“The judge ruled in Nanci & David Frazer’s favor along with Albert Rosebrock (ministry board members) . . . to release frozen funds. The FBI and the Federal government is categorizing Frazer as having suffered from a case of ‘innocent ignorance’ as she worked for nine months doing customer support for a UK Collateral Loan company.” — Lede from “story” on Topix.com, Oct. 5, 2013

This is what is known from the publicly accessible court docket in Ohio’s July 8 fraud case against alleged Profitable Sunrise promoter Nancy Jo Frazer (also known as Nanci Jo Frazer), Focus Up Ministries and others: On Sept. 24, the docket of the case noted that the judge had ordered the release of $20,000 to Frazer and her husband (David Frazer) to pay legal bills. Another $8,000 was made accessible to Albert Rosebrock, another defendant, to pay legal bills.

The $20,000 ordered returned to the Frazers was in the form of a cashier’s check David Frazer had surrendered to the court after Ohio’s July action. Rosebrock’s money came from a bank account the judge ordered frozen after the Ohio action was filed. The docket shows that the judge authorized $8,000 from this frozen account to be made accessible to Rosebrock, but the freeze remains on any other money in the account. Freezes also remain on seven other accounts Ohio authorities have associated with the defendants. (Of the eight accounts originally ordered frozen in July, all eight remain frozen.)

Importantly, Ohio’s civil case remains ongoing. So does a civil case by the SEC at the federal level. The SEC action does not name the Frazers or Rosebrock defendants, but suggests that pitchmen could have promoted Profitable Sunrise without even knowing who was running the purported “opportunity.”

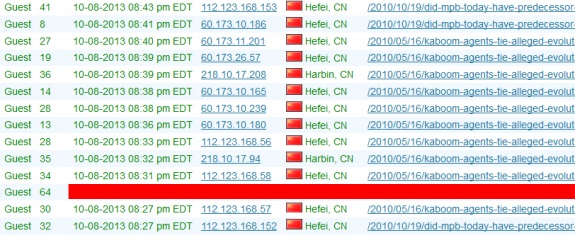

Purported Profitable Sunrise operator “Roman Novak” and his brother “Radoslav Novak,” a purported attorney associated with Profitable Sunrise, may be fictitious, according to the SEC, which has described Profitable Sunrise as a murky and massive international pyramid scheme that potentially gathered tens of millions of dollars.

“Profitable Sunrise operates for the benefit of unknown individuals and/or organizations doing businesses through companies formed in the Czech Republic and using bank accounts in the Czech Republic, Hungary, Latvia, and China, among other places,” the SEC alleged in April.

“There is more than a slight possibility, as with many offering frauds, that the people described in the [Profitable Sunrise] website, including the Novak brothers, do not exist,” the SEC said.

Enter ‘scampoliceinsider’

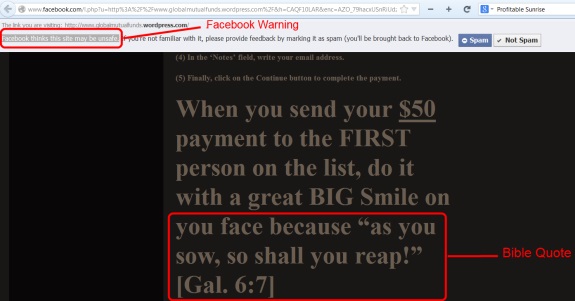

On Oct. 5, 11 days after the Sept. 24 Ohio docket entry, someone using the handle “scampoliceinsider” and a photo of a news reporter posted something that resembles a news story on the Topix.com site for Ogdensburg, NY., near the Saint Lawrence Seaway and the border with Canada.

Gregg Evans, a poster and occasional guest columnist at the PP Blog and a regular poster at the RealScam.com antiscam forum, posted a link to the Topix story at RealScam.com on Oct. 13.

Among other things, “scampoliceinsider” asserts on Topix that “I WILL GIVE YOU THE INSIDE SCOOP YOU DID NOT KNOW” and that “I am investigating a fraud within a fraud. I am the one who does what others won’t bother to do.” Moreover, “scampoliceinsider” asserts that he or she believes in “The truth backed by facts.”

Here is the headline on the Topix “scampoliceinsider” story: “Nanci Jo Frazer WINS in Court – a Case of Innocent Ignorance.” The headline stressed the word “WINS” in uppercase. Nowhere does the story mention that Ohio’s case is ongoing and that any money ordered unfrozen was further ordered to be used for the express purpose of paying legal bills. Instead, the story contends that Ohio authorities had known since October 2012 that Profitable Sunrise was a fraud and that the authorities “failed to inform the public and especially Nanci Frazer.”

It further positions Frazer as a victim of harassment from “A tight group of online individuals [who] have been targeted to be running their own bitcoin scheme” and claims the purported bitcoin schemers “stole Frazer’s image, identity and training videos while she was on vacation” in a bid to drive traffic to their own websites “and cash in on their own fraud.”

Meanwhile, a strangely worded passage in the story contends that “The FBI and the Federal government is categorizing Frazer as having suffered from a case of ‘innocent ignorance’” while she “worked for nine months doing customer support for a UK Collateral Loan company.” (This would be Profitable Sunrise, which perhaps would be better described as a purported collateral-lending company.)

Like the bitcoin and associated claims, the story does not substantiate the “innocent ignorance” claim. At the same time, the story ventures that “The last straw was watching Toledo 11 Fox News put her children in harms way by airing a hateful and false, damaging, home made video story from one of the online stalkers- James L Paris is was a convicted criminal for Securities fraud(they never checked out his background).” (Unedited by PP Blog.)

The Fox Toledo outlet now is “in position to be turned in to be put under regulators [sic] scrutiny and to be liable for a full investigation which connects them to another scam,” according to the Topix story.

Paris is the editor of ChristianMoney.com and recently published an ebook on what he describes as his pressure-packed, nerve-racking experience writing about Profitable Sunrise and the enmity directed at him from certain members of the Christian community. Paris denies he is a convicted criminal, saying that he once was named in a civil securities action in Maine after his brother embezzled money from a Paris company and hid the act from Paris and accountants.

(DISCLOSURE: The PP Blog is referenced in the Paris ebook. The Blog does not personally know Jim Paris, has no business association with him and does not benefit from the book, which was offered by Paris for free online for several days earlier this month and now costs $4.99 at Amazon.com. The book is titled, “Exposing The Ponzi Masters – The Profitable Sunrise Scam: How I Exposed It, How They Tried To Stop Me.” The Blog obtained the book free on Oct. 9 through a link supplied by Paris at RealScam.com. On Oct. 11, the Blog posted to RealScam.com about the book, opining that it believed the Paris book would “serve his intended audience in the Christian community well.” In its RealScam.com post, the Blog also drew some comparisons to the AdSurfDaily Ponzi scheme. ASD, like Profitable Sunrise, was targeted at people of faith.)

Now, back to the Topix story referenced above . . .

The photo of the reporter that appeared alongside the Frazer story on Topix in Ogdensburg, near the Canadian border, appears to be a low-resolution copy of a professional portrait/publicity still of a real reporter, a broadcast journalist who started her career at a California TV station in 2010 and accepted a job in 2012 at a station in Nevada, where she works as a weekend anchor. The photo does not identify the reporter by name and appears to have been taken while the reporter was working for the California TV station prior to moving on to the Nevada station.

It may be the case that a fake reporter posting at Topix found an image of the real reporter online and used it as an avatar to add credibility to the story on Frazer published at the site. The PP Blog believes it has established the identity of the real reporter and emailed her yesterday to determine if the image on Topix was being used without her knowledge and consent and to rule out that she was the author of the Topix post. As of the time of this post, the Blog has not heard back from the reporter, which is not unusual. Media people have busy schedules. (For the purposes of this post, the Blog is not identifying the real reporter by name and has brushed the screen shot above to obscure her face and the identity of a TV station that, like the reporter, may have no knowledge of Frazer or Profitable Sunrise or the Ohio case.)

In the Blog’s view, the Topix story does not read like one prepared by a trained, working journalist. Rather, the story on Topix reads like fractured marketing and PR fluff of the type often seen in the HYIP sphere. At least part of it seeks to demonize both the media and the government. Similar situations occurred after the action by the United States against ASD in 2008. Online scammers have been known to pose as legitimate members of the media to add presumptive authority to a scheme.

In 2011, the famous brand of Consumer Reports was appropriated by scammers to drive dollars to an acai-berry scheme, the FTC said. Meanwhile, “fake” news sites in the United States using the image of a real reporter from France were used in the acai scheme.

The PP Blog would be very surprised if the Topix story was authored by a real reporter, especially one using the handle “scampoliceinsider” and trying to stick it to a TV station in Toledo, other media outlets and Ohio authorities in this bizarre fashion.