What once was only theoretical in the context of MLM HYIP schemes — that a receiver appointed by a court could simultaneously sue thousands of “winners” from disparate locations for return of funds received from an alleged Ponzi or pyramid scheme — is now a reality.

What once was only theoretical in the context of MLM HYIP schemes — that a receiver appointed by a court could simultaneously sue thousands of “winners” from disparate locations for return of funds received from an alleged Ponzi or pyramid scheme — is now a reality.

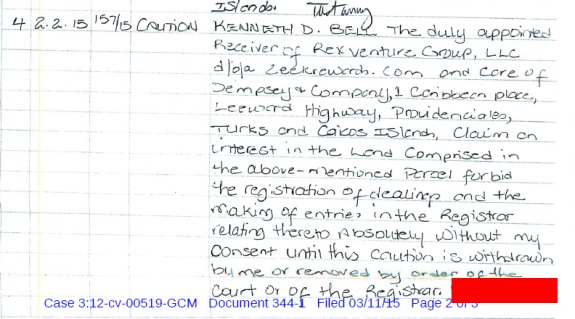

This reality was cemented today by the posting of a “Notice of Certification of Defendant Class Action” by Zeek Rewards receiver Kenneth D. Bell. The four-page document is posted on the receivership website.

Bell is suing more than 9,000 individuals in the United States alleged to have received more than $1,000 from the “program.”

Senior U.S. District Judge Graham C. Mullen of the Western District of North Carolina certified the defendant class of alleged winners last month. On March 11, Mullen approved Bell’s plan to notify the defendants on the receivership website and through the email addresses they used for Zeek or the receivership.

Here is the notice. (Because the PP Blog could not precisely duplicate the formatting, some of the formatting below is approximate.)

NOTICE OF CERTIFICATION OF DEFENDANT CLASS ACTION

On February 10, 2015, Judge Graham C. Mullen, United States Judge for the Western District of North Carolina issued an ORDER granting the motion of Kenneth D. Bell, the court-appointed Receiver for Rex Venture Group, LLC (“RVG”), to certify a Defendant Class (the “Net Winner Class”) in this action comprised of all persons and entities who were Net Winners of more than $1000 in ZeekRewards. A copy of this ORDER is attached. This notice is being provided to notify you that according to RVG’s records you are a member of the Net Winner Class and inform you about certain important information related to the Net Winner Class and the legal process going forward.

1. In this lawsuit against the named Defendants and the Net Winner Class, the Receiver alleges that because ZeekRewards’ Net Winners “won” (the victims) money in an unlawful Ponzi and/or pyramid scheme, the Net Winners are not permitted to keep their winnings and must return the fraudulently transferred winnings to the Receiver for distribution to the ZeekRewards’ victims. Specifically, the Receiver has asserted claims for relief for: (1) Fraudulent Transfer of RVG Funds in violation of the North Carolina Fraudulent Transfer Act; (2) Common Law Fraudulent Transfer; and (3) Constructive Trust.

2. Net Winners are defined in the Complaint as those who received more money from ZeekRewards than they paid in. Therefore, the Net Winner Class includes all persons and entities who participated in ZeekRewards and received at least $1000 more in money from ZeekRewards than they put into the program. RVG’s records show that you are a member of the Net Winner Class. Your membership in the Net Winner Class depends solely on the amount of your net winnings. It does not depend on whether or not you believed ZeekRewards was lawful, your level of knowledge concerning the program or whether you still have the money you received.

3. The Court has not yet ruled on the merits of the claims in this lawsuit; however, when it does so, its orders will be legally binding upon you and all other members of the Net Winner Class. The Court has noted that the common questions related to the Net Winner Class are “whether ZeekRewards operated as a Ponzi and/or pyramid scheme and whether net winnings received by the Defendants should be returned to the Receiver.” The Court has further held that the details of each class member’s participation in ZeekRewards do not need to be addressed in answering these common and controlling questions. The ongoing legal proceedings in the case will answer these common questions.

4. You are not required to and there should be no need for you to participate in the legal proceedings related to answering the common questions for the Net Winner Class. The Court has determined that the named Defendants, who the Court noted collectively won more than $11 million in profits from ZeekRewards, “inevitably share the same defenses against liability for repayment of the alleged fraudulent transfers made to the class, which does not depend on the personal circumstances of particular affiliates” and that those Defendants and their counsel “are able to fairly and adequately represent the interests of the defendant class.” Also, all pleadings and other papers filed in this action are available for your inspection in the office of the Clerk of Court for the Federal Court in the Western District of North Carolina in Charlotte, North Carolina, and on the Federal Court PACER electronic public access service that allows users to obtain case and docket information online at https://www.pacer.gov/.

5. You will, however, have an opportunity to participate in the process if the Net Winner Class is found to be required to repay their net winnings. If liability is found, the Receiver intends to seek a court Judgment against each class member in the amount of their individualized net winnings plus interest at least from August 17, 2012, when ZeekRewards was shut down and the Receiver appointed. The final amount of each Net Winner Class member’s net winnings and any Judgment against them will be set later in the proceedings after the liability of the class has been established. While the specifics of the process for determining those amounts has not yet been decided, the Receiver intends to seek a process that will notify you of the amount of your net winnings according to the RVG records, allow you a reasonable opportunity to provide a response (supported by relevant documentation if you disagree with the calculation) and then either reach an agreement on the amount or have the amount determined by a judicial process. It is likely to be several months or longer before this process begins so you do not need to take any action at this time either with the Receiver or counsel for the named Defendants related to determining the amount of your net winnings. This is true even if you believe that you are not a member of the Net Winner Class because you did not receive more than $1000 more from ZeekRewards than you put in (you will have an opportunity to make that argument at the appropriate time). However, if you have not already done so, you are advised to gather and preserve any documents or information (including electronic files) related to the amount you paid into and received from ZeekRewards so those documents and that information can be used in the later process to determine the amount of your net winnings.

6. CONTACT INFORMATION REQUIRED – This notice has been sent to the last known electronic address for each member of the Net Winner Class and published on the Receivership website, the Court’s docket and other forums. For purposes of future communications to the Net Winner Class it is important that the Court have updated contact information for all class members. Therefore, please provide your Name, Residential Street Address (or Business address for an entity), Email Address and Phone Number to:

Kenneth D. Bell

McGuireWoods LLP

ATTN: ZeekRewards Class Action

201 North Tryon Street, Suite 3000

Charlotte, North Carolina 28202

Or

zeekrewardsclassaction@mcguirewoods.com

Please be advised that the failure to provide current contact information will not allow you to avoid any liability or obligation related to this matter.

7. Since early in the Receivership, the Receiver has expressed a willingness to consider voluntary settlements on the Receiver’s claims with ZeekRewards’ net winners and others against whom the Receiver has claims. To date, there have been numerous settlements approved by the Court in which net winners and the Receiver agreed on an amount to be repaid, often with payment terms that allowed the net winner to repay the agreed amount over a number of months. Net Winners are still permitted to discuss a potential settlement of the Receiver’s claims against them even though they have become members of the Net Winner Class. If you desire to discuss a settlement of the Receiver’s claims against you, please communicate with the Receiver at zeeksettlement@mcguirewoods.com.

8. This notice is intended to inform you about the Net Winner Class and answer basic questions regarding the Receiver’s claims and the legal process.

PLEASE CONSIDER THIS NOTICE CAREFULLY BECAUSE YOU WILL BE LEGALLY BOUND BY FUTURE ORDERS OF THE COURT IN THIS ACTION. IF YOU ARE UNSURE OF WHAT COURSE TO FOLLOW OR IF YOU HAVE ANY QUESTIONS ABOUT YOUR SPECIFIC CIRCUMSTANCES, YOU MAY WISH TO CONTACT YOUR OWN ATTORNEY. PLEASE DO NOT CONTACT THE RECEIVER, THE COURT OR COUNSEL FOR THE NAMED DEFENDANTS WITH GENERAL QUESTIONS ABOUT THE NET WINNER CLASS OR YOUR PARTICULAR SITUATION OTHER THAN IF YOU WANT TO DISCUSS A POTENTIAL SETTLEMENT WITH THE RECEIVER AS DESCRIBED ABOVE.

Read the notice on the receivership website.

Visit the receivership website.

NOTE: Our thanks to the ASD Updates Blog.