Updated 9:45 a.m. (Feb. 27, 2014, U.S.A.) Police who serve Portuguese-speaking residents in two British Crown dependencies — the States of Jersey and Guernsey — have issued warnings on the TelexFree scheme. News of the warnings was published on BehindMLM.com.

Brazil-based TelexFree executive Carlos Costa waved the flags of Portugal and Madeira in a curious TelexFree cheerleading promo last year about a bankruptcy filing. Jersey Police specifically referenced the Madeiran community in the agency’s warning. So did Guernsey.

After the bankruptcy claim involving a TelexFree arm in Brazil known as Ympactus Comercial Ltd., TelexFree became a sponsor of the Botafogo football club in Rio de Janeiro — apparently through one of its U.S. arms.

From a statement by Jersey Police (italics added):

The States of Jersey Police have been made aware of a potential fraud which is targeting Jersey’s Madeiran community.

Guernsey Police have issued a similar appeal.

The scheme is under a company name of TELEXFREE and would require initial investments with the promise of big returns.

The scheme originated from Brazil and is currently being investigated by the Brazilian authorities as it is believed to be fraudulent.

Jersey Police know that islanders have been approached to “invest” in the scheme, but as yet have not had any contact from victims of the scam.

If anyone in Jersey has invested money into a TELEXFREE scheme they should contact the Joint Financial Crimes Unit on Tel: 01534 612250 (during office hours) or Police headquarters on 01534 612612 (at other times).

Guernsey Police also referenced its Madeiran community in the agency’s Feb. 19 warning posted on Facebook (italics added):

Guernsey Police have been made aware of a potential fraud which was intended to specifically target Guernsey’s Madeiran community.

The scheme was under a company name of Telexfree and would require initial investments with the promise of big returns.

The scheme originated from Brazil and is currently being investigated by the Brazilian authorities as it is fraudulent.

If anyone in Guernsey has invested money into a Telexfree scheme they should contact Sgt Snowdon in the Financial Intelligence Service on 01481 755812.

TelexFree, which might represent a form of affinity fraud and is under investigation in Brazil amid pyramid-scheme allegations, appears first to have targeted Portuguese-speaking populations in Brazil and Europe. TelexFree is based in the Boston region, which has a considerable population of Brazilians.

Sann Rodrigues, a purported TelexFree millionaire, is one of the “program’s” top hucksters. He was successfully sued by the SEC in a 2006 case that alleged he presided over a pyramid scheme and engaged in affinity fraud.

At the time, Rodrigues, also known as Sanderley R. De Vasconcelos, advised the court that he was unable to pay a considerable portion of the sanctions against him.

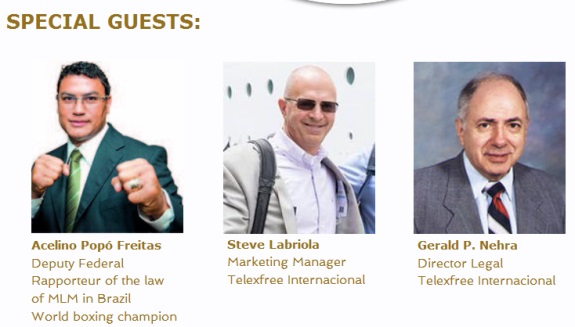

TelexFree says Rodrigues is among the headliners at a rah-rah session in Spain March 1 and 2. As things stand, that event now will take place against the backdrop of the warnings in Jersey and Guernsey and the possibility of increased scrutiny in Portugal and the United States.

Some U.S. promoters have claimed that $15,125 sent to the firm triples or quadruples in a year. TelexFree says it is in the VOIP business and claims it is expanding into cellphones and credit repair. Why a purported communications business would get into credit repair is unclear.

Some members of the AdSurfDaily Ponzi scheme broken up by the U.S. Secret Service in 2008 were in purported credit-repair and debt-elimination businesses.

See March 3, 2009, PP Blog story on a bizarre “twenty-one dollars in silver coinage” claim that appeared in the context of ASD.