EDITOR’S NOTE: Absent sufficient contributions from readers as outlined here, the PP Blog will suspend publication at 5 p.m. today, Dec. 5. I will try to bring it back as soon as possible, but my hands are tied for now by a lack of money. This morning I restored full functionality, after causing the Blog to load only one story rather than the customary 11 on the front page about a day and a half ago. Full service also has been restored to the search, archives and tag functions.

The idea of briefly limiting services was to bring attention to the donation post, the Blog’s first since January 2013. It didn’t work. The Blog receives a high percentage of traffic from online searches for specific topics. Much of that traffic never even sees the front page.

As things stand right now, the Blog and its full archives, including thousands of internal and external links designed to help readers gain a fuller understanding of the menace posed by HYIP scams, securities fraud, Ponzi schemes, pyramid schemes and precious-metals and commodities scams, will be available for the balance of this month. I expect my ability to publish to end, however, at 5 p.m. or shortly thereafter today.

Known as a destination site for Ponzi scheme victims, researchers, financial analysts, media companies, members of the antiscam community and government readers, the Blog has branched out over the past couple of years to cover the “sovereign citizens” movement. In some ways, that parallel coverage is even more important than our longstanding coverage of financial scams.

“Sovereigns” are threatening judges, prosecutors, officers of the court, agencies, agents, support staff, litigation opponents and banks — and even members of the Cabinet and Presidential appointees. They’ve also threatened the PP Blog and other media outlets. When government officials, the critical service-providers in the financial sector and the media aren’t safe from outrageous attacks in the courts and through other venues, YOU aren’t safe.

In any event, I’d like to share a few things that are on my mind — until we meet again . . .

_____________________________________

The Essay

Because I do not know when I’ll regain my ability to publish, today seems an appropriate day to add some context to specific PP Blog posts or coverage related by theme. While I’m at it, I’ll share some of the details about the pressure I’ve been feeling over the past few years of publishing this Blog. I fear for the security of my country. I don’t feel entirely safe.

My core belief is that unseen enemies of the United States and its way of life are trying to seize on a chance to affect domestic stability and disrupt the nation in unprecedented ways. Thousands of tiny attacks aimed at the U.S. financial system have occurred — everything from relatively low-grade attacks on payment processors to much more sinister, orchestrated attacks on major banks. At a minimum, these events drive up costs, but that may be just a precursor to the larger risk: repetitive injury in small waves that, over time, can create conditions under which vital infrastructure can be subjected to death by a thousands tiny cuts. These waves at first were interpreted as innocuous or perhaps even benign. The danger is that the small waves will have the same mathematical effect over time as a sudden tsunami that occurred in an instant.

For the first time in my life, I find myself pondering what once was unimaginable: that criminal gangs or worse could affect systems to such a degree that the scale tips more toward anarchy than order, that greed-driven schemes could be designed and have the effect over time of turning Americans against each other. In short, every man for himself.

And it’s not just financial schemes; it’s also political schemes. State secrets have been stolen in volume and used in dangerous games of political brinkmanship. A man in his underwear sitting in Any Small Town U.S.A. instantly can become part of a destructive force if something simply rubs him the wrong way. Such a man may or may not understand the issues. He may be particularly susceptible to a narrative that incorporates his personal political beliefs, a narrative that instructs him he is acting in the interests of the public. In some U.S. states, “sovereign citizens” effectively are stealing homes. Some of the “sovereigns” effectively are teaching courses in anarchy: How to gum up the mix and frustrate the process as part of an effort to undermine judicial authority. The effective goal, as outrageous as it seems, is to create a condition under which crime becomes lawful and criminals become nonprosecutable.

And then there are the tax frauds and other schemes so often associated with “sovereigns.” There can be no doubt “sovereigns” also are directly involved in HYIP frauds or serving as enforcers for them. A typical investor in such schemes may see them as a way out of their financial misery or even as a way to support their place of worship. The “sovereigns,” however, may see it as something quite different: a chance to infiltrate the U.S. banking system while inflicting pain on the “evilGUBment.”

I think the Profitable Sunrise case that has been referenced many times on the PP Blog is an example of how international criminals joined with “sovereign citizens” and political extremists in the United States to steal millions and millions of dollars. And I think they used U.S. banking wires and international facilitators to do it, while leaving members of the Christian faith holding the bag. I think the targeting of Christians was deliberate because the masterminds knew the so-called Prosperity Gospel is playing well in faith communities across the country.

My principal fear in this specific area is that the events create glee in the murkiest corners of the world, that Americans and in particular American Christians, are particularly vulnerable to handing over money to sinister forces and actually providing the means for their own demise.

This is why I categorically reject some of the criticism directed at the Blog and me personally.

A Madness Over The Land

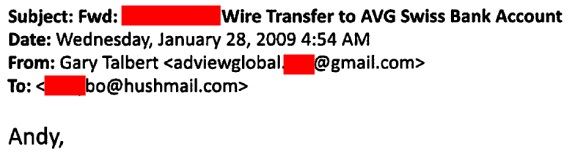

On Aug. 6, 2012, the PP Blog received a communication that suggested former U.S. Presidents George H.W. Bush, George W. Bush and Bill Clinton were viewed as assassination targets within the HYIP sphere. I immediately sent all of the information to the U.S. Secret Service, including the chosen identity and hushmail address of the sender, the IP address from which the threat originated, the full text of the threat and the specific PP Blog URL at which the threat was directed.

Here is the story at which the threat was directed: Jailed AdSurfDaily Figure Kenneth Wayne Leaming Sues Obama, Holder; Purported ‘Sovereign Citizen’ Claims President Not A U.S. Citizen And Demands Compensation In ‘Silver’ And ‘Gold’ For Alleged Unlawful Imprisonment

“People like Kenneth L. are true Patriots that know that without sending out mercenaries to take out those corrupt bankers, USG politicians, agents, judges and attorney’s [sic] that cause us all harm and d[a]mages,” the email read in part. (Bolding added.)

It went on to specifically question why both President Bushes and President Clinton were “still alive and running around,” describing them as “real criminals.”

Given the subject matter of the thread, for all I know maybe President Obama and Attorney General Holder are on the target list, too. I do not believe Kenneth Wayne Leaming was the sender; I believe it was one of his supporters, posting from overseas and/or perhaps trying to mask his IP. Leaming was in jail near Seattle at the time; he’s still in jail, having been convicted earlier this year on charges of filing false liens against public officials involved in the ASD Ponzi case and against other officials, harboring federal fugitives and being a convicted felon in possession of firearms.

This is what was on my mind: How did Leaming, a Washington state resident, gain the support of an individual overseas? Could this person have been in the United States and then made his way to Europe? Could he perhaps have been in the United States at the time of the threat and relied on a proxy to make it appear he was overseas?

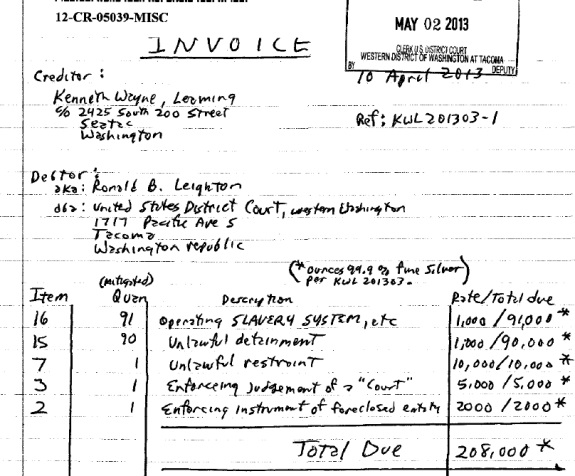

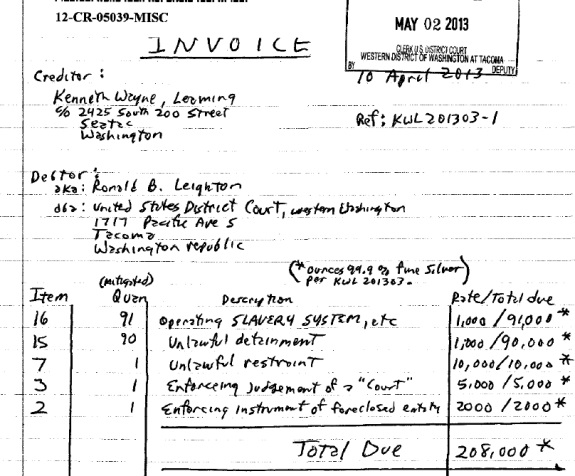

In any event, Leaming later asserted that the federal judge who presided over his trial owed him 208,000 ounces of fine silver, another outrageous claim from the alleged member of the Washington state “County Rangers,” a group of “sovereign citizens” with an armed enforcement wing.

Pardon me for being offended at a would-be comment I received yesterday that called me a beggar and asserted that, if my readers kicked in to help me and this Blog, they’d be contributing to the starvation of children and perhaps denying them a visit from Santa Claus.

If anyone thinks they’re going to manipulate me in this fashion and cause me to abandon the overall security story and turn my back on a journalism career that has spanned a quarter of a century, they don’t know me very well. Earlier in my career — while print publishing was still healthy and I had a continuous flow of work from multiple clients — I’d thought a medical scandal I covered at an institution for people with mental retardation likely would be the story of my life. There were at least four deaths, including the death of an individual with profound mental retardation. He was denied adequate medical treatment when his body temperature plunged to 86 degrees.

The far-reaching story triggered menacing conduct against my family, which backed me fully. My coverage only intensified. Reporters worth their titles don’t back down.

Within a few years, however, I began to believe that a mortgage-fraud and predatory-lending scandal I’d covered beginning in April 2001 in a 150-part series of installments would be the story of my life. Hundreds of inexplicable foreclosures had occurred in a county that traditionally had averaged only a couple of dozen per year. There was no corresponding triggering event such as a plant shutdown that would explain the incredibly rapid rise in local misery. A real-estate professional gave me the tip and told me where to look. From this base, I uncovered scores of of documents showing that deals in a region of counties were tainted from the start. There were corrupt appraisers, corrupt brokers, corrupt notaries public, corrupt home-improvement companies using multiple identities. Some of the deals later were packaged as securities and sold on Wall Street.

State and federal investigations ensued. Scammers went to prison. Companies got shut down.

I received two awards from the Associated Press for the series — Investigative Reporting and Public Service — and I didn’t think I’d ever encounter another story that would have such an impact on a community and region. Some of my reporting is referenced in one of the earliest books on the coming mortgage meltdown that caused so much chaos in 2008.

But by 2005, even before the mortgage meltdown hit, the great free-fall in print publishing was under way. My reliable stable of clients began to contract. I responded by studying web-publishing as a means of stabilizing my income; I had a lot of skill sets to learn — and I learned them. Having the skill sets, however, did not translate into the money I needed to sustain the middle-class reality I had known. By 2007, I was down to only one regular client. A year earlier, in 2006, I almost certainly lost a chance to become the full-time editor of a print publication prominent in its field. In retrospect, the “mistake” I made was to answer a question truthfully during an interview with the publisher.

I was asked how I saw the web emerging in the publishing industry in the near future; I answered by saying I believed the Internet was going to win and that print publishers would have to find a web model that paid the bills or the publications would vanish. They could rely on their cherished brands for only so long, and in the short term could use their familiarity with readers to drive traffic, I contended. But in the long term, I further ventured, readers accustomed to paying for a print subscription would be reluctant or unwilling to pay for an electronic subscription because of the easy accessibility of free content on the web, including an ever-expanding library of pirated content and content that was accessed by multiple readers sharing one paid subscription. Readers no longer had to wait for the newspaper or magazine to come out to see what was on sale. The major challenge, in my view, was that long-established advertising clients of well-recognized publishing firms and titles were becoming less and less reliant on publishers to carry their messages and inserts because the clients now could use the Internet to establish direct, personal relationships with customers. Print — and even electronic versions of print publications — were becoming less and less attractive as a middleman for major advertisers

You could have heard a pin drop after I uttered those words; the publisher, it very much seemed, wanted to be told that print would win and that electronic versions of publications would be seen as an added value.

Suffice to say, I did not get the job, so I dialed up my efforts to learn the ways of the web and become both a publisher and salesman.

My Greatest Mistake

The greatest mistake I made in the ensuing months was creating the Patrick Pretty brand and positioning it in the general space of “Internet Marketing” as a fun and entertaining way to do business online.

The fictional backstory of the brand was that a child prodigy who had the permanent gift of brains but only the temporary gift of physical beauty had become an adult who believed that both his intellectual gifts and his childhood good looks had followed him into adulthood. Although people admired him in adulthood for his brain, they were put off by his looks. Patrick Pretty just didn’t make the connection and assumed he was “The Most Beautiful Man In The World” because he’d been awarded the title of “The Most Beautiful Little Boy In The World” in 1964.

It was a hoot actually to create a brand, especially one with Gumpian qualities and a higher-functioning brain. I’d formerly only helped represent and extend existing brands or subbrands.

I had hoped that the PP brand and the backstory would help me sell Amazon.com and other affiliate products via Blogs online by introducing readers to a fantasy cartoon character with an engaging way of doing business, sort of my version of the GEICO gecko. I further hoped that IM editorial prospects seeing my writing skills would hire me to prepare their news releases and marketing materials. The PP brand gained a lot of attention, particularly during a period in which I served as a volunteer moderator at the Warrior Forum. I hoped to supplement my income by selling short, self-created eBooks online through which customers also looking to make money online could learn skills such as how to prepare news releases, how to structure the flow of writing, how to create a brand identity.

From the standpoint of building sustenance, all of my products were flops, despite the name recognition of the brand within the Internet Marketing space. The web can be a particularly wicked place: My products quickly were stolen and put behind paywalls, some in faraway lands. Virtual ghosts started to use me as a sort of free labor force; I’d create a product, they’d steal it and put it behind a paywall and charge subscription fees. In 2010, my PonziNews website was completely eviscerated by a thief who stole my articles verbatim and monetized them 100 percent for his benefit.

I did not perform a careful study or analysis before joining what was being painted as the IM Revolution, the greatest way ever conceived to do business. In that sense, my story is far from unique. One of my assumptions was totally wrong: that professional Internet Marketers would be interested in hiring me to improve their presentations and eliminate or minimize mistakes on their websites. The reality proved to be that they were much more interested in writers who’d produce incredibly over-the-top hype-fests for a fee. Quality was an afterthought, if a thought at all.

For the most part, they didn’t care about news releases, responsible sales copy and branding materials. Nor did they care to engage the mainstream media and Main Street consumers in the long-term at all. What they were mostly interested in was creating shiny dreck and selling it in limited quantities for exorbitant prices while creating what effectively was a free labor force duped into believing they’d become rich like the masters, virtually all of whom were selling against their own affiliates. In a nutshell, it was modern carnival barkers invading the Wild West of the Internet and mining it for everything it was worth — with virtually no attention paid to the social consequences of it all.

In August 2008 — after my stint at the Warrior Forum had come to an end during a July weekend over which a thief at the forum was stealing electronic information products from other Internet Marketers and putting them behind paywalls and charging subscription fees — I changed the focus of PatrickPretty.com entirely. I did not fit in this space at all; I detested the gamesmanship, the general lack of professionalism and decorum within the IM space, the never-ending hype fests, the shiny dreck, the culture of instant riches.

Beyond that, my experience battling scammers at the Warrior Forum taught me there effectively was no permanent way to contain them because of the ready availability of proxies to mask locations. There were instances in which a person used an IP to sell products under one identity, and then posed as a satisfied customer using the same IP but a different posting identity. Other forms of shilling often were suspected, but were very hard to prove. Other people purchased products, immediately demanded refunds and then ran off with the products and sold them behind paywalls. For a nominal fee, corrupt shoppers could access corrupt websites and their troves of stolen products, denying the true authors the profits from the sale of their property while creating confusion over who was the real seller and party responsible for support.

My core strength is news reporting, not Internet Marketing. During July of 2008, AdSurfDaily members were coming to the Warrior Forum to defend their “program” in droves. All of it had a cult-like feel that I found particularly disturbing; I decided to write about it.

That single event — the emergence of the ASD Ponzi scheme and its endless series of Stepfordian shills — changed my life like no other event before it. PatrickPretty.com had a small, loyal following, so I decided to keep the name of the domain and transition it into producing hard-news reporting that would help legitimate Internet Marketers and online merchants keep track of events that could affect their futures.

What I found out relatively quickly was that the antiscam community was on my side, but that the Internet Marketing community in general was not. By 2009, my last remaining regular print client — a client with which I had had a 21-year business relationship and had authored a monthly column or other works for 17 years — had filed for bankruptcy. This effectively canceled my contract, gutting my income and putting me in a tailspin.

The PP Blog itself was producing De minimis revenue, but had developed a large audience compared to many Blogs. My efforts to improve the Blog’s performance were hampered by trolls and cyberstalkers who tried to create trouble at every turn. The only thing that saved the Blog (and me) were 14-hour days, an occasional check from Google, emergency saves by my family and the reemergence of a lost client that provided scattered, well-paying assignments.

I had no disposable income to speak of, but continued to focus on building the Blog as a vital news source. My decision was simple: I was not going to be run out of this space, not by trolls and stalkers, not by noxious, unthinking critics, not by anyone. The stories that were emerging were impossible to ignore, and they weren’t being covered in any detail by much larger publications that were having their own struggles making ends meet. Some of them exited print altogether. Others tried to publish print versions two or three days a week. Still others folded or became a mishmash of print and electronic publishing.

When Events Collide

There has never been more upheaval or greater confusion in publishing — and it’s happening at the worst possible time: News that needs to be covered isn’t being covered. Fractiousness within media itself is creating even greater confusion. America’s politics has become utterly poisonous, putting cockroaches ahead of national politicians on the popularity meter.

And all of this is happening while white-collar fraud thrives, government resources are strained and America is experiencing attacks both internally and externally. The banks are frequent targets, as are media sites, including large, general-interest publications such as the New York Times and the Washington Post, and much smaller, niche publications such as the PP Blog. DDoSers hit here in 2010, knocking the publication offline for days and increasing its costs. The site has experienced traffic floods and bot swarms virtually ever since, some broad enough to affect server performance or even to knock the blog offline for periods of time.

This Blog is my house; people and things are attacking me in my house. They want to extort me emotionally to achieve their ends, an ends potentially dangerous for all Americans if the mob can gain the upper hand.

Some people don’t understand this — something I see as frustrating but only natural. It is not happening directly to them; it is happening to me, and it is exceptionally difficult to explain, in part because so much of it happens via proxy. In the larger context, it also is happening to the United States, to financial institutions, to media sites, to key infrastructure guardians, and again much of it is happening via proxy. It often is hard to determine who the enemy is, a circumstance that likely is driving the national-security state.

_____________________________________

In 2009, after a series of vulgar stalking incidents at the Blog carried out by an apparent enforcer for HYIP scams and possibly aided by accomplices interested in destroying the Blog or otherwise extorting it, I was contacted by a party I will not disclose and asked if I would accept a subpoena aimed at identifying the stalker. I eventually provided the information voluntarily, based on my belief a crime was being carried out against the Blog. I later supplemented this information to include data on another stalker.

Since that time and likely just coincidentally, an interesting IP has appeared occasionally at the Blog. It is an IP for the “Executive Office of the President of the United States.”

I do not know who at the White House or companion offices is reading the Blog. Nor do I know why the White House comes here from time to time. There could be more visits than I know about because not all government workers use an IP that connects them to the government.

Call me an optimist. The presence of the White House gave me both comfort and hope. I’ve also been comforted by visits to the Blog from the U.S. Senate and House and the U.S. State Department, despite the fractiousness in Washington. Law-enforcement agencies routinely visit the Blog. I believe people who can make a difference are trying to piece together clues about what it all means — everything from the effect on national security of serial Ponzi schemes, bizarre HYIP and “prime bank” swindles to the effect on national security of the outrageous scams and court swindles carried out by “sovereign citizens” operating within America’s borders, perhaps with cross-border assistance.

A government IP associated with an agency I am declining to identify by name routinely appears at the Blog and accesses stories about “sovereign citizens” and “sovereign citizen” swindles. This, too, gives me comfort. I understand why some law-abiding and patriotic Americans might find that very proposition a source of discomfort, but these dots have to be connected.

After Sept. 11, 2001, American agencies were faulted for lacking imaginations on how attacks could be carried out, for not connecting dots, for not sharing information vital to national security and for engaging in parochialism and turf wars. The 9/11 attacks and the need for fusing information resulted in the creation by President George W. Bush and the Congress of the Department of Homeland Security.

I support DHS and have written about it or subagencies often. Many Americans, including law-abiding and patriotic ones, worry about DHS’s role in what they see as an expansion of the national-security state. What I’ve noticed about President Obama is that he, like his predecessor, is willing to take the incessant pounding and the Beltway blistering. In my view, both men know something highly concerning if not highly disconcerting is going on and that their first duty is to protect the safety of the American people.

It’s easy for even responsible Americans to cast both Bush and Obama as politicians who made deals with the devil to infringe individual liberty. I do not see it that way — not at all. I think both men perceived a clear-and-present danger and were courageous enough confront it and wise enough to perceive that things could evolve in a way that triggered an internal crisis and caused panicked people to spill out onto the streets. In short, they had the imaginations to perceive that enemies would view the United States as a weakened country after 9/11 and seek new means of exploitation and penetration, including means that did not exist prior to the Internet and only now can be appreciated if not fully understood in a deeper context.

It is my belief that the HYIP schemes initially were viewed by the government as ordinary crimes. That view has changed, I believe, because ordinary crimes would not fill the Rose Bowl to capacity ten times over and cause heartache and financial misery in tens of thousands of localities simultaneously.

You may be paying higher interest rates and seeing the value of your property plunge because homes in your neighborhood are in foreclosure or otherwise attached to the limit. Lax lending standards and dubious deal-making with clients often are blamed for this circumstance, which nearly led to a financial collapse in America in 2008. That view may be reliable, but is not all-encompassing.

The recovery from events in 2008 has been slow and painful for millions of people. The “rebound” that emerged, I believe, was far from inclusive because millions of people feeling financial pain got sucked into scams on the Internet, thus minimizing the effect of any post-2008 rising tide. I think the scams are only intensifying and that the efforts to combat them are intensifying in ways not currently known.

That thought gives me comfort, and increased hope for the future.

In some ways, the scammers are rationalizing these outrageous frauds as a response to bad politics and political infighting in Washington. There is an audience for that message. Within that audience are highly skilled financial criminals, political extremists and anarchists. They’re planning for what they see as a coming war and siphoning wealth from neighbors and strangers to fund it. Their systems have been designed first to gain access to the U.S. financial infrastructure, then to identify a target audience of disaffected Americans and Americans desperate to make money, and finally to bleed those very Americans and American institutions of resources.

The aim, in my view, is to injure America one tiny cut at a time and to put in place a constant series of follow-up scams.

My coverage of these miserable Ponzi and pyramid schemes and the sinister forces driving the “sovereign citizens” movement is the story of my life; I have done my best to deliver it to you, to provide analysis, to connect dots. I am proud of this Blog. At the same time, I recognize that a Donation shingle provides fuel for my critics and helps them advance narratives that paint me in the worst possible light.

But calling me a beggar and a demon won’t change my point of view: This Blog needs to be freely available to a wide audience, and establishing a paywall or mandatory subscription fee will vastly reduce the audience that can benefit from information and use it to recognize red flags and steer clear of scams. For now, at least, it’s contributions from readers who also are able to check a box to make their contributions recurring by the month — or nothing.

It seems clear that relatively few people could fund the Blog and help keep it available to a wide audience. It is clear from logs that many of the Blog’s readers come here after searching online for information on specific scams and “programs.” That particular audience consists of thousands of readers, many of whom may be victims of scams or have come to the realization that a “program” that promised them riches just might be a scam

It is my sincere hope that the suspension of publishing will last only a short time and that the Blog and I will emerge stronger. And it is my fondest hope that this essay marks not a long goodbye, but the opening work of a new hello.

I miss you already, Dear Readers.