At the moment, Google News is providing an interesting juxtaposition on the subject of JSS Tripler, the purported arm of the “JustBeenPaid” program that does not identify itself with a nation-state, makes members affirm they are not with the “government” and advertises an absurd monthly return of 60 percent.

Frederick Mann, the “opportunity’s” purported operator, was identified in 2008 promos as a pitchman for AdSurfDaily. The U.S. Secret Service called ASD an online Ponzi scheme that had gathered at least $110 million and defrauded thousands of people. JSS Tripler/JustBeenPaid advertises a daily payout rate twice that of ASD.

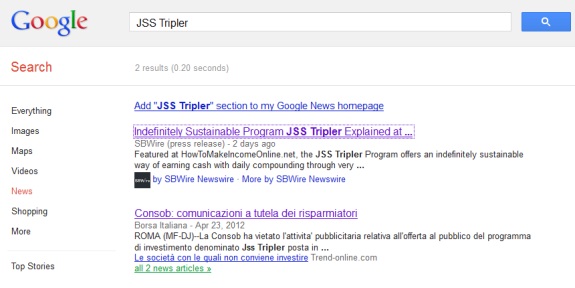

As the screen shot above shows, Google News today is publishing information on JSS Tripler from three sources. Two of the sources report on the April 23 JSS Tripler promotional ban by CONSOB, the Italian securities regulator.

A third source — dated May 2, nine days after CONSOB announced the JSS Tripler ban — does not reference the ban at all. Instead, it instructs readers via an affiliate’s press release that JSS Tripler is “an income-generating program that lets investors start with just $10 and turn it into a fortune. Essentially an HYIP, the program factors in the daily compounding system to increase earnings or make daily withdrawals as any investor would wish.”

One of the issues in the ASD Ponzi case is lack of disclosure to investors.

JSS Tripler/JustBeenPaid has no known securities registrations. Regardless, the affiliate’s release defines participants as “investors” and positions the program as one that is passive in nature. Claims in the release easily could lead to questions about whether the “opportunity” and its affiliates are benefiting in ASD-like fashion from the sale of unregistered securities by a global network of unregistered brokers.

In March, Mann told members it was OK to describe the opportunity as an investment program. Regardless, this line appears in his own program’s member agreement. (Italics added):

5. I have NOT been led to believe that this activity is an investment activity, franchise, or employment opportunity.

Although the release prompts readers (in the first paragraph) to “look closely at what they are getting into and ensure that they are joining income opportunities through programs that are proven to truly deliver financial freedom and sustainability,” it does not explain why the Member Agreement says one thing and Mann another.

Nor does it explain why any reasonable person would direct money to an entity whose Member Agreement also says this. (Italics added):

6. I affirm that I am not an employee or official of any government agency, nor am I acting on behalf of or collecting information for or on behalf of any government agency.

7. I affirm that I am not an employee, by contract or otherwise, of any media or research company, and I am not reading any of the JBP pages in order to collect information for someone else.

Bizarre ambiguities, incongruities and internal inconsistencies are common in the HYIP fraud sphere.

News about CONSOB’s JSS Tripler ban was published in English on CONSOB’s own website April 23. It also was published on the PP Blog and other sites, including the sites referenced by Google News.

Even as the affiliate was prompting JSS Tripler/JustBeenPaid prospects to “look closely,” he apparently missed information that was available through simple web searches — and this apparently also occurred after he missed the conflict between Mann’s words and the “opportunity’s” published Member Agreement.

The release concludes with these words:

“People who want real money from a reliable online networking system without the fuss and tricks should visit [URL deleted by PP Blog] to learn more.”