BULLETIN: (3rd Update 8:32 a.m. ET, Feb. 20 U.S.A.) The Tata Group, a global conglomerate based in India, says its name has been stolen by an HYIP Ponzi scheme. The fraud scheme is associated with a domain styled TataAgro.com and has a presence on the MoneyMakerGroup, TalkGold and DreamTeamMoney Ponzi forums, according to search results.

Like the recently exposed WCM777 fraud scheme, the TataAgro scam claims a business presence in the British Virgin Islands. WCM777 also traded on the names of famous companies, including Siemens, the German conglomerate. Siemens issued statements warning the public about WCM777. Tata now has done the same thing with the purported TataAgro entity.

The TataAgro website “claims that ‘Tata Agro Holding is a subsidiary of the globally known Tata group, [and is] one of the top 10 agro investment players in Asia’s financial market,’” the real Tata says. “It goes on to offer a wide range of investment plans with a monthly profitability of up to 100%.

“Members of the public are hereby cautioned that the information provided on the website is absolutely false, misleading and intended to defraud innocent and unwary members of the public,” the real Tata says. “Neither Tata Sons nor any other Tata company has any connection whatsoever with the aforesaid Tata Agro Holding. Tata Sons is initiating appropriate action in the matter.”

PonziTracker.com was among the first outlets to report the news of the Tata warning.

The TataAgro site appears not to be loading.

It is somewhat common for fraud schemes to try to steal the identities of major figures on the world financial stage. CONSOB, the Italian securities regulator, regularly publishes information on purported “opportunities” that adopt the names of legitimate firms to create confusion and fleece the masses.

A post dated Dec. 3, 2013, at the MoneyMakerGroup Ponzi forum claims the purported TataAgro entity pays “1.9-3.1% daily for 15-90 days” and accepts Perfect Money, BitCoin, EgoPay and Qiwi.

Meanwhile, a post dated Dec. 17 at the DreamTeamMoney Ponzi forum makes this claim (italics added):

Tata Agro is an agricultural investment company founded in 2012 in British Virgin Islands. We are a subsidiary of transcontinental conglomerate Tata Group that has been established in India back in 1868 and now boasts the combined market capitalization of $96 bln.

We have retained only the best things from a rich and long experience of our ancestor: the unique corporate culture, client-oriented and customized approach, and understanding of the market through retrospective analysis. Our fundamental aim is to help you grow your capital.

We work with assets like barley, soya, soya oil and meat, corn, wheat, and livestock and currently operate in CME Group, TOCOM, and MGEX exchange houses.

We are eager to offer you four investment plans with the daily ROI of 1.9% to 3.1% and investment term of 15 to 120 days. You can invest from 5 to 10,000 USD. Apart from that, we offer you a profitable referral program that lets you earn more and work side by side with your family and friends.

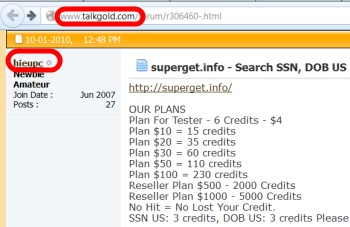

A post dated Dec. 17 at the TalkGold Ponzi forum makes these claims (italics added):

- Invest 5 to 100$ for 15 days and earn 1.9% ROI daily;

- Invest 100 to 1000$ for 30 days and earn 2.3% ROI daily;

- Invest 1000 to 5000$ for 60 days and earn 2.5% ROI daily;

- Invest 5000 to 10,000$ for 120 days and earn 3.1% ROI daily.

Collapsed fraud schemes such as Zeek Rewards, AdSurfDaily, Legisi, Pathway to Prosperity, Profitable Sunrise, Imperia Invest IBC and many more also had a presence on the Ponzi boards.

The TelexFree “program” currently has a presence on the Ponzi boards.