3RD UPDATE 4:02 P.M. ET U.S.A. The “Achieve Community,” an 800-percent ROI Ponzi-board “program” apparently hamstrung by problems with payment processors, now is serving up a spectacle in which confusion and delay are the only consistent themes.

BehindMLM.com reported late last night (or early today, depending on your time zone) that the office of Michigan Attorney General Bill Schuette had confirmed an “open investigation” into Achieve involving the Attorney General’s Consumer Protection Division.

The PP Blog this morning sought comment from Schuette’s office.

“We don’t comment on investigations,” said Andrea Bitely, the Attorney General’s communications director and press secretary.

The response appears to confirm the report on BehindMLM.com that Achieve is under investigation in Michigan.

Because the Colorado Division of Securities has confirmed a probe into Achieve, the PP Blog sought comment yesterday from Michigan’s Corporations, Securities & Commercial Licensing bureau on whether Achieve was under investigation in that state. The bureau referred the Blog to the communications division of its parent agency, the Michigan Department of Licensing and Regulatory Affairs (LARA).

A LARA spokeswoman said only that the bureau neither confirms nor denies investigations.

But if the bureau is working with the Attorney General’s office, it would mean that Achieve might have two types of trouble in Michigan: consumer fraud and securities fraud — and at the same time it faces the Colorado investigation.

Given information on two websites linked to Achieve, the “program” appears to operate through a Delaware corporation known as Work With Troy Barnes Inc. Barnes is a Michigan resident, and the two websites linked to Achieve list a Riverview, Mich., address for the “program.” Although Work With Troy Barnes Inc. appears in Delaware records as a company domiciled in that state, there appears to be no corresponding registration as a foreign corporation in Michigan.

Precisely how Achieve is operating through Work With Troy Barnes is unclear. The two Achieve websites — ReadyToAchieve.com and The Achieve Community.com — have Korean lettering near the bottom. IP addresses for the web properties resolve to Iceland.

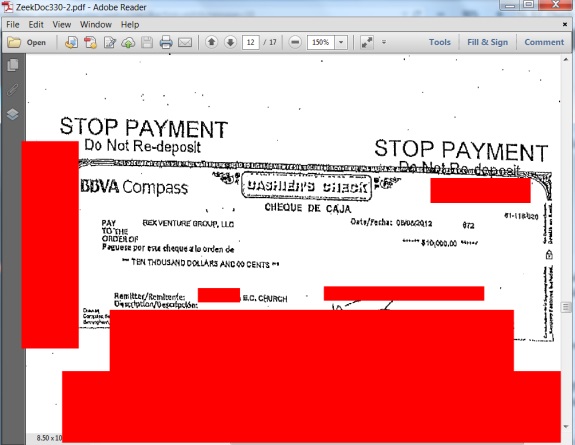

Any number of Achieve members have shown blind faith in Achieve. Some “defenders” of the “program” have spoken of faith in God and Jesus Christ. Achieve, though, appears repeatedly to have encountered struggles with payment processors after reportedly losing its ability to do business through Payoneer in late October or early November.

And this brings us to today . . .

Instructional Video Goes Missing

Barnes — along with Kristi Johnson of the Denver area — are the purported operators of Achieve.

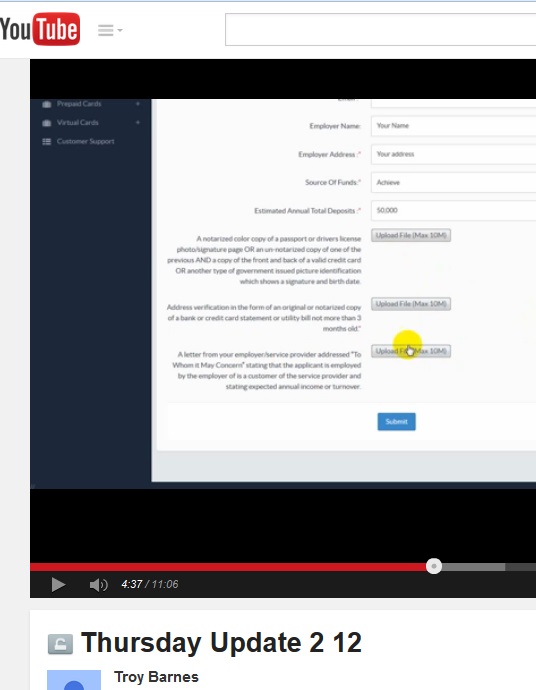

At some point yesterday (Feb. 12), a Barnes-narrated video appeared on YouTube. The 11:06 video was titled “Thursday Update 2 12.” The video provided Achieve members instructions on how to register for a purported new payment processor.

This video now mysteriously has gone missing, amid concerns expressed by some Achievers that even registering for the processor might open the door to identity theft. What’s more, the identity of the processor itself, how it is operating and where it is operating from are murky.

The narration by Barnes was disjointed, at once advising members they had to submit all information requested in the information fields but backtracking to insist certain information was optional.

In the video, fields requesting standard identification such as name and address were shown. But there also was a field that requested the submission of notarized color copies of a passport or driver’s license with a signature, “OR an un-notarized copy of one of the previous AND a copy front and back of a valid credit card OR another type of government issued picture identification which shows a signature and birth date.”

There also were fields that solicited information on income and a letter from the employer of an Achieve member addressed “To Whom it May Concern” to verify employment.

With respect to the field soliciting an employment-verification letter, Barnes said this: “Don’t even worry about this. You don’t need it, all right. This is going to disappear off of here. For now, it’s there. Don’t worry about it.”

Despite those words, Barnes also said, “Remember: When you submit, everything’s gotta be filled out. Everything.”

He also said, “If you have a PO Box and you’re in the United States, so, you’re [going to] need to go to the bank. Take your driver’s license. Any bank will do this. Tell them you [want to] get your driver’s license notarized. They’ll take it and make a copy of your driver’s license. I understand your mail may go to a PO Box, but your address should have your driver’s license on it [sic]. And that’s it. Just upload it here, and you’re all set.”

About a field soliciting address verification, Barnes said this: Address verification is “very important. A utility bill. Anything that has your address on it that you’re billed for. You need to upload that here.”

Barnes described a field soliciting information on estimated annual total deposits in this fashion: “You know: What do you think you’re gonna make [through Achieve?] Put whatever you want. It doesn’t matter. You know, for me, I put a hundred thousand. So, put whatever.”

At a minimum, the video suggested Achievers who successfully submitted information would receive some sort of debit card to offload profits — perhaps in a couple of weeks. Achieve appears not have have made a payout for more than three months while at once engaging in payment-processor roulette.

The FBI has warned for years that certain types of debit cards and shell companies can be used for the purposes of money-laundering, handing economic strength to criminals or worse.

Some Achievers have joined other Ponzi-board schemes and published YouTube promos for the schemes.