“Investigators from [the Social Security Administration] discovered that hundreds of victims throughout the United States were losing their social security benefits and their life savings either because they believed that they had won ‘The Jamaican Lottery’ or because, as part of another telemarketing scheme, they revealed enough information about themselves that allowed the thieves to fraudulently divert their money.” — Office of U.S. Attorney James L. Santelle, Eastern District of Wisconsin, June 7, 2013

For O’Brain J. Lynch, senior citizens receiving retirement benefits from the Social Security Administration and other sources were the perfect targets of a criminal organization operating an international mass-marketing fraud scheme from Jamaica.

For O’Brain J. Lynch, senior citizens receiving retirement benefits from the Social Security Administration and other sources were the perfect targets of a criminal organization operating an international mass-marketing fraud scheme from Jamaica.

The scheme duped people into believing they had won “The Jamaican Lottery.” In reality, authorities said, it was an advance-fee scam designed to drain retirement accounts and to recruit cashers in the United States.

Lynch, 28, of of Montego Bay, Jamaica, now faces up to 20 years in federal prison after pleading guilty to wire fraud, the office of U.S. Attorney James L. Santelle of the Eastern District of Wisconsin said last week. The case was investigated by SSA, the U.S. Postal Inspection Service and Homeland Security Investigations (HSI).

“Americans have lost millions of dollars to criminals from countries around the world in foreign lottery scams, said Pete Zegarac, inspector in charge of the Chicago Division of the U.S. Postal Inspection Service. “When one family member is harmed by a foreign lottery scam, the impact is felt by all. Losses can be monumental, sometimes entire life savings are wiped out. ”

From a statement by prosecutors (italics added):

A Jamaican Lottery Scheme is a form of mass-marketing fraud committed via the internet, telemarketing, or mass mailings. Jamaican criminal organizations contact victims and identify themselves as lawyers, government officials, law enforcement agents, or lottery company officials. The potential victims are led to believe they won an international multi-million dollar lottery. The fraudulent telemarketers then inform the victims that in order to receive their winnings the victim needs to pay an advance fee. This fee is usually described as a tax, insurance payment, or customs duty that must be paid to release the winnings. The victims are instructed to send the funds via mail or wire transfer.

The scammers routinely involve victims to help facilitate the laundering of financial transactions by receiving and withdrawing funds from prepaid cards and receiving and sending wire transfers. In an attempt to conceal and layer the proceeds from the lottery scams, the scammers direct victims to send funds, knowingly and unknowingly, to other victims and associates of the scammers within the United States. These victims and co-conspirators then transfer the proceeds of this fraud to the scammers in Jamaica by wire transfers. The Jamaican criminal organizations have modified the lottery scam into other variations of telemarketing schemes to include redirecting individuals Social Security Administration (SSA) benefits, direct deposit, automatic debit, re-routing schemes and other identity theft schemes.

According to documents filed in court, in March 2012, the SSA learned that a social security recipient, from Glendale, Wisconsin, was receiving social security benefits in the name of other recipients and cashing in these benefits. Special Agents from the SSA – Office of Inspector General (OIG) discovered the recipient was sending this money to Jamaica because he believed he had won “The Jamaican Lottery.” He said he was contacted by an official from Global International who informed him that he won $2.5 million and two (2) Mercedes Benz vehicles in a sweepstakes. He was then advised that in order for him to collect the money and the cars, he had to pay taxes, customs duty, and other fees. He initially sent his own money to Jamaica, and, once he had depleted his own assets, he was directed, by telephone, to accept checks, Direct Express cards, and other cash value cards in the names of other people (who were also victims), cash them out and then send the money to Jamaica. As a result, numerous victims did not receive their social security benefits, and instead they were mailed to Jamaica. Investigators from SSA discovered that hundreds of victims throughout the United States were losing their social security benefits and their life savings either because they believed that they had won “The Jamaican Lottery” or because, as part of another telemarketing scheme, they revealed enough information about themselves that allowed the thieves to fraudulently divert their money.

Prosecutors said they believed Lynch was the first Jamaican national charged in the United States with this type of fraud.

“We will continue to work with our partners in Jamaica and other law enforcement agencies to put these criminal enterprises out of business,” said Gary Hartwig, special-agent-in charge of HSI’s Chicago Division.

The Journal Sentinel newspaper (Milwaukee) reported last week that Lynch also is known as “Jake Dinero.”

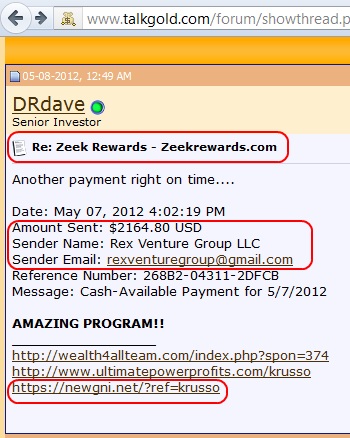

International mass-marketing fraud takes many forms. In 2010, the U.S. Postal Inspection Service alleged that the Pathway To Prosperity HYIP scheme gathered about $70 million and affected 40,000 investors in 120 countries. P2P was a Ponzi-board “program” that in part gained a head of steam on the TalkGold and MoneyMakerGroup fraud forums.

The alleged $600 million Zeek Rewards Ponzi- and pyramid scheme followed P2P as a favored “program” on the Ponzi boards, as did the alleged Profitable Sunrise HYIP scheme. Profitable Sunrise may have collected tens of millions of dollars, the SEC said in April 2013, after bringing fraud charges against Zeek Rewards in August 2012.

Reload scams have been targeted at both Zeek and Profitable Sunrise victims, authorities said.

On May 9, the PP Blog reported that an emerging scam that is seeking to tie itself to the Catholic Church is engaging in a spam campaign and seeking to lure Profitable Sunrise victims into a new trap. The scam is using the name of “ALL SAINTS CATHOLIC CHURCH LOAN FIRM” and many other names, some of which are published in the Comments thread in the story linked in the first sentence of this paragraph.

![Andrew Neil yesterday made the universal "[batspit] crazy" gesture after trying to interview Alex Jones of InfoWars.](https://patrickpretty.com/wp-content/uploads/2013/06/andrewneilbbc.jpg)