URGENT >> BULLETIN >> MOVING: (10th Update 8:53 p.m. ET U.S.A.) In his first formal report to the Massachusetts bankruptcy court, TelexFree Trustee Stephen B. Darr calls the company a “pyramid scheme” that may have involved 1 million or more participants globally and gathered as much as $1.8 billion through arms in the United States and Brazil.

URGENT >> BULLETIN >> MOVING: (10th Update 8:53 p.m. ET U.S.A.) In his first formal report to the Massachusetts bankruptcy court, TelexFree Trustee Stephen B. Darr calls the company a “pyramid scheme” that may have involved 1 million or more participants globally and gathered as much as $1.8 billion through arms in the United States and Brazil.

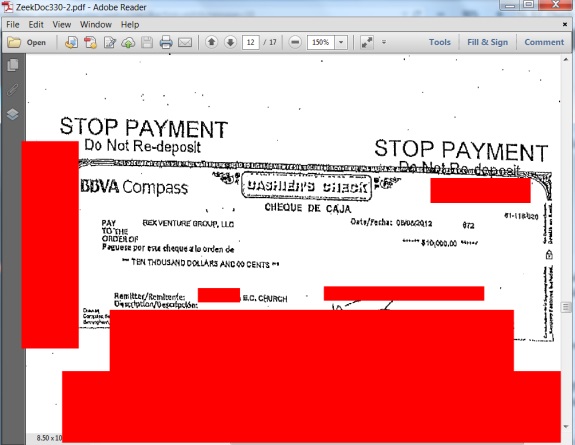

If the numbers hold up, it would mean that TelexFree has surpassed the Zeek Rewards scheme in both victims’ count and haul. Zeek is estimated to have created about 800,000 victims, while hauling about $897 million. Zeek was shut down by the SEC in August 2012.

The SEC and the Massachusetts Securities Division brought actions against TelexFree in April 2014.

Darr also revealed that 13 private lawsuits have been filed against TelexFree and/or related principals, including former executives James Merrill and Carlos Wanzeler.

TelexFree’s Brazilian arm was known as Ympactus and “grew much more quickly than the Debtors and its shutdown by Brazilian authorities in the summer of 2013 was the first of many red flags that the Debtors were operating an unsustainable pyramid scheme,” Darr advised U.S. Bankruptcy Judge Melvin S. Hoffman.

Darr also strongly implied that a black market existed both internally at TelexFree and externally to the cross-border enterprise. It is known that the U.S. Department of Homeland Security, through its Homeland Security Investigations arm, is deeply involved in the TelexFree probe.

Today’s report by Darr may — at least in part — explain why. From the report (italics added/minor editing performed):

The Debtors’ business plan was complicated in and of itself. The scheme’s complexity was expanded further, however, through a web of inter-Participant transactions that permeated the scheme.

First, a new Participant could purchase a membership plan by making payment directly to the Debtors . . . or by redeeming accumulated credits.

In lieu of paying funds directly to the Debtors, it appears that many Participants became involved in the scheme by paying their membership fee directly to a recruiting Participant who often did not remit the payment from the new Participant to the Debtors. Rather, the recruiting Participant frequently retained the payment from the new Participant in return for a reduction, or redemption, of their accumulated credits. The mechanics of this transaction were as follows:

a) After an invoice was issued to the new Participant and marked as pending, the new Participant would forward the invoice through the system to the recruiting Participant for payment;

b) The recruiting Participant would then pay the invoice using the recruiting Participant’s credits. The Debtors’ database would charge the recruiting Participant’s credits for the invoice and mark the invoice as paid.

In this manner, new Participants often joined the Debtors’ scheme without any money actually being paid to the Debtors.

In addition to the two scenarios outlined above, there appears to have been a third type of transaction that did not involve the Debtors at all. This type of transaction involved the transfer of credits by one Participant to another Participant in exchange for cash or other consideration. The motivation for the transfer of credits is not always clear, although in some instances recruiting Participants may have purchased credits so that such recruiting Participant had sufficient credits to be redeemed after receiving payment from a new Participant.

Growth at the Ympactus arm in Brazil accelerated “in the fall of 2012 through the early summer of 2013,” Darr asserted.

“The Debtors’ records indicate that by the spring of 2013, Ympactus had cash receipts of more than $100,000,000 per month,” he continued. “These receipts do not reflect inter-Participant transactions that did not involve direct payment to Ympactus.”

After Brazilian authorities intervened in June 2013, freezing as much as $300 million in that country, the U.S. TelexFree arms — previously underperformers compared to Ympactus — began to surge, Darr alleged.

“Following the shutdown of Ympactus, the Debtors’ revenues increased dramatically such that by the end of 2013 and early 2014, the Debtors were generating cash of as much as $50,000,000 per month, without regard to inter-Participant transactions for which consideration did not pass to the Debtors,” Darr said.

TelexFree banking relationships crumbled, Darr said in the report.

“Multiple banks closed the Debtors’ operating accounts apparently based upon suspicious activity in those accounts,” Darr said.

A lawyer advised TelexFree in mid-2013 that its business plan constituted a pyramid scheme, Darr said.

“Although the Debtors were apprised in mid-2013 by counsel that the business plan was a pyramid scheme, they continued to operate using that plan until March 2014. At that time, the Debtors introduced a new business plan, even though the Debtors were apparently advised that the new plan did not rectify the problem. The new plan was unanimously rejected by the Participants, which appears to have precipitated a ‘run on the bank’ inasmuch as $58,000,000 or more was paid out to certain Participants in the several weeks leading up to the filing of the petitions. An additional $100,000,000 was requested by Participants but was not paid.”

In September 2014, Darr identified MLM lawyer Jeffrey Babener as an attorney who advised TelexFree it was operating a pyramid scheme. Babener isn’t named in today’s filing, so it is not immediately clear if a second attorney also advised TelexFree that its platform was a pyramid.

Darr also said in the report that TelexFree “wrote off” a receivable “in the approximate amount of $180,000,000” due from Ympactus. The write-off appears to have occurred in late 2013, after the action in Brazil.

“Upon information and belief, the Debtors advanced the costs for the voice over internet protocol, or ‘VOIP’, service for both the Debtors and Ympactus,” Darr said. “Ympactus contracted to pay a portion of its revenues to the Debtors as a commission, but it is unclear the extent to which these payments were ever made. In December 2013, six months after the seizure of Ympactus’ assets by the Brazilian authorities, the Debtors established, and then subsequently wrote off, a receivable due from Ympactus in the approximate amount of $180,000,000, purportedly for unpaid commissions and related services.”

Darr also identified a number of TelexFree subsidiaries or affiliates, noting there could be more. These are among the entities and ownership information listed in the report. (Please note that not all location information is listed):

- TelexFree International LLC:: Ownership: Wanzeler, Carlos Costa, Merrill:: Location:: Nevis.

- TelexFree Mobile Holdings Inc.:: Ownership:: Wanzeler and Merrill.

- Graham Bell Telex LLC:: Ownership:: TelexFree Mobile Holdings LLC and Costa.

- TelexFree Mobile LLC:: Ownership:: Graham Bell Telex LLC and Infinium Wireless.

- TelexElectric LLLP: Ownership:: Wanzeler, Costa and Merrill.

- Bright Lite Future LLC:: Ownership: Wanzeler, Costa and Merrill.

- Brazilian Help Inc.:: Ownership: Wanzeler.

- Sunwind Energy Group LLLP: Ownership: 1127 Enterprises LLC and Merchant Enterprises Inc.

- Sunwind Energy Solutions:: Ownership:: 1127 Enterprises Inc., ACE.

- LLLP: Ownership:: LLP, Executive Marketing Inc. and Sunwind Energy Group LLLP.

- Sunwind Energy Doyle North LLC:: Ownership: Sunwind Energy Southern LLLP, ACE LLP, Adams Craft Ewing LLLP, Guasti LLC.

- ACE LLP:: Ownership:: Undetermined.

- Executive Marketing Inc.:: Ownership:: Undetermined.

- 1127 Solutions LLC:: Ownership: Undetermined.

- Merchant Enterprises Inc.:: Ownership: Undetermined.

“There may have been other entities formed by the Debtors’ principals to conduct similar operations in other jurisdictions, including TelexFree Ecuador, TelexFree Columbia, TelexFree Dominican Republic, TelexFree Canada, and TelexFree International, Ltd. (Cayman Islands),” Darr alleged.

And, he noted, “In addition, other entities appear to have been formed by the Debtors’ principals for related or unrelated purposes, including JC Real Estate Investments LLC; JC Real Estate Management Co., LLC; Above and Beyond the Limit LLC; CNW Real Estate LLC; CNW Realty State LLC; Acceris Realty Estate LLC; KC Realty State LLC; Makeover Investments LLC; Eagleview Realty Estate LLC; and Grandview Realty Estate LLC.

With forensics well under way and with Darr in communication with investigators in the United States and Brazil, how big is the job ahead? (Bolding added):

“The database identifies more than 2,100,000 electronic mail addresses for Participants in the operations of both the Debtors and Ympactus,” Darr said. “Of this amount, approximately 1,000,000 appear to be provided by Participants of the Debtors, with the balance related to the Ympactus Participants. The database identifies more than 17,000,000 different accounts, of which approximately 12,000,000 are those of Participants and 5,000,000 are those of Ympactus Participants. As referenced earlier, an individual Participant could maintain multiple accounts using a single electronic mail address, and an individual Participant could also maintain more than one electronic mail address. During the period February 2012 to April 2014, the total combined cash receipts for the Debtors and Ympactus were in excess of $1,800,000,000 and combined noncash revenue was approximately $4,200,000,000.

Oddities abound, according to the report.

” . . . the Debtors’ computer system does not link all accounts for an individual Participant, and the Participant name field enabled Participants to use different variations of their name in the input process,” Darr said.

“Certain accounts do not contain electronic mail address information. Of those accounts that do contain electronic mail address information, in some instances, the information is facially inaccurate, such as the Participant’s use of the Debtors’ electronic mail address as a placeholder such as [deleted by PP Blog]. In other instances, a Participant may have used the same electronic mail address as other Participants, including the sharing of electronic mail addresses with family members. Unlike the computer systems of similar type enterprises, the Debtors’ system did not require confirmation of an electronic mail address.

“Similarly,” Darr said, “certain accounts do not contain physical address information. Some other accounts contain physical address information that is facially inaccurate, such as the use of a country code that is inconsistent with the address, e.g., ‘San Paulo, USA.’”

From the report (italics/bolding added):

Manual credits were credits assigned to a Participant’s account balance on account of money paid to the Debtors for one of several reasons, as distinguished from credits “earned” from the placement of advertisements or other components of the compensation scheme. The Debtors’ records reflect approximately $151,000,000 of manual credits issued to certain Participants. The issuance of manual credits appears to be a fraud within the larger fraud of the pyramid scheme with the Debtors’ insiders adding large amounts of credits to certain accounts whereby the credits could then be sold to other Participants. There appears to be no corresponding payment supporting many of these large manual credits.