BULLETIN: (2ND UPDATE 8:47 P.M. ET U.S.A.) The court-appointed receiver in the Zeek Rewards Ponzi-scheme case says he has located $12 million in receivership assets held in an unspecified “eastern European country” — but the funds have not been returned.

BULLETIN: (2ND UPDATE 8:47 P.M. ET U.S.A.) The court-appointed receiver in the Zeek Rewards Ponzi-scheme case says he has located $12 million in receivership assets held in an unspecified “eastern European country” — but the funds have not been returned.

“This account is owned and was used by a payment processor outside the United States to provide funds to a foreign e-wallet that processed payments for ZeekRewards,” receiver Kenneth D. Bell said in court filings. “The Receiver previously caused the Freeze Order to be sent to the foreign financial institution which holds this account and demanded that the funds held in that account be turned over to the Receivership Estate. The foreign payment processor who owns this account was also sent the Freeze Order and a demand notice for the turnover of the funds in this account. However, neither the financial institution nor the foreign payment processor responded to the demands sent by the Receiver. Additionally, the Receiver has worked with the foreign e-wallet to seek to have these funds returned. While cooperative, the foreign e-wallet was unable to cause their customer to provide the funds held in this account to the Receiver.”

Bell also confirmed today that the U.S. Secret Service “continues to pursue” money related to Zeek. Meanwhile, he announced a “Final Liquidation Plan” and proposed claims process will be filed tomorrow in U.S. District Court for the Western District of North Carolina. Zeek was based in Lexington, N.C. Senior U.S. District Judge Graham C. Mullen is presiding over the Zeek case.

Massive Paper Chase Under Way

In August 2012, the SEC described Zeek as a $600 million Ponzi- and pyramid scheme. What has transpired since then speaks to the enormous logistical challenges law enforcement and court-appointed receivers may confront when a fraud scheme goes viral on the Internet and spreads globally.

Bell noted today that the receivership has communicated to “over 7,000 financial institutions” on the subject of cashier’s checks sent to Zeek by affiliates. Some affiliates also sought to fund their accounts with “certified checks, personal checks, bank money orders, and personal money orders.”

One of the earliest problems with marshaling assets was the sheer volume of instruments sent to Zeek, according to Bell’s filing.

“As of December 31, 2012, the Receiver presented over 140,000 financial instruments for deposit,” Bell said. “Many of these items were returned and not paid for various reasons. The Receiver Team is working with financial institutions to re-present instruments that were returned in error, and it is working to identify all instruments that were improperly returned.”

One Zeek vendor alone was in possession of 85,000 cashier’s checks and other instruments, Bell said.

“After reviewing these instruments, reviewing the records of the Receivership Defendant, communicating with [Zeek vendor Preferred Merchant Services] and working with a forensic accounting vendor, the Receiver Team was unable to definitively ascertain which instruments had already been processed and presented for payment by PM,” Bell said. “In order to maximize recovery to the Receivership Estate, the Receiver Team elected to present all of these instruments for payment. Approximately 34,000 of these instruments worth approximately $15 million were accepted and paid. Approximately 50,000 of these PM instruments were returned, which resulted in returned check fees of approximately $450,000.”

Bell negotiated to reduce the return charges by 25 percent, he said.

Beyond that, Bell said, “[t]he Receiver has been receiving numerous communications from financial institutions and Affiliate-Investors regarding cashier’s checks that have never been presented for payment,” adding that he is “unaware of any additional locations where cashier’s checks payable to the Receivership Defendant might be stored.”

The receiver “determined that he does not have rights under the Uniform Commercial Code or the Receiver Orders to claim an interest in cashier’s checks that were never received by the Receiver or the Receivership Defendant,” Bell said. “Therefore, the Receiver has taken the position that although any cashier’s check that is subsequently received by the Receiver is a Receivership Asset and will be deposited, financial institutions should consider any cashier’s check that has not been presented by the Receiver or the Receivership Defendant as having been lost, and may refund the remitters of such cashier’s checks without fear of liability to the Receiver.”

Crunching Numbers

Zeek’s database included 1.6 billion records, which are now being analyzed, Bell said.

“This analysis has taken longer than initially anticipated due to several issues: problematic transactions with questionable accuracy, the validity of database records, and the lack of available documentation (including look-up tables, database dictionaries, and source code documentation which are commonly used to understand the organization and function of a database’s components). In the absence of these tools, [receivership team member FTI Consulting Inc.] has been required to perform extensive testing of the data to validate the proposed calculations and to rely on disparate third-party sources, including Paul Burks, e-wallet vendors, financial institutions, and subpoena responses, for understanding the organization and function of the database components.”

Compounding matters, according to today’s filing, was the sheer number of Zeek participants, including participants who had multiple usernames.

“There are approximately 2.2 million unique users (“Affiliates” or “usernames”) in ZeekRewards,” Bell said. “The number of Affiliates does not reflect the number of unique individuals who participated in ZeekRewards, as it is likely that some individuals had more than one username. Approximately 1 million Affiliates paid money into the ZeekRewards Program . . .”

And, Bell noted today, “[a]t this time, the Receiver has identified over 800,000 net-loser usernames in the Receiver Defendant’s records.”

Taxing Matters

The section below is verbatim from the receiver’s filing today (italics added):

During the fourth quarter, the Receiver Team worked to determine which federal tax filings needed to be made with respect to income taxes, payments made to service providers, and payments made to Affiliate-Investors. The efforts were focused on the latter two issues because of the earlier filing deadline (January 31, 2013). The Receiver Team, including FTI, had discussions with RVG’s outside tax and accounting advisors to ascertain what had been filed for 2011 and earlier. After analyzing the issues, consulting with these various entities, and reviewing [Zeek operator Rex Venture Group LLC] ’s records, the Receiver Team determined that it would be necessary to file and issue 1099s to certain Affiliate-Investors and began the process of compiling the data necessary to issue the 1099s.

Since the receivership began in August, Bell said, it has been determined that “some individuals who RVG classified as ‘independent contractors,’ to whom it had issued 1099s, were misclassified pursuant to IRS regulations.

“Accordingly,” he continued, “the Receiver Team has reclassified them as employees and is issuing them W-2s. The Receiver Team will begin the process of identifying, misclassified employees, paying back taxes, and determining whether the Receivership Estate should pay any back wages owed to such employee as a result of RVG’s misclassification.”

Pursuing International ‘Winners’

Offshore members of Zeek expecting a free pass from the receivership may have to think again if they are classified as “winners.”

“The group of net-winners identified to date includes numerous individuals residing outside of the United States, with the largest foreign winners living mainly in countries with established legal systems which are signatories to the Hague Convention for international service of process,” Bell said. “While the pursuit of ‘clawback’ claims against these foreign net winners raises various service issues and other challenges, the Receiver intends to include these winners as parties to domestic litigation based on their contacts with the ZeekRewards Program in the United States so long as doing so will not delay the litigation against domestic winners. The Receiver will also pursue cost-effective foreign litigation to establish the repayment obligation and/or to collect judgments where necessary and appropriate.”

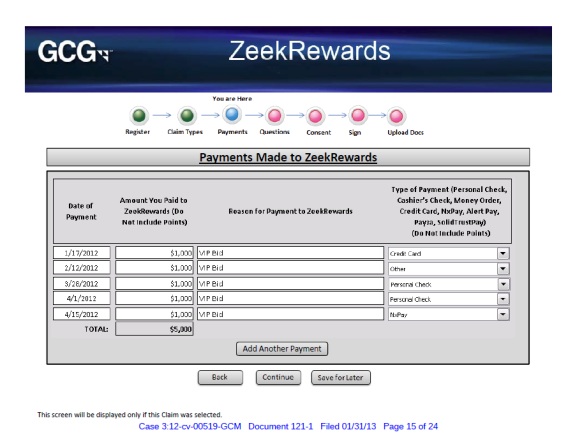

Claims Process

Bell said he will file with the court tomorrow “the proposed claims process” as part of a “Final Liquidation Plan.”

From Bell’s filing today (italics added):

The Receiver anticipates filing a motion seeking approval of the Claims Submission Process by the conclusion of the first quarter of 2013. The Claims Motion will seek (i) approval of the claims submission process, (ii) to establish the date by which claims must be filed against the Receivership Defendant (the “Bar Date”), and (iii) approval of the noticing procedures to be used in providing notice of the Bar Date and the claims submission process.

The website of “NewGNI” has not resolved to a server for days. The “program” is believed to have been a knockoff of a predecessor scam known as “GNI” or GoldNuggetInvest, which collapsed in early 2010 after being promoted by members of the AdSurfDaily Ponzi scheme.

The website of “NewGNI” has not resolved to a server for days. The “program” is believed to have been a knockoff of a predecessor scam known as “GNI” or GoldNuggetInvest, which collapsed in early 2010 after being promoted by members of the AdSurfDaily Ponzi scheme.