URGENT >> BULLETIN >> MOVING: (14th update 3:19 p.m. ET U.S.A.) The U.S. Securities and Exchange Commission has gone to federal court in Massachusetts, alleging the “Wings Network” MLM “program” is a Ponzi and pyramid scheme that gathered at least $23.5 million.

URGENT >> BULLETIN >> MOVING: (14th update 3:19 p.m. ET U.S.A.) The U.S. Securities and Exchange Commission has gone to federal court in Massachusetts, alleging the “Wings Network” MLM “program” is a Ponzi and pyramid scheme that gathered at least $23.5 million.

Wings Network purported to offer “digital and mobile solutions to customers, including apps and cloud storage.”

“However, Wings Network’s revenues actually came solely from selling memberships to investors, not from the sale of any products,” the SEC said.

Company operators and at least 12 promoters have been charged, the SEC said. A federal judge has ordered an asset freeze. Some of the SEC employees involved in the prosecution of the Wings Network action also are involved in the TelexFree Ponzi- and pyramid case filed last year in Massachusetts federal court.

“Although Wings Network purported to use a multi-level distribution network to sell products and services, it had little or no revenue from the sale of those products or services,” the SEC charged. “Instead, to the extent that it and its members obtained revenue, that revenue was derived from the recruitment of new members. In fact, its own procedures made it clear that members were not required to sell products to receive promised profits – simply recruiting other members to purchase membership packs was enough.”

The SEC also charged that Wings Network last year falsely implied that it had a “relationship” with the Direct Selling Association, a trade association for MLM firms. But when the DSA “compliance monitoring team became aware that Wings Network was claiming membership, the DSA sent Wings Network a cease and desist letter to stop representing that DSA had any connection with Wings Network.”

Charged Wings Network entities include Tropikgadget Unipessoal LDA and Tropikgadget FZE. The LDA entity was incorporated in the Madeira Free Trade Zone in November 2013 with its principal place of business in Lisbon, Portugal, the SEC said.

“It withdrew its license from the Madeira Free Trade Zone in April 2014,” the SEC said.

The FZE entity “incorporated in the United Arab Emirates in November 2013 with its principal place of business in Lisbon, Portugal,” the SEC said. “Tropikgadget FZE holds the rights to Wings Network marketing and brand services, which includes but is not limited to, the names Wings Network, Wingsnetwork, and WingsNetwork.Com.”

Charged executives and/or operators include Sergio Henrique Tanaka, 40, of Sao Paulo, Brazil, and Davie, Fla.; Carlos Luis da Silveira Barbosa of Lisbon, Portugal; and Claudio de Oliveira Pereira Campos, also of Lisbon. No ages were given for Barbosa and Campos.

Meanwhile, the charged promoters include Yinicius Romulo Aguiar, 42, of Marlborough, Mass.; Thais Aguiar, 34, the wife of Yinicius and also of Marlborough; Andrew Elliot Arrambide, 47, of Sandy, Utah; Julio G. Cruz, 34, of Duluth, Ga.; Wesley Brandao Rodrigues, 28, of Marlborough; Dennis Arthur Somaio, 35, of Marlborough; Elaine Amaral Somaio, 35, of Marlborough; Pablo Andres Garcia, 38, of Waco, Texas; Viviane Amaral Rodrigues, 37, of Clinton, Mass.; Simonia De Cassia Silva, 43, who sometimes operated from Massachusetts and Florida; Geovani Nascimento Bento, 41, of Marlborough; and Priscila Bento, 36, of Marlborough.

Named relief defendants as the alleged recipients of ill-gotten gains from the scam were Uninvest Financial Services Corp. of Deerfield Beach, Fla.; Compasswinner LDA of Setubal, Portugal; and Happy SGPS SA of Santa Cruz, Madeira, Portugal.

“After establishing a network of lead promoters, recruitment of new members surged through the use of social media such as Facebook and YouTube,” the SEC said. “The promoters used Facebook to publicize ‘business meetings’ that took place at hotels and other locations in Connecticut, California, Florida, Massachusetts, Pennsylvania, Texas, Georgia, and Utah. The promoters also set up storefronts or ‘training centers’ to lure investors into attending Wings Network presentations. For example, one promoter used a storefront in downtown Philadelphia to make presentations to prospective investors, and another promoter rented office space in Pompano Beach, Fla., and spread the word in the local Latino community to attract prospective investors to come in and hear presentations.”

The scheme raised at least $23.5 million and targeted “many members of the Brazilian and Dominican immigrant communities in Massachusetts,” the SEC said.

Massachusetts Commonwealth Secretary William Galvin, head of the Massachusetts Securities Division, charged Wings Network and some individuals last year. Both Galvin and the SEC have squared off against TelexFree, a massive scheme targeting immigrant communities.

In a statment today, the SEC thanked MSD and Comissão do Mercado de Valores Mobiliários of Portugal and the Procuradoria-Geral da República of Portugal.

Here are the alleged hauls or alleged qualifying criteria in the pay plan for some of the charged promoters, according to the SEC:

- Yinicius Romulo Aguiar, “at least $1 ,302,880.”

- Andrew Elliot Arrambide allegedly reached the “Director” rank, “indicating that he had accumulated at least $6 million from investors.”

- Julio G. Cruz also achieved the Director rank, “indicating that he had accumulated at least $6 million from investors.”

- Wesley Brandao Rodrigues allegedly achieved the “Senior Manager rank, “indicating that he had accumulated at least $1.5 million from investors. According to Tropikgadget records, Wesley Rodrigues generated commissions of $791,745 from the sale of Wings Network membership packages.”

- Elaine Amaral Somaio. “According to Tropikgadget records, Elaine Somaio generated commissions of $557,240 from the sale of Wings Network membership packs.”

- Pablo Andres Garcia. “According to Tropikgadget records, Garcia generated commissions of

$550,135 from the sale of Wings Network membership packs.” - Viviane Amaral Rodrigues. Allegedly reached the Director rank, “indicating that she had accumulated at least $6 million from investors. According to Tropikgadget records, Viviane Rodrigues generated commissions of at least $434,150 from the sale of Wings Network membership packs.”

- Simonia De Cassia Silva. “According to Tropikgadget records, Silva generated commissions of $419,900

from the sale of Wings Network membership packs. She temporarily moved and used an office space in Pompano Beach, Florida where she and Vinicius Aguiar promoted Wings Network locally.” - Geovani Nascimento Bento. “According to Tropikgadget records, Geovani Bento generated commissions of $163,845 from the sale of Wings Network membership packs.”

False Claims Of Insurance Coverage

Perhaps mirroring a TelexFree trick in Brazil, Wings Network hucksters also are accused of duping members into believing their payments were insured. From the SEC complaint (italics/carriage returns added):

Campos, Viviane Rodrigues, Vinicius Aguiar, and other promoters represented to prospective investors that their initial investments in the Member Packs would be 100% guaranteed through insurance issued by Porto Seguro, the fourth-largest insurance company in Brazil.

In making these claims, Campos, Viviane Rodrigues and Vinicius Aguiar pointed to the existence of Porto Seguro S.A. insurance associated with the Wings Card, a debit card issued to Wings Network members for payment processing.

In a You Tube video that solicited investors to purchase Wings Network memberships, Campos guaranteed that everything purchased by the investors would be insured for a year by Porto Seguro. In their presentations to investors, Rodrigues and Aguiar emphasized that the investments were guaranteed while juxtaposing the Porto Seguro logo. Viviane Rodrigues and Vinicius Aguiar also included a slide purportedly of a Porto Seguro insurance policy.

False claims of insurance coverage are somewhat common in the fraud sphere and may be occurring now in an emerging “program” known as “MooreFund.”

Read the SEC statement on Wings Network and the complaint.

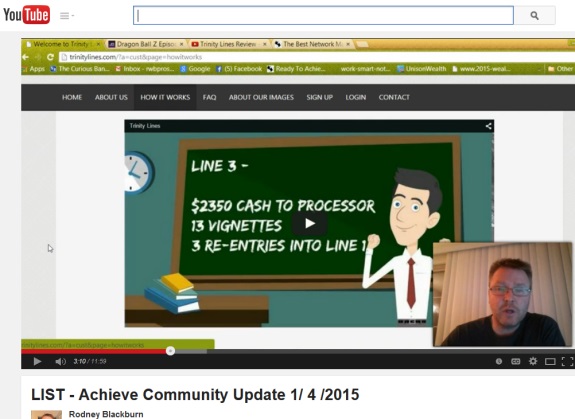

On Feb. 12, the SEC charged a “program” known as the “Achieve Community” with operating a combined pyramid- and Ponzi scheme. Some Achieve promoters appear now to be promoting MooreFund.