EDITOR’S NOTE: This post was updated at 2:48 p.m. on Dec. 20 to include this link to a recording of the receiver’s Dec. 17 call. The information below reflects the PP Blog’s original notes from the call on Dec. 17 . . .

UPDATED 7:27 A.M. (DEC 18, U.S.A.) A conference call by Kenneth D. Bell, the court-appointed receiver in the Zeek Rewards Ponzi scheme case, is under way. (Call ended at 6:03 p.m., as noted below.) The call began at 5 p.m. ET (U.S.A).

UPDATE 5:15 p.m. Bell, formerly a federal prosecutor, has said he knows what a Ponzi scheme is — and “this was one.” Somewhere between $500 million and $600 million was lost. The receivership estate has recovered about half of that. “We’re roughly half-way home, but that’s a huge gap,” Bell said.

UPDATE 5:18 p.m. A claims form for victims should be ready by the end of January, Bell said. It’s doubtful that victims can be made 100 percent whole.

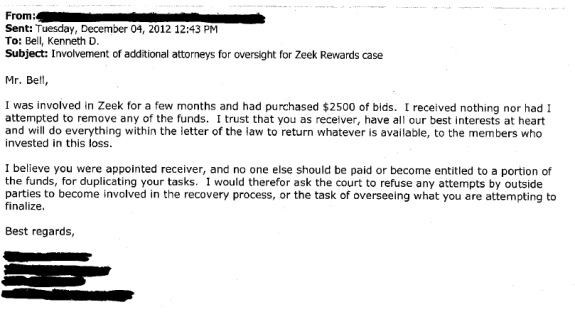

UPDATE 5:21 p.m. There are some sad, Zeek-related stories of loss out there. Bell said he had emails from people who’d lost anywhere from $49 to $10,000.

Some folks are worried they can’t establish their loss because they sent money to their sponsor, not Zeek parent Rex Venture Group, Bell said. A means of addressing such claims is being established.

UPDATE 5:25 p.m. Bell said some people have questioned whether he is dragging out the receivership to drive up legal fees. He asked listeners to trust him, and he denied foot-dragging. His “goal is to be the most cost-effective receivership in history,” Bell said.

UPDATE 5:33 p.m. Bell said he did not know if other people will be charged by authorities in connection with Zeek. (Zeek/Rex operator Paul R. Burks is the only person charged to date — civilly by the SEC.)

He added that he’ll be prepared to prove Zeek was a Ponzi scheme as he pursues winners in clawback litigation. A motion by Zeek winners to appoint attorney Michael Quilling examiner was “absurd,” he said. He did not reference Quilling by name.

UPDATED 5:38 p.m. Bell also will oppose a motion by attorney Ira Lee Sorkin to dissolve the receivership. He did not mention Sorkin’s name. (Sorkin was Bernard Madoff’s defense attorney.)

UPDATED 5:41 pm. Bell is contemplating an interim distribution to victims. More study needs to be done, but “I don’t see any reason to sit on $300 million,” he said. No timetable has been established for an interim distribution.

UPDATED 5:44 p.m. Zeek’s database “is a real mess,” Bell said. He is studying a means by which victims could gain access to their back offices to gain access to information, but such a capability could be cost-prohibitive.

UPDATED 5:48 p.m. Some Zeek members have poor records, but others have good records that are helping fill in gaps in Zeek’s database. “We will try to help you establish your claim,” Bell said. The more records members can submit, the better.

UPDATED 5:50 p.m. The plan is to treat all Zeek members equally. Distributions likely will occur all at once. No one has received money from the receivership to date.

UPDATED 5:52 p.m. In the early days of the receivership, Bell said he received “tens of thousands” of emails.

UPDATED 5:54 p.m. Bell will sell real estate and furnishings owned by Zeek, he said.

UPDATED 5:58 p.m. There are “eight to 10” core members of the Zeek receivership team. At the moment, some of the lawyers are arguing with lawyers on the other side of the issues, Bell said.

UPDATED 6 p.m. Bell said if Paul Burks still has Zeek receivership property, he’ll be treated as a winner. The case was not over simply because Burks paid a $4 million fine to the SEC, he said. It was not up to the receivership to determine if Burks would be charged criminally, Bell said.

UPDATED 6:03 p.m. Call ended. Bell thanked those supporting his efforts and said he understood why some people would not.

MISC NOTES AT 6:05 p.m. What happens to possible Zeek “ringleaders” is the responsibility of law enforcement, Bell said during the call.

The current math, he said, looks something like this: 840,000 losers and 77,000 winners. “A lot” of people had more than one Zeek username, Bell said. Every dollar the receivership estate spends on court battles is a dollar that won’t go to victims, Bell said. Prudent choices have to be made when deciding how to fund the receivership estate in a cost-effective manner to maximize the distributions to victims, Bell said. There were “boxes and boxes” of cashier’s checks at Rex headquarters, Bell said.

Those cashier’s checks were receivership property under the law, Bell said.