Text Cash Network Inc. as “a new division of a five year old communications company owned 100% by The Johnson Group.” No state of registration was listed in promos that referenced The Johnson Group, and the “communications company” and the “division” under which Text Cash Network Inc. purportedly operates are far from clear.

Wyoming records show a company by the name of The Johnson Group Inc., but it is unclear if it is the same company referenced by TCN affiliates. The Wyoming records of The Johnson Group entity contain this notation: “Standing – Tax: Delinquent.” The firm appears to have used a residential dwelling in New Jersey as the address of its corporate headquarters.

RED FLAG: TCN’s website design and “prelaunch” approach are similar in a number of key ways to the tactics employed by DNA, which planted the seed last year that it could help the AMBER Alert program rescue abducted children by paying DNA members to record the license-plate numbers of automobiles for entry in a purported database. (Some of these commonalities are referenced lower in this story.)

Until four days ago, a promo for TCN appeared on the website of OWOW, a site linked to Piccolo. (Referenced in Editor’s Note above.) The TCN promo then vanished mysteriously, possibly because Ponzi forum posters were questioning whether Piccolo was involved with TCN. The OWOW website previously was linked to the DNA scam, and also was linked to purported cancer cures.

DNA — as is a Piccolo signature — sold the purported tax benefits of joining the DNA “program,” which traded on the names of Oprah Winfrey and Donald Trump and also purported to offer a “free” cell phone with “unlimited” talk and text for $10 a month. The purported cell-phone “program” used the intellectual property of Apple Inc., claiming that DNA had a “branding” relationship with the company led by the late Steve Jobs. No DNA cell phone appears to have emerged in the marketplace. No branding deal with Apple appears to have existed.

RED FLAG: On its pitch page, TCN currently is publishing the logos of Groupon, Google Offers and Bing Shopping, among others. Last year — in addition to using the intellectual property of Apple and the images of Winfrey and Trump — DNA used email pitches to compare itself to “FACEBOOK, GOOGLE & WALMART…” It is common for hucksters to tie an upstart business to an established business as a means of creating the appearance of legitimacy. Brand leeching is common in the worlds of MLM scams and securities swindles.

RED FLAG: Joe Reid, the Piccolo business associate, has led the conference-call hype for TCN and has suggested TCN is the next Groupon, which recently conducted an IPO. Reid also led the conference-call cheerleading last year for DNA, which purported to be “going public” while making a bizarre reference to Martha Stewart. DNA appears never to have gone “public.” Some members said the firm never paid them, but continued to charge them — and at least one website is claiming that Piccolo (aka “Mr. P.”) stiffed it on orders for bottled water in the OWOW program.

Things got so strange at DNA that the firm asked members to imagine that an earlier “launch” (March 2010) had not occurred and to reimagine a relaunch that occurred last summer (July 2010) as the only time the company had launched.

DNA members were told it was the “MORAL OBLIGATION” of churches to pitch the firm’s purported “program.” Some DNA promos accented DNA commissions purportedly paid 10 levels deep. TCN also is accenting a 10-level payment plan.

RED FLAG: In November 2010, the PP Blog published a story about the FBI foiling a Thanksgiving holiday bombing plot at a Christmas tree lighting ceremony in Portland, Ore. The Blog’s report was wholly unrelated to DNA or OWOW.

An OWOW/DNA/Piccolo apologist who identified himself to the PP Blog as “John” took great exception to the Blog’s report on the Portland plot, despite the fact the Blog’s report did not reference OWOW, DNA or Piccolo in any way.

RED FLAG: Like DNA, TCN also is being promoted on Ponzi scheme forums such as MoneyMakerGroup.

When things went south at DNA last year, the DNA site began to redirect to the OWOW site, which was hawking products linked to Piccolo, including a purported “magnetic” product that prevented leg amputations while also helping garden vegetables grow to twice their normal size.. The DNA site then mysteriously stopped redirecting to the OWOW site — on a date uncertain, but after Piccolo started promoting OWOW products as cancer cures or treatments. At least one OWOW affiliate was trading on the name of the National Institutes of Health.

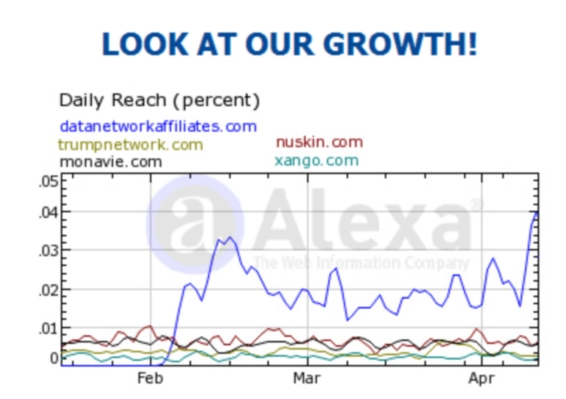

RED FLAG: Both the TCN site and the DNA site are using Alexa charts that provide viewers the same sort of fundamentally meaningless comparisons — while the sites accent the word “free.”

RED FLAG: Like the DNA site, there is no obvious way on the TCN site for prospects to contact Support.

RED FLAG: Like the DNA site, the TCN site is using Google Translate. The use of the Google service — along with other commonalities on both sites — leads to questions about whether TCN and DNA are using the same designer.