With the alleged $600 million Zeek Rewards Ponzi scheme dominating local headlines in North Carolina’s Piedmont Triad region, including the city of Lexington in Davidson County, an earlier, smaller fraud scheme operating in the region largely fell out of the news.

But the Integra Capital Management LLC Ponzi and fraud scheme operated by Nicholas Cox and Rodney Whitney is back in the headlines. Cox, 35, of Lexington, has been sentenced to three years in federal prison, followed by three years’ supervised release, for his role in Integra Capital’s $3.2 million commodities and Forex swindle.

But the Integra Capital Management LLC Ponzi and fraud scheme operated by Nicholas Cox and Rodney Whitney is back in the headlines. Cox, 35, of Lexington, has been sentenced to three years in federal prison, followed by three years’ supervised release, for his role in Integra Capital’s $3.2 million commodities and Forex swindle.

Whitney, 50, from the nearby community of Archdale, pleaded guilty in January. He was sentenced to five years in federal prison.

The Integra Capital scam, which had a Ponzi component, operated between September 2006 and August 2009, the CFTC said in September 2010. Among other things, the fraud scheme was notable for destroying a myth: that “opportunities” that send out 1099 tax forms to investors could not possibly be operating a scam.

Cox and Whitney were charged both civilly and criminally. The CFTC led the civil probe; the U.S. Postal Inspection Service led the criminal investigation. Cox was arrested in May 2011 in Denton, N.C. Like Zeek’s home base of Lexington, Denton is in Davidson County.

During Zeek’s run, some promoters argued that the enterprise could not be a scam because it collected data to be used on tax forms. Promoters also argued that Zeek was above-board because it was registered as a corporation in North Carolina.

Records show, however, that Integra Capital also was registered as a North Carolina corporation — with business addresses in the Triad cities of High Point, Denton and Archdale. Neither Integra’s registration nor the issuance of tax forms proved to be proper barometers for investors to follow.

What matters in Ponzi and financial-fraud schemes is how the money moves within the sphere of the actual practices of a business, not whether a company is a registered entity that issues tax forms.

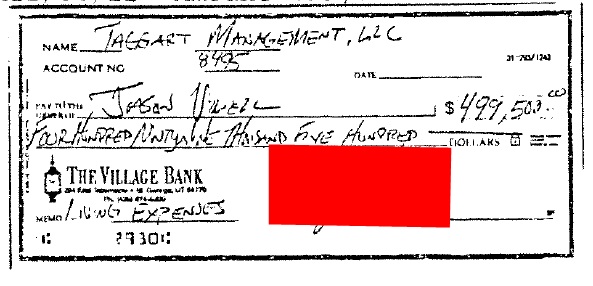

Citing court documents, the U.S. Department of Justice said that “Cox and Whitney obtained and misappropriated more than $3.2 million in investor funds and fabricated account statements and tax forms to conceal their fraud.”

In December 2012, Cox pleaded guilty to one count of conspiracy to commit mail fraud, five counts of mail fraud and one count of conspiracy to commit money laundering. Earlier, in March 2011, Whitney pleaded guilty to one count of conspiracy to commit mail and wire fraud and one count of conspiracy to commit money laundering.

“Cox and Whitney used the money invested by later investors to pay the monthly investment returns they had promised to earlier investors,” prosecutors said today.

And the Triad duo also bought real estate, funded other business ventures and purchased automobiles and other personal goods and services, prosecutors said.

In September 2012, the SEC said Lexington-based Zeek was a “classic” Ponzi scheme in which “[m]ost of ZeekRewards’ total revenues and the ‘net profits’ paid to investors” were “comprised of funds received from new investors.”