EDITOR’S NOTE: This story originally was published Dec. 22, 2011, 10:41 a.m. It was updated at 8:11 a.m. on Dec. 23, 2011. The PP Blog temporarily “unpublished” the story on March 23, 2012. Explanation of why it was taken offline temporarily is here. On March 23, 2012, the PP Blog’s security software recorded a “mass injection attack” as the Blog visited a domain styled CollotGuerard.com while researching matters pertaining to Jeremy Johnson. Collot Guerard is an attorney for the FTC and an alleged subject of harassment by Johnson or people close to Johnson because of the FTC actions against Johnson. The PPBlog is not revisiting the CollotGuerard.com domain and believes it is imprudent for readers to visit the domain.

Our Dec, 22, 2011, story is republished below. The republication date is Jan. 15, 2013 . . .

UPDATED 8:11 A.M. ET (DEC. 23, U.S.A.) Robb Evans, the court-appointed receiver in the Jeremy Johnson/IWorks Internet Marketing fraud case filed by the FTC a year ago, first came to national prominence as a liquidator in the Bank of Credit and Commerce International case in the 1990s. If the bank’s name alone doesn’t spark your memory, think of the acronym by which it was known: BCCI.

If you’re, say, over 40, images of BCCI and the spectacle it created perhaps are seared in your memory. The bank’s criminality and 1991 collapse created a scandal royale on both sides of the Atlantic and all over the world, including the Middle East. BCCI, the Wall Street Journal (Europe) wrote on Aug. 3, 2001 — a little more than a month before the 9/11 terrorist attacks — was a “renegade bank” that had relied on secrecy and had been designed to be “offshore everywhere” to evade regulatory scrutiny. The stunning collapse amid allegations of international money-laundering and a disguised takeover of U.S. banks initially put customers on the hook for $9 billion in losses.

BCCI, which allegedly conducted business with the terrorist Abu Nidal (died 2002) and the now-dead or imprisoned dictators of Iraq and Panama (Saddam Hussein [died 2006] and Manuel Noriega) — and also could not say no to the Medellin Cartel and Colombian narcotics traffickers — went on to become perhaps the most infamous acronym in the history of banking. Evans has testified before Congress on the subject of offshore banking, corruption and the war on terrorism. His bona fides and expertise in unraveling the affairs of companies implicated in complex fraud schemes are firmly established in the courts.

U.S. District Judge Joyce Hens Green of the District of Columbia once described Evans’ efforts as “remarkable.” In 1998, noting that she had presided over elements of the multibillion-dollar BCCI case for eight years and calling it the “longest-running forfeiture proceeding in the history of federal racketeering law,” the judge thanked Evans and others publicly for helping preserve $1.2 billion in U.S. assets for distribution to defrauded BCCI customers.

Evans is the namesake of Robb Evans & Associates LLC. What does the company do?

“What we do in my organization is we trace money, and we try and recover it for the victims of fraud, and we do it mostly on behalf of the United States Government,” Evans told the House Subcommittee on Oversight and Investigations in 2006.

Despite his bona fides — despite his record as a court-appointed receiver in numerous cases and his testimony before the U.S. Congress on critical matters of U.S. and international financial security — someone with a Google AdWords account and perhaps some knowledge about SEO planted the seed earlier this month that Evans was presiding over a fraudulent company, according to new federal court filings in the Johnson/IWorks case.

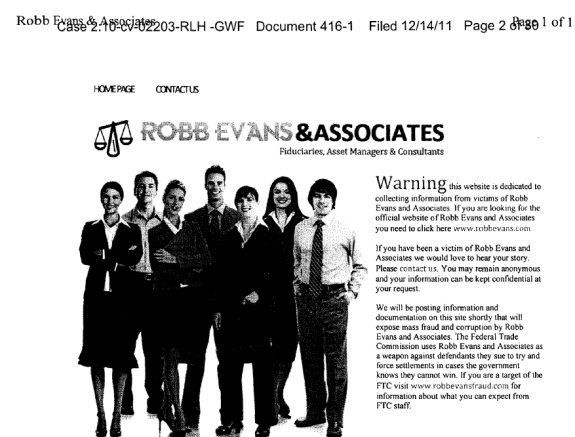

For a yet-to-be-determined period of time, the names of Evans and his company were pushed down in Google search results and replaced at the top of the rankings by a domain styled RobbEvansFraud.com — with a paid AdWords ad to the right of the No. 1 search result driving traffic to the faux Evans site, according to an evidence exhibit filed in federal court on Dec. 14.

The faux site planted the seed that Robb Evans & Associates consisted of “Thieves,” “Lairs” (sic) and “Crooks,” according to to an emergency motion filed by an attorney for Evans.

“Warning,” the first sentence on the faux site blared, “this website is dedicated to collecting information from victims of Robb Evans and Associates.”

In June, Johnson, 35, was arrested at the Phoenix airport at which federal agents allegedly found him in possession of $26,400 in cash and a one-way ticket to Costa Rica. He asserts his innocence to both the criminal and civil charges brought in the case. Johnson now is free on bond.

Stop The Madness

The FTC moved against Johnson, IWorks and other companies in December 2010, alleging an Internet-fueled fraud involving hundreds of millions of dollars. Evans was appointed receiver by a federal judge in Nevada, the venue from which the action was brought. The agency alleged that at least 51 shell companies were set up to dupe banks and to carry out the fraud, which resulted in “hundreds of thousands” of chargebacks and threats to consumers who filed chargebacks.

FBI Director Robert Mueller III warned Congress in March 2010 and again a month later about the dangers of shadowy banking practices, noting that that shell companies often play a role in disguising fraudulent proceeds.

“Money laundering allows criminals to infuse illegal money into the stream of commerce, thus manipulating financial institutions to facilitate the concealing of criminal proceeds; this provides the criminals with unwarranted economic power,” Mueller said.

IWorks operated out of an office at 249 E. Tabernacle St. in St. George, Utah. The street intersects with nearby South Main, home of the historic St. George Tabernacle. The Tabernacle opened in 1876. The city of St. George is famous for its geology, its climate and for its historic ties to Brigham Young and The Church of Jesus Christ of Latter-day Saints.

The city, unfortunately, also is becoming increasingly known as the town from which Johnson allegedly carried out a fraud involving hundreds of millions of dollars, in part by manipulating the banking system through dozens of shell companies in Nevada and other states.

In the emergency motion, an attorney for Evans now says that Johnson and perhaps others are seeking to interfere with the courts and the receivership estate by using the Internet to slime Evans, the FTC and Collot Guerard, an attorney for the FTC. The FTC has filed its own emergency motion.

On Feb. 10, 2011, Chief U.S. District Judge Roger L. Hunt of the District of Nevada expressly ordered Johnson and other defendants not to interfere with the receivership, according to a preliminary injunction issued on that date.

Despite Hunt’s order, Johnson sued Evans in Utah state court. On Dec. 7, Hunt ordered the Utah state action brought by Johnson dismissed.

Johnson also asked Hunt to order the FTC to pay the legal fees of corporate defendants. The judge refused.

Of all the troubling developments, perhaps the most troubling is the allegation that Johnson and perhaps others have weaponized the Internet to interfere with the administration of justice. The site that attacks Guerard — a career civil servant — clams she has been “accused of fraud and corruption.” The site was created on Oct. 7, 2011, months after Hunt issued the preliminary injunction and order not to interfere. The site appears to operate from servers in Utah, with the registration hidden behind a proxy.

“[W]e are collecting information related to any wrongdoing on her part,” the site informs visitors.

The attack on Guerard is just the latest in a string of attacks or veiled threats against law enforcement. AdSurfDaily figure Kenneth Wayne Leaming, for example, is jailed near Seattle on federal charges he filed bogus liens against public officials in the ASD Ponzi case, including a federal judge, three federal prosecutors and a special agent of the U.S. Secret Service.

Vincent McCrudden, meanwhile, was arrested and jailed in January 2011 amid allegations he threatened to kill 47 regulators and government officials while using a website and emails to terrorize public servants. Just last week, federal prosecutors in Virginia said that Roger Charles Day Jr., who endangered the U.S. military and others in an offshore scam and was sentenced to 105 years in federal prison, had “filed hundreds of billions of dollars of fraudulent default judgments against more than 100 people who Day claimed had prosecuted him unfairly.”

The Day procurement scheme involved at least 18 companies, prosecutors said. When the scheme was exposed, Day simply “directed his conspirators to discontinue bidding through those companies and instead form and use new companies,” the Justice Department said.

In the new filings by the attorney for Evans in the FTC’s case against Johnson and IWorks, is is alleged that Johnson had a role in the posting of “false and scurrilous” material on the Internet in a bid to hamstring the administration of the receivership estate.

Among other things, one of the websites tied to Johnson “makes false allegations concerning ‘mass fraud and corruption by Robb Evans and Associates,’” according to the attorney’s emergency motion to disable the site.

Gmail addresses using the names of Evans and Guerard were created and were designed to “impersonate and/or interfere” with the receiver and others associated with the case, according to the emergency motion.

Johnson and others created other websites — including EvilFTC, FTCTactics and a site in Guerard’s name — to further undermine the legal process, according to the receiver’s emergency filing. Two other sites in the names of other FTC attorneys also were created, according to the receiver’s emergency motion.

Those sites, according to records, both were created on Dec. 1. Like the site in Guerard’s name, the servers appear to be based in Utah.

When the receiver’s attorney contacted Johnson to demand the site targeted at Evans be taken offline, Johnson claimed he did not own, host or control the site while insisting that “the domain has not been used for anything deceptive.”

“It is a constitutional right to be able to speak freely even if your client does not like it,” Johnson informed the receiver’s attorney in an email, according to an exhibit attached to the receiver’s emergency motion.

Comments

3 responses to “EDITORIAL: The Deeply Disturbing Attack On The Federal Trade Commission, A Public Official And The Court-Appointed Receiver In The Jeremy Johnson/IWorks Fraud Case”

[…] attorney for Evans has filed a similar motion. Hunt is scheduled to hear arguments […]

[…] The issuance of the report by receiver Robb Evans occurred against the backdrop of an ongoing advertising campaign — apparently conducted by a person or persons within Johnson’s camp — that plants the seed that Evans is presiding over a fraudulent company. The ad campaign, which is taking place on Google’s network, initially started on a web domain whose root was formed in part with the receiver’s first and last names, followed by the word “fraud.” (See Dec. 22 editorial.) […]

[…] Johnson long has denied wrongdoing in a case that, at a minimum, has showcased the logistical nightmares government agencies and court-appointed receivers may confront when they tackle an alleged Internet-based fraud scheme with tentacles all over the world, including shell companies allegedly set up to carry out a fraud scheme. (See Jan. 9, 2012, PP Blog editorial. See Dec. 22, 2011, PP Blog editorial.) […]