URGENT >> BULLETIN >> MOVING: (3RD UPDATE 6:11 P.M. EDT U.S.A.) On virtually the eve of the criminal trial of Paul Burks, receiver Kenneth D. Bell has asked the court presiding over a huge class-action lawsuit against 9,400 alleged Zeek “winners” for a finding the MLM program was a Ponzi scheme.

Such a finding would mandate winners to return nearly $300 million. Bell contended that “[o]f the over $900 million that was paid in to Zeek, only approximately $10 million (1.1%) came from actual retail purchases.”

Retail sales are crucial to the determination of whether an MLM program is legitimate. Bell contends Zeek, which offered a penny auction, was both a Ponzi scheme and a pyramid scheme. Zeek affiliates allegedly believed enormously profitable auctions made Zeek sustainable.

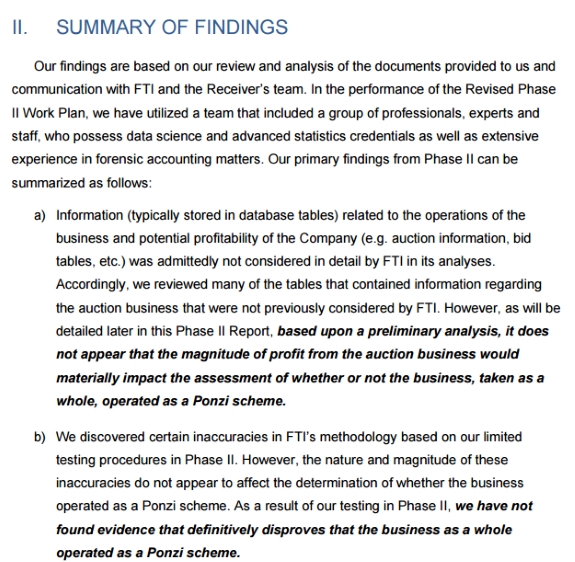

“Two of the primary creators and operators of the ZeekRewards scheme have already admitted it was a Ponzi scheme and pleaded guilty to criminal conduct in connection with the scheme,” Bell argued to Senior U.S. District Judge Graham C. Mullen in a June 30 motion. “In sum, the evidence that ZeekRewards was a Ponzi scheme is overwhelming. Even the Defendant class’ expert has acknowledged finding no evidence that ‘disproves that the business as a whole operated as a Ponzi scheme.’

“Because Zeek’s net winners ‘won’ (the victims’) money in an unlawful Ponzi scheme, under long settled law those winners are not permitted to keep their winnings and must return the fraudulently transferred funds back to the Receiver for distribution to Zeek’s victims,” Bell argued.

At stake in the civil clawback case is more than $282 million allegedly paid to winners by Zeek. Berkeley Research Group is the expert for the defense. Bell used FTI Consulting Inc. as his expert.

Burks’ criminal trial is scheduled to begin Tuesday (July 5).

What kind of financial environment did Zeek create?

According to FTI, only about 8 percent (75,000 usernames) were winners, while 90 percent (841,000 usernames) were losers. Meanwhile, only 0.3 percent (2,778 usernames) were net neutral, with only 1.6 percent (14,500 usernames) classified as auction bidders only.

Bell sued 9,400 alleged winners who’d received more than $1,000 each. FTI asserted that the net losers lost more than $822 million and the net winners hauled away more than $282 million. The small number of auction bidders suggests that Zeekers by and large joined for the purported money-making venture.

But Zeek, Bell alleged, was insolvent even while paying out large sums of money.

Cocaine Allegation Made By Alleged Insider

During a deposition conducted in April 2016 by an attorney for the receivership, alleged Zeek insider Darryle Douglas made a claim that former Zeek COO Dawn Wright-Olivares was a user of “crack cocaine” who was “asked to leave” Free Store Club, a Zeek predecessor, according to a partial transcript included in Bell’s June 30 motion.

Wright-Olivares also is an alleged Zeek insider and one of two Zeek figures to plead guilty to Ponzi-related criminal charges. (The other is Daniel Olivares, her stepson.) Wright-Olivares and Olivares both are expected to testify against Burks at his criminal trial.

Whether Burks intended to use the cocaine allegation against Wright-Olivares to impeach her credibility as a witness was not immediately clear. But Wright-Olivares and Olivares both lived with Douglas at one time in Lexington, N.C., according to the transcript.

Zeek, as part of Rex Venture Group, was based in Lexington.

While living in Lexington, a “separation” developed between Douglas and Wright-Olivares and a once-strong business relationship between Douglas and Burks became “fractured,” according to the transcript.

“And that’s where our separation began,” Douglas said, according to the transcript. “Dawn was a crack cocaine user . . . Dawn used cocaine and was asked to leave the company eventually . . . This was FreeStore Club. She left but came back with the idea for a penny auction, which no one had ever heard of. Because we had a fractured relationship, we created MyBidShack, they created Zeekler. Eventually Paul decided to get rid of MyBidShack and that the company would only go under Zeekler, which made our rift expand. It set up a war that we — that’s when I was no longer allowed to have access codes or key information from accessing the system . . .”

The receiver’s motion, memo and exhibits are available at the receivership website.

Also see “ANNOUNCEMENT FROM THE RECEIVER – July, 1, 2016” at the receivership site.